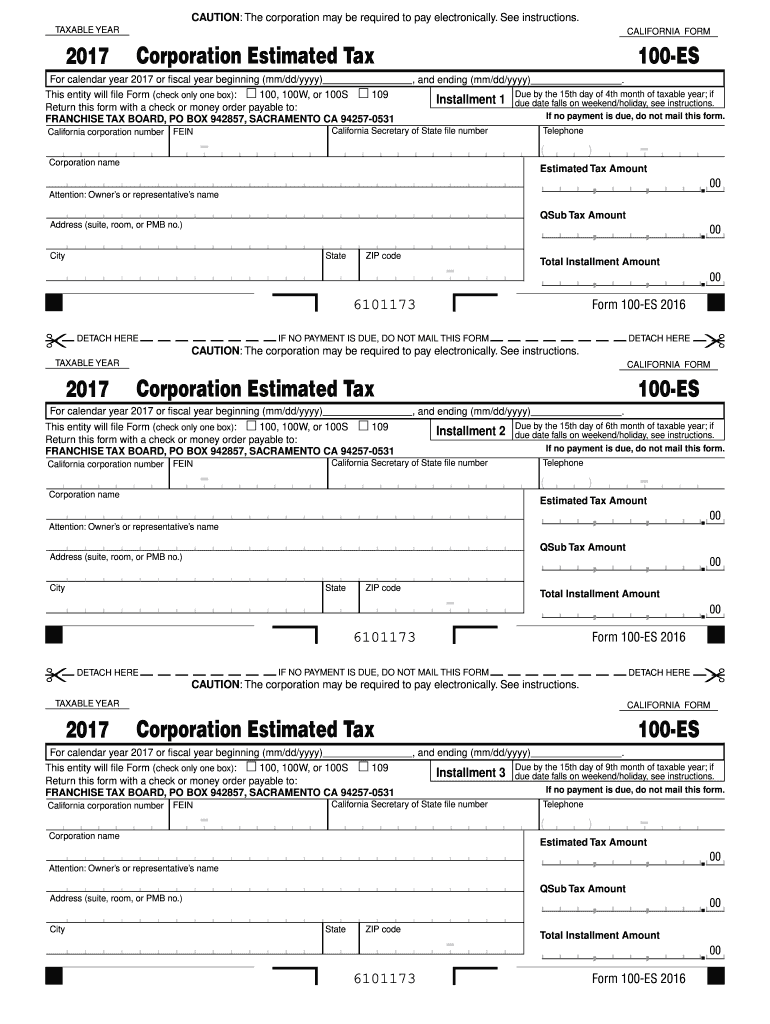

Estimated Form 2017

What is the Estimated Form

The Estimated Form is a crucial document used by taxpayers in the United States to report and pay estimated taxes on income not subject to withholding. This form is particularly relevant for self-employed individuals, freelancers, and those with significant income from investments, rental properties, or other sources. By submitting this form, taxpayers can ensure they meet their tax obligations throughout the year, rather than facing a large tax bill when filing their annual return.

How to use the Estimated Form

Using the Estimated Form involves several straightforward steps. First, taxpayers must calculate their expected income for the year, taking into account any deductions and credits. Next, they will determine the estimated tax liability based on the current tax rates. Once the calculations are complete, the taxpayer can fill out the form, providing necessary personal information, income details, and the calculated estimated tax. Finally, the form can be submitted online or via mail, depending on the taxpayer's preference.

Steps to complete the Estimated Form

Completing the Estimated Form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Calculate your total expected income for the year.

- Determine applicable deductions and credits that may lower your taxable income.

- Use the IRS tax rate schedule to estimate your tax liability based on your expected income.

- Fill out the Estimated Form with your personal information, income details, and calculated tax.

- Review the form for accuracy before submission.

- Submit the form electronically or by mail, ensuring it is sent before the deadline.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Estimated Form. Taxpayers should refer to the IRS website for the most current tax rates and instructions. It is important to ensure that the form is filled out accurately to avoid penalties. The IRS also outlines the frequency of estimated tax payments, typically quarterly, and the due dates for each payment. Following these guidelines helps maintain compliance and avoids unnecessary fines.

Filing Deadlines / Important Dates

Filing deadlines for the Estimated Form are crucial for taxpayers to remember. Generally, estimated tax payments are due on the 15th of April, June, September, and January of the following year. If these dates fall on a weekend or holiday, the deadline is extended to the next business day. It is essential to mark these dates on your calendar to ensure timely submissions and avoid penalties for late payments.

Penalties for Non-Compliance

Failing to submit the Estimated Form or making insufficient payments can result in penalties from the IRS. Taxpayers may be subject to an underpayment penalty if they do not pay enough tax throughout the year. This penalty is calculated based on the amount of underpayment and the duration of the underpayment period. To avoid these penalties, it is advisable to accurately estimate tax liabilities and make timely payments.

Quick guide on how to complete estimated 2017 form

Your assistance manual on how to prepare your Estimated Form

If you’re curious about how to generate and submit your Estimated Form, here are a few concise guidelines to make tax filing simpler.

To begin, you just need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and complete your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and return to update information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to finalize your Estimated Form in a matter of minutes:

- Set up your account and start working on PDFs shortly.

- Utilize our catalog to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your Estimated Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that paper filing can increase return errors and delay reimbursements. Naturally, before e-filing your taxes, consult the IRS website for filing rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct estimated 2017 form

FAQs

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

Create this form in 5 minutes!

How to create an eSignature for the estimated 2017 form

How to make an eSignature for the Estimated 2017 Form in the online mode

How to make an electronic signature for your Estimated 2017 Form in Chrome

How to generate an electronic signature for signing the Estimated 2017 Form in Gmail

How to create an eSignature for the Estimated 2017 Form right from your smartphone

How to generate an eSignature for the Estimated 2017 Form on iOS devices

How to generate an eSignature for the Estimated 2017 Form on Android devices

People also ask

-

What is an Estimated Form in airSlate SignNow?

An Estimated Form in airSlate SignNow refers to a document that allows you to gather and manage estimates effectively. This feature enables businesses to streamline their estimation process, ensuring that clients receive accurate quotes quickly and efficiently. With airSlate SignNow, you can customize these forms to suit your specific business needs.

-

How does airSlate SignNow enhance the Estimated Form process?

airSlate SignNow enhances the Estimated Form process by providing a user-friendly interface that simplifies document creation and eSigning. It allows users to easily add fields for signatures, dates, and other necessary information, ensuring a seamless experience for both senders and recipients. This efficiency can signNowly reduce turnaround times for your estimates.

-

What pricing plans are available for using Estimated Forms in airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to meet various business needs, including options specifically designed for managing Estimated Forms. Each plan provides a range of features, from basic document signing to advanced customization options. You can choose a plan that fits your budget while maximizing the capabilities of your Estimated Form.

-

Can I integrate Estimated Forms with other applications?

Yes, airSlate SignNow allows you to integrate Estimated Forms with a variety of applications, enhancing your workflow efficiency. Popular integrations include CRM systems and project management tools, enabling seamless data transfer and document management. This connectivity helps ensure that your estimates are always up-to-date and easily accessible.

-

What are the benefits of using Estimated Forms for my business?

Using Estimated Forms in airSlate SignNow offers numerous benefits, including improved accuracy in your estimates and faster turnaround times. By reducing manual errors and streamlining the documentation process, your business can enhance customer satisfaction and build trust. Moreover, the ability to track and manage estimates electronically saves time and resources.

-

Is it secure to send Estimated Forms through airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, ensuring that all Estimated Forms are transmitted and stored with high-level encryption. You can trust that your sensitive information is protected throughout the eSigning process, providing peace of mind for both you and your clients. Compliance with industry standards further enhances the security of your documents.

-

How can I customize my Estimated Forms in airSlate SignNow?

Customizing your Estimated Forms in airSlate SignNow is straightforward and intuitive. You can add your branding elements, adjust fields, and modify templates to fit your specific requirements. This flexibility allows you to create professional-looking estimates that reflect your brand identity and meet client expectations.

Get more for Estimated Form

- The psychometric properties of the barkley deficits in executive functioning scale bdefs in a college student population form

- Dhgate payment verification authorization form

- Instructions the alsup is intended for use as a discussion guide rather than a freestanding checklist or rating scale form

- Oregon ct 12f 2015 2019 form

- Cheba hut abq nm online hiring form

- Fmcsa sample lease agreement form

- Maryland protocols self study guide form

- Fyba purchase agreement final clean form

Find out other Estimated Form

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document