Arizona Form A1 R 2021-2026

What is the Arizona Form A1 R?

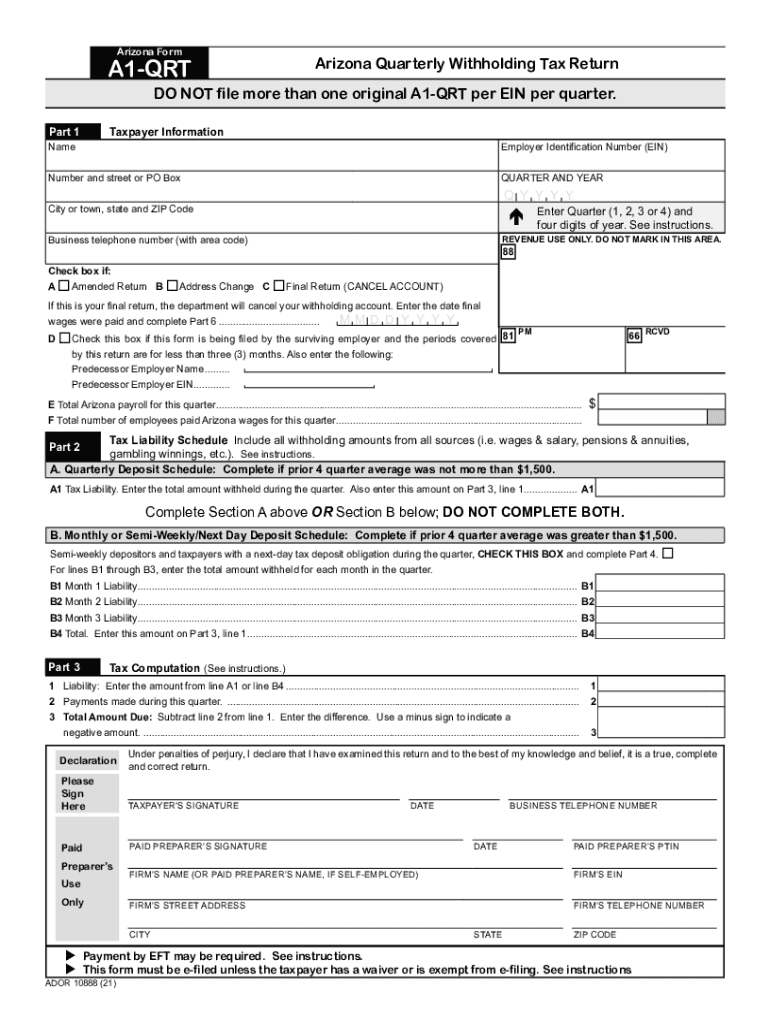

The Arizona Form A1 R is a tax document used by employers to report and remit withholding taxes for employees. This form is specifically designed for use in the state of Arizona, ensuring compliance with state tax regulations. It is essential for businesses to accurately complete this form to avoid penalties and ensure proper tax reporting.

How to use the Arizona Form A1 R

Using the Arizona Form A1 R involves several steps. First, employers must gather all necessary information about their employees, including wages paid and the amount of state income tax withheld. Next, the form should be filled out with accurate details, ensuring that all calculations reflect the correct withholding amounts. Once completed, the form can be submitted electronically or via mail, depending on the employer's preference.

Steps to complete the Arizona Form A1 R

Completing the Arizona Form A1 R requires careful attention to detail. Follow these steps:

- Gather employee wage and withholding information.

- Fill in the employer details, including name, address, and Employer Identification Number (EIN).

- Report total wages paid and total state income tax withheld for the reporting period.

- Double-check all entries for accuracy.

- Submit the form by the designated deadline.

Legal use of the Arizona Form A1 R

The legal use of the Arizona Form A1 R is crucial for compliance with state tax laws. Employers are required to use this form to report withholding accurately. Failure to do so can result in penalties, including fines and interest on unpaid taxes. The form must be completed in accordance with Arizona Revised Statutes to ensure its validity.

Filing Deadlines / Important Dates

It is important for employers to be aware of the filing deadlines associated with the Arizona Form A1 R. Typically, the form must be submitted quarterly, with specific due dates set by the Arizona Department of Revenue. Missing these deadlines can lead to penalties, so employers should mark their calendars and ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form A1 R can be submitted through various methods. Employers have the option to file electronically, which is often the most efficient way to ensure timely processing. Alternatively, the form can be mailed to the appropriate state office or submitted in person. Each method has its own requirements, so employers should choose the one that best suits their needs.

Quick guide on how to complete arizona form a1 r 2022

Complete Arizona Form A1 R effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without hassle. Manage Arizona Form A1 R on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Arizona Form A1 R with ease

- Find Arizona Form A1 R and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Do away with lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Arizona Form A1 R and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form a1 r 2022

Create this form in 5 minutes!

How to create an eSignature for the arizona form a1 r 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 AZ quarterly report, and how can airSlate SignNow help?

The 2018 AZ quarterly report provides essential insights into Arizona's economic performance. With airSlate SignNow, you can easily prepare, send, and eSign documents related to your quarterly reports, streamlining your workflow and ensuring compliance with state requirements.

-

How does airSlate SignNow's pricing model work for the 2018 AZ quarterly submissions?

airSlate SignNow offers flexible pricing plans designed to accommodate different business needs, making it a cost-effective choice for organizations preparing the 2018 AZ quarterly submissions. You can choose between monthly and annual subscriptions, and all plans include features that simplify document management.

-

What features does airSlate SignNow offer for handling 2018 AZ quarterly documents?

airSlate SignNow includes features such as customizable templates, bulk sending, and real-time tracking for documents like the 2018 AZ quarterly. These tools not only simplify the eSigning process but also enhance productivity and ensure that you stay organized.

-

Is airSlate SignNow compliant with regulations for 2018 AZ quarterly filings?

Yes, airSlate SignNow is fully compliant with legal regulations regarding eSignatures and document management. This compliance ensures that your 2018 AZ quarterly filings are valid and can be relied upon in any legal context.

-

Can airSlate SignNow integrate with other tools for the 2018 AZ quarterly process?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enabling you to enhance your workflow while managing 2018 AZ quarterly processes. Whether you use CRM systems, cloud storage, or project management tools, these integrations help centralize your document management.

-

How does airSlate SignNow improve efficiency for 2018 AZ quarterly documentation?

By utilizing airSlate SignNow, businesses can drastically reduce the time spent on manual documentation and signatures for the 2018 AZ quarterly. Automated reminders and streamlined workflows enhance efficiency, allowing teams to focus on more strategic activities.

-

What are the benefits of using airSlate SignNow for businesses with 2018 AZ quarterly needs?

Using airSlate SignNow provides numerous benefits for businesses managing 2018 AZ quarterly needs, including increased accuracy, reduced processing time, and improved collaboration among team members. This powerful solution ensures that your documentation is handled efficiently and securely.

Get more for Arizona Form A1 R

Find out other Arizona Form A1 R

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement