Www Ftb Ca Govforms20212021 Form 100 E S Corporation Estimated Tax 2022

Understanding the 2021 Form 100 E S Corporation Estimated Tax

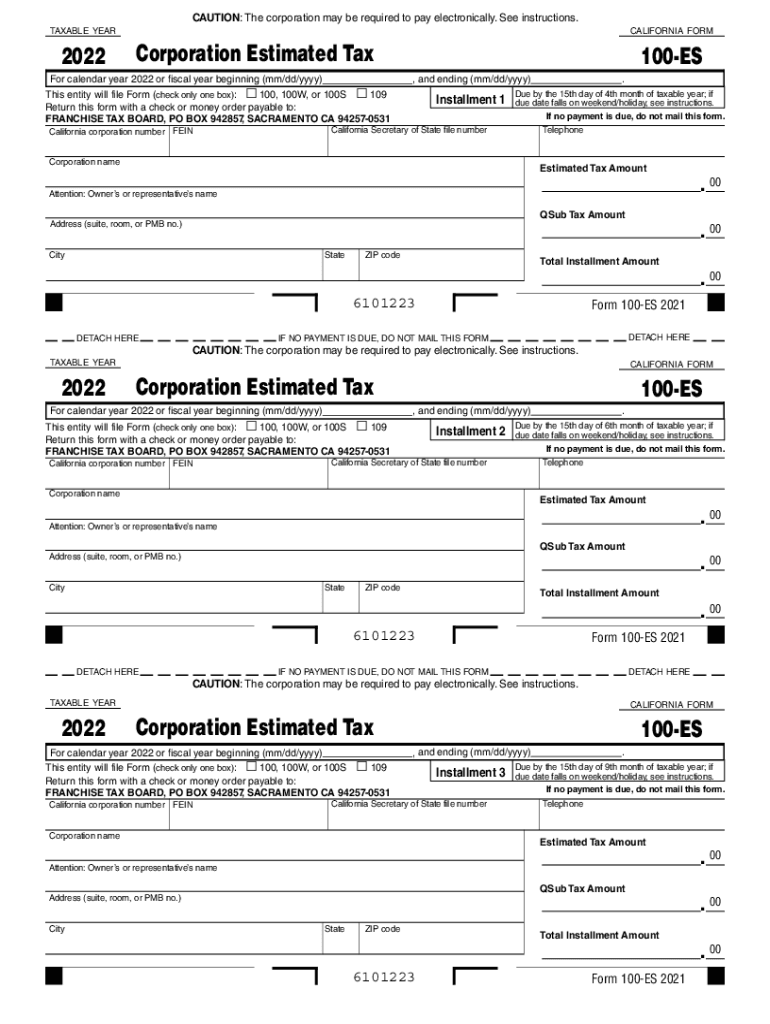

The 2021 Form 100 E S Corporation Estimated Tax is a crucial document for S corporations operating in California. This form is used to report and pay estimated taxes on income generated by the corporation. It is essential for ensuring compliance with state tax obligations and avoiding penalties. The form allows corporations to calculate their estimated tax liability based on projected income, ensuring that they meet their tax responsibilities throughout the year.

Steps to Complete the 2021 Form 100 E S Corporation Estimated Tax

Completing the 2021 Form 100 E S Corporation Estimated Tax involves several key steps:

- Gather necessary financial information, including projected income, deductions, and credits.

- Calculate the estimated tax liability based on the corporation's expected income for the year.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for accuracy before submission to avoid errors that could lead to penalties.

- Submit the form by the specified deadline to ensure timely payment of estimated taxes.

Filing Deadlines for the 2021 Form 100 E S Corporation Estimated Tax

Filing deadlines for the 2021 Form 100 E S Corporation Estimated Tax are essential to avoid late fees and penalties. Typically, estimated tax payments are due quarterly. The specific deadlines for the 2021 tax year are:

- First quarter: April 15, 2021

- Second quarter: June 15, 2021

- Third quarter: September 15, 2021

- Fourth quarter: December 15, 2021

Legal Use of the 2021 Form 100 E S Corporation Estimated Tax

The 2021 Form 100 E S Corporation Estimated Tax is legally binding when completed and submitted according to California tax laws. It is important for S corporations to adhere to the guidelines set forth by the California Franchise Tax Board to ensure that their estimated tax payments are recognized as valid. Proper execution of this form helps maintain compliance and avoid legal complications.

Key Elements of the 2021 Form 100 E S Corporation Estimated Tax

Understanding the key elements of the 2021 Form 100 E S Corporation Estimated Tax can help streamline the filing process. Important components include:

- Identification information for the corporation, including name, address, and taxpayer identification number.

- Calculation of estimated income and deductions to determine the tax liability.

- Payment options for submitting estimated taxes, including electronic payment methods.

Who Issues the 2021 Form 100 E S Corporation Estimated Tax

The 2021 Form 100 E S Corporation Estimated Tax is issued by the California Franchise Tax Board (FTB). This agency is responsible for administering California's tax laws and ensuring compliance among businesses operating within the state. Corporations must follow the guidelines provided by the FTB to ensure that their estimated tax payments are processed correctly.

Quick guide on how to complete wwwftbcagovforms20212021 form 100 e s corporation estimated tax

Complete Www ftb ca govforms20212021 Form 100 E S Corporation Estimated Tax seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly and efficiently. Manage Www ftb ca govforms20212021 Form 100 E S Corporation Estimated Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Www ftb ca govforms20212021 Form 100 E S Corporation Estimated Tax effortlessly

- Locate Www ftb ca govforms20212021 Form 100 E S Corporation Estimated Tax and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your preferred method for sharing your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Www ftb ca govforms20212021 Form 100 E S Corporation Estimated Tax to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwftbcagovforms20212021 form 100 e s corporation estimated tax

Create this form in 5 minutes!

How to create an eSignature for the wwwftbcagovforms20212021 form 100 e s corporation estimated tax

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What pricing options does airSlate SignNow offer for the estimated 2022 period?

airSlate SignNow provides flexible pricing plans designed to suit various business needs. Customers can choose from individual, team, and enterprise packages, ensuring that you get an estimated 2022 cost that aligns with your budget and document signing requirements.

-

What key features should I expect from airSlate SignNow in 2022?

In the estimated 2022 timeframe, airSlate SignNow offers robust features such as advanced eSignature capabilities, document templates, and real-time collaboration tools. These features are designed to streamline workflows and enhance productivity for businesses of all sizes.

-

How does airSlate SignNow benefit my business in 2022?

By leveraging airSlate SignNow, businesses can signNowly reduce the time spent on paperwork and improve efficiency. With an estimated 2022 transition from traditional methods to digital, your business can benefit from quicker turnaround times and reduced operational costs.

-

What integrations are available with airSlate SignNow in the estimated 2022 year?

In 2022, airSlate SignNow integrates seamlessly with popular applications like Google Workspace, Salesforce, and Microsoft Office. This means you can streamline your document processes by connecting your existing tools for a more cohesive experience.

-

Is airSlate SignNow secure for handling sensitive documents in 2022?

Absolutely! airSlate SignNow employs advanced security measures like end-to-end encryption and compliance with industry standards, ensuring that all sensitive documents are secure. Businesses can trust that their information is protected while using our services in estimated 2022.

-

How easy is it to use airSlate SignNow for new users in 2022?

airSlate SignNow is designed with user-friendliness in mind, making it accessible for both tech-savvy individuals and beginners. With an estimated 2022 focus on intuitive navigation and guidance, new users can quickly learn to send and sign documents without hassle.

-

Can I customize my documents using airSlate SignNow in 2022?

Yes, in estimated 2022, airSlate SignNow allows users to customize their documents with branding, fields, and personalized messages. This feature helps businesses maintain a professional image while enhancing the customer experience.

Get more for Www ftb ca govforms20212021 Form 100 E S Corporation Estimated Tax

- Letter to bank advising of attorney representation and bankruptcy filing louisiana form

- Letter hearing appeal form

- Louisiana demand 497308891 form

- Opposing counsel form

- Sample letter to opposing counsel with settlement offer form

- Louisiana community property form

- Opposing counsel 497308895 form

- Letter to opposing counsel regarding intent to file motion to dismiss louisiana form

Find out other Www ftb ca govforms20212021 Form 100 E S Corporation Estimated Tax

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself