Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax 2024-2026

What is the Form 100 ES Corporation Estimated Tax

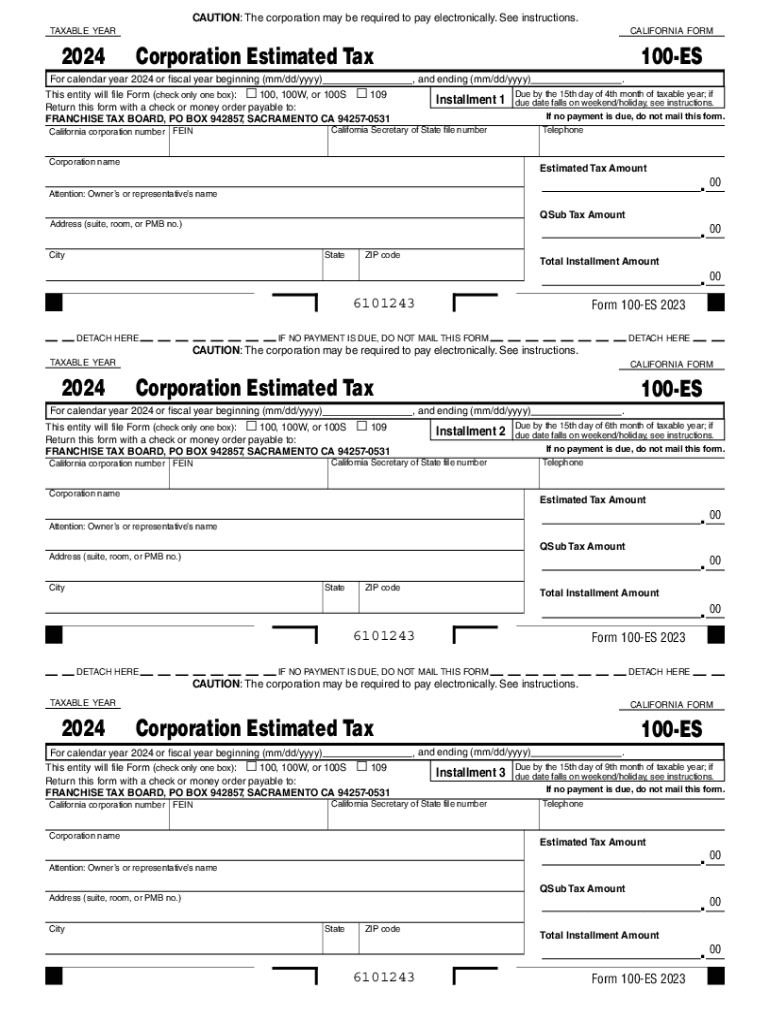

The Form 100 ES is a tax form used by S corporations in California to report estimated tax payments. This form is essential for corporations that expect to owe tax of five hundred dollars or more for the year. It allows businesses to make quarterly estimated tax payments to the California Franchise Tax Board. Understanding this form is crucial for compliance with California tax laws and for managing cash flow effectively throughout the tax year.

How to Use the Form 100 ES Corporation Estimated Tax

To use the Form 100 ES, corporations must first determine their estimated tax liability for the year. This involves calculating expected taxable income and applying the appropriate tax rate. Once the estimated tax amount is established, the corporation can fill out the form, indicating the payment due for each quarter. It is important to submit the form along with the payment by the specified deadlines to avoid penalties and interest.

Steps to Complete the Form 100 ES Corporation Estimated Tax

Completing the Form 100 ES involves several steps:

- Calculate your estimated taxable income for the year.

- Apply the current California tax rate to determine your estimated tax liability.

- Divide the total estimated tax by four to find the quarterly payment amount.

- Fill out the Form 100 ES, providing the necessary information such as the corporation's name, address, and estimated tax payment amounts.

- Submit the form and payment to the California Franchise Tax Board by the due dates.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when submitting the Form 100 ES. The estimated tax payments are typically due on the 15th day of the fourth, sixth, ninth, and twelfth months of the taxable year. For example, for a calendar year taxpayer, the due dates would be April 15, June 15, September 15, and December 15. It is essential to mark these dates on your calendar to ensure timely filing and payment.

Penalties for Non-Compliance

Failure to file the Form 100 ES or to make the required estimated tax payments can result in penalties. California imposes penalties for late payments, which can add up quickly. Additionally, interest may accrue on unpaid amounts. To avoid these consequences, it is important for corporations to stay informed about their tax obligations and to file the form on time.

Key Elements of the Form 100 ES Corporation Estimated Tax

The Form 100 ES includes several key elements that are important for accurate completion:

- Corporation's name and identification number.

- Estimated tax payment amounts for each quarter.

- Signature of an authorized representative.

- Contact information for any questions regarding the submission.

Create this form in 5 minutes or less

Find and fill out the correct form 100 e s corporation estimated tax form 100 es corporation estimated tax

Create this form in 5 minutes!

How to create an eSignature for the form 100 e s corporation estimated tax form 100 es corporation estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2016 form 100 es and why is it important?

The 2016 form 100 es is a California state tax form used for estimated tax payments. It is crucial for businesses to accurately report their estimated tax liabilities to avoid penalties. Using airSlate SignNow can streamline the process of filling out and submitting the 2016 form 100 es, ensuring compliance and efficiency.

-

How can airSlate SignNow help with the 2016 form 100 es?

airSlate SignNow provides an easy-to-use platform for businesses to fill out and eSign the 2016 form 100 es. With its intuitive interface, users can quickly complete the form and send it securely, saving time and reducing errors in the submission process.

-

Is there a cost associated with using airSlate SignNow for the 2016 form 100 es?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that simplify the completion and eSigning of documents like the 2016 form 100 es. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 2016 form 100 es?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easier to manage the 2016 form 100 es and other important documents, ensuring that you can access and send them whenever needed.

-

Can I integrate airSlate SignNow with other software for the 2016 form 100 es?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This means you can easily connect your accounting or tax software to streamline the process of preparing and submitting the 2016 form 100 es.

-

What are the benefits of using airSlate SignNow for the 2016 form 100 es?

Using airSlate SignNow for the 2016 form 100 es offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and sharing of documents, which can signNowly speed up your tax preparation process.

-

Is airSlate SignNow secure for submitting the 2016 form 100 es?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your documents, including the 2016 form 100 es, are protected. The platform uses advanced encryption and secure storage solutions to safeguard sensitive information during the eSigning process.

Get more for Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax

Find out other Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free