Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax 2020

Understanding the Form 100 ES Corporation Estimated Tax

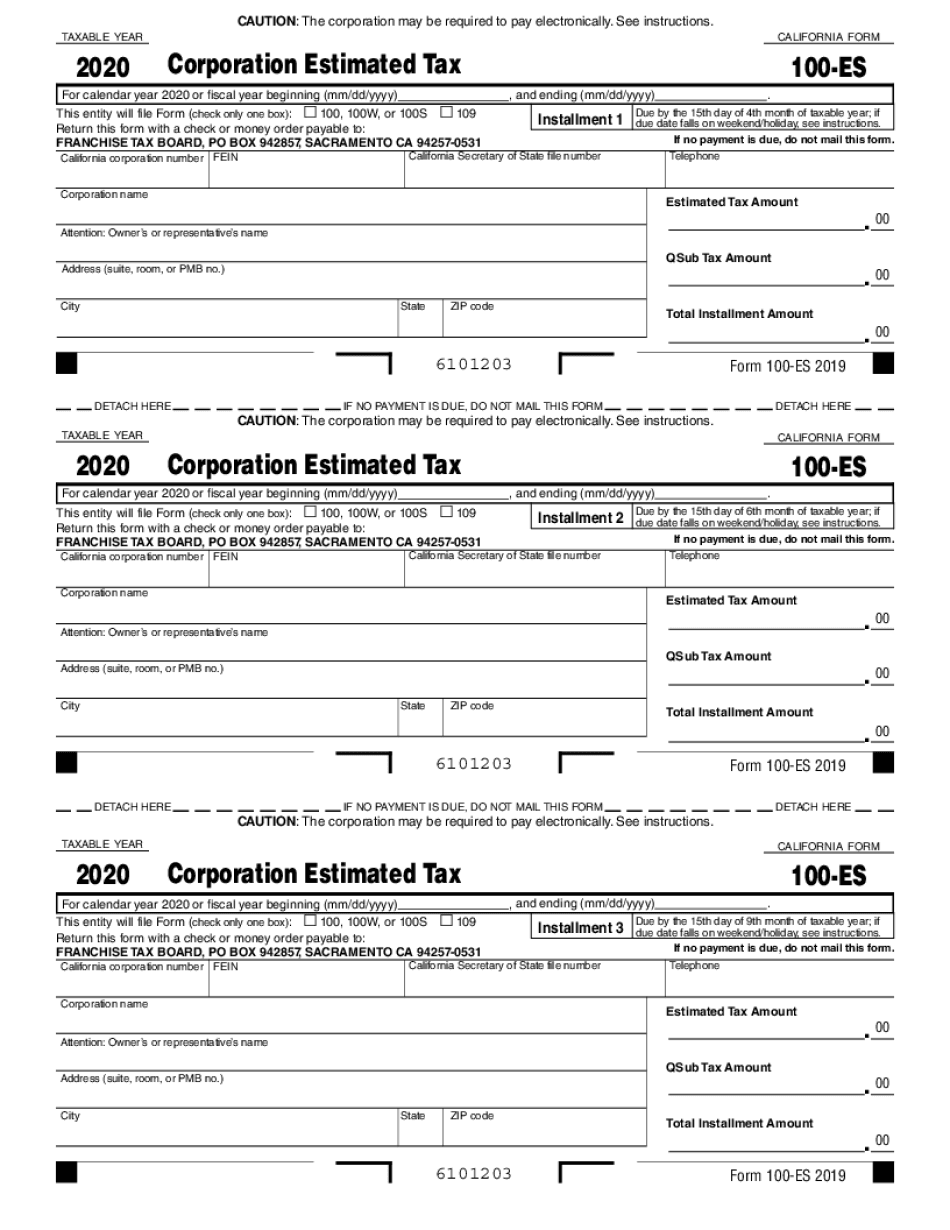

The Form 100 ES is specifically designed for S Corporations in California to report estimated tax payments. This form is essential for corporations that expect to owe tax of five hundred dollars or more during the year. By submitting this form, corporations can prepay their tax obligations, which helps in managing cash flow and avoiding penalties for underpayment at the end of the tax year.

Steps to Complete the Form 100 ES

Completing the Form 100 ES involves several key steps to ensure accuracy and compliance with California tax regulations. First, gather the necessary financial information, including estimated income and deductions for the year. Next, calculate the estimated tax based on the current tax rates applicable to S Corporations. After determining the amount, fill out the form carefully, ensuring all sections are completed. Finally, review the form for any errors before submission to avoid delays or penalties.

Filing Deadlines for Form 100 ES

Timely filing of Form 100 ES is crucial to avoid penalties. The estimated tax payments are typically due on the 15th day of the fourth, sixth, ninth, and twelfth months of the taxable year. For example, if the tax year aligns with the calendar year, the due dates would be April 15, June 15, September 15, and December 15. Corporations should mark these dates on their calendars to ensure compliance.

Legal Use of the Form 100 ES

The Form 100 ES is legally binding when filled out and submitted according to California tax laws. It is important that corporations maintain accurate records of their estimated tax payments, as these may be required for future audits or tax assessments. Compliance with the legal requirements surrounding this form helps corporations avoid unnecessary penalties and ensures smooth operation within the state's tax framework.

Obtaining the Form 100 ES

Corporations can obtain the Form 100 ES through the California Franchise Tax Board's website, where it is available for download. Additionally, physical copies may be requested directly from the tax board. Ensuring that the most current version of the form is used is vital, as tax laws and regulations may change from year to year.

Examples of Using the Form 100 ES

For instance, if an S Corporation anticipates a taxable income of one hundred thousand dollars for the year, it can use the Form 100 ES to calculate and remit estimated taxes quarterly. This proactive approach not only aids in budget management but also helps in avoiding a large tax bill at the end of the year. Corporations can also adjust their estimated payments based on changes in income throughout the year to ensure they are paying the correct amount.

Quick guide on how to complete 2020 form 100 e s corporation estimated tax 2020 form 100 es corporation estimated tax

Effortlessly Prepare Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax on Any Device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax seamlessly on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The Easiest Way to Alter and Electronically Sign Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax with Ease

- Locate Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax and click Get Form to initiate.

- Utilize the tools available to complete your document.

- Mark important sections of the documents or conceal sensitive information with features specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to store your adjustments.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax, ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 100 e s corporation estimated tax 2020 form 100 es corporation estimated tax

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 100 e s corporation estimated tax 2020 form 100 es corporation estimated tax

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the importance of the 2020 tax 100 for businesses?

The 2020 tax 100 is signNow for businesses as it determines their eligibility for various tax deductions and credits. Understanding this information helps businesses optimize their finances and ensure compliance with tax regulations, making it essential for effective financial planning.

-

How does airSlate SignNow assist with the 2020 tax 100 documentation process?

airSlate SignNow simplifies the documentation process for the 2020 tax 100 by allowing businesses to send and eSign necessary forms electronically. This streamlines the workflow, reduces paperwork, and ensures that all documents are securely stored and easily accessible when needed.

-

What pricing options are available for using airSlate SignNow with the 2020 tax 100?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it easy to choose a plan that fits your budget while handling the 2020 tax 100 requirements. Whether you are a small business or a larger enterprise, airSlate SignNow provides competitive rates to support your documentation needs.

-

Can I integrate airSlate SignNow with accounting software for the 2020 tax 100?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, enabling businesses to manage their 2020 tax 100 filings more efficiently. Such integrations ensure that all financial documents and signatures are synchronized, improving overall accuracy and productivity.

-

What features does airSlate SignNow offer that benefit the 2020 tax 100 process?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage, all of which benefit the 2020 tax 100 process. These features help businesses enhance their workflow, reduce errors, and maintain compliance with tax regulations.

-

How does eSigning with airSlate SignNow enhance the 2020 tax 100 experience?

eSigning with airSlate SignNow enhances the 2020 tax 100 experience by providing a fast, legally binding way to sign documents. It eliminates the need for printing, scanning, and mailing, allowing businesses to complete their tax-related paperwork quickly and efficiently.

-

Is airSlate SignNow user-friendly for managing the 2020 tax 100?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes it easy for users of all skill levels to handle the 2020 tax 100. With straightforward navigation and helpful tutorials, users can quickly learn how to create, send, and eSign documents.

Get more for Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax

- Fencing contract for contractor wyoming form

- Hvac contract for contractor wyoming form

- Landscape contract for contractor wyoming form

- Commercial contract for contractor wyoming form

- Wy contract form

- Renovation contract for contractor wyoming form

- Concrete mason contract for contractor wyoming form

- Demolition contract for contractor wyoming form

Find out other Form 100 E S Corporation Estimated Tax Form 100 ES Corporation Estimated Tax

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself