Q Y Y Y Y 2019

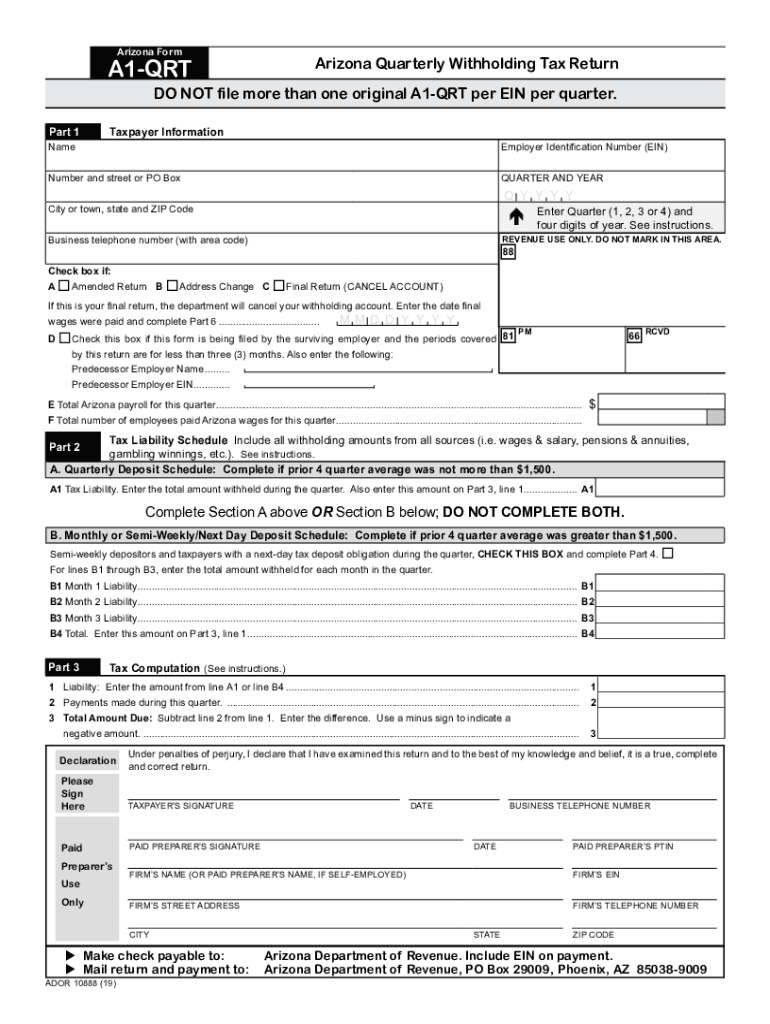

What is the Arizona withholding reconciliation return?

The Arizona withholding reconciliation return is a crucial tax document used by employers to report the total amount of state income tax withheld from employee wages during a specific reporting period. This form is essential for ensuring compliance with Arizona tax laws and accurately reconciling the amounts withheld against what is owed to the state. Employers are required to submit this return annually, summarizing the withholding amounts for the year and ensuring that they match the payments made to the Arizona Department of Revenue.

Steps to complete the Arizona withholding reconciliation return

Completing the Arizona withholding reconciliation return involves several key steps:

- Gather all necessary payroll records for the reporting year, including total wages paid and state income tax withheld.

- Access the appropriate form, typically the Arizona Form A1-QRT, which is used for quarterly and annual reconciliation.

- Enter the total amount of Arizona withholding from employee wages in the designated fields on the form.

- Review the information for accuracy, ensuring that it aligns with your payroll records.

- Submit the completed form to the Arizona Department of Revenue either electronically or via mail, depending on your filing preference.

Filing deadlines for the Arizona withholding reconciliation return

It is important for employers to be aware of the filing deadlines for the Arizona withholding reconciliation return. Typically, the annual return is due on January 31 of the following year, allowing employers to report all withholding amounts for the previous calendar year. Employers who fail to file by this deadline may face penalties and interest on any unpaid taxes. Keeping track of these dates is essential for maintaining compliance with state tax regulations.

Required documents for the Arizona withholding reconciliation return

To accurately complete the Arizona withholding reconciliation return, employers need to have specific documents on hand:

- Payroll records detailing employee wages and state income tax withheld.

- The Arizona Form A1-QRT or the applicable reconciliation form for the reporting period.

- Any previous correspondence with the Arizona Department of Revenue regarding withholding taxes.

Having these documents readily available will streamline the process and help ensure that all information reported is accurate and complete.

Penalties for non-compliance with Arizona withholding regulations

Employers who do not comply with Arizona withholding regulations may face various penalties. These can include:

- Late filing penalties, which are typically a percentage of the unpaid tax amount.

- Interest on unpaid taxes, accruing from the due date until the tax is paid in full.

- Potential audits by the Arizona Department of Revenue, which can lead to further scrutiny and additional penalties.

Understanding these penalties can help employers prioritize timely and accurate filing of their withholding reconciliation returns.

Digital vs. paper version of the Arizona withholding reconciliation return

Employers have the option to file the Arizona withholding reconciliation return either digitally or via paper submission. The digital version often allows for quicker processing and confirmation of receipt, while the paper version may be preferred by those who are more comfortable with traditional filing methods. Regardless of the method chosen, ensuring that the information is accurate and submitted on time is crucial for compliance with state tax laws.

Quick guide on how to complete q y y y y

Complete Q Y Y Y Y effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Q Y Y Y Y on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and eSign Q Y Y Y Y seamlessly

- Obtain Q Y Y Y Y and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a typical wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you prefer to submit your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mismanaged files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Q Y Y Y Y while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct q y y y y

Create this form in 5 minutes!

How to create an eSignature for the q y y y y

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is an Arizona withholding reconciliation return?

An Arizona withholding reconciliation return is a form that employers file to reconcile the amount of state income tax withheld from employee wages with the total amount reported. This return is essential for compliance and ensures that the correct amount of taxes are submitted to the state. Utilizing airSlate SignNow can streamline the process by allowing electronic signatures and document management.

-

How can airSlate SignNow help with filing the Arizona withholding reconciliation return?

airSlate SignNow provides an easy-to-use platform for preparing and submitting your Arizona withholding reconciliation return electronically. The platform allows businesses to create, send, and sign documents securely online, reducing the need for paper processes. This results in faster filing and ensures that your returns are submitted on time.

-

What features does airSlate SignNow offer for Arizona withholding reconciliation return processing?

airSlate SignNow offers features such as document templates, electronic signatures, and a secure cloud storage system that simplify the submission of your Arizona withholding reconciliation return. Additionally, the platform includes tracking options, which allow you to monitor the status of your documents in real-time. These features enhance efficiency and minimize errors in your filing.

-

Is airSlate SignNow cost-effective for small businesses handling the Arizona withholding reconciliation return?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing their Arizona withholding reconciliation return. The platform offers various pricing plans, allowing businesses to choose one that fits their budget. By reducing paperwork and expediting the signing process, small businesses can save both time and money.

-

Can I integrate airSlate SignNow with other software for managing my Arizona withholding reconciliation return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easier to manage your Arizona withholding reconciliation return. By connecting your existing tools with SignNow, you can streamline your workflow and reduce the likelihood of errors when reconciling withholding amounts.

-

What are the benefits of using airSlate SignNow for my Arizona withholding reconciliation return?

Using airSlate SignNow for your Arizona withholding reconciliation return offers several benefits, including increased efficiency, enhanced security, and improved compliance. The platform allows for quick document turnaround times and easy access to past filings, ensuring that your business stays organized. By simplifying the signing and submission process, you can focus on other essential aspects of your operations.

-

How secure is airSlate SignNow when handling my Arizona withholding reconciliation return?

Security is a top priority for airSlate SignNow, especially when it comes to sensitive documents like the Arizona withholding reconciliation return. The platform employs advanced encryption and secure data storage solutions to protect your information. Additionally, all electronic signatures are compliant with legal regulations, ensuring that your submissions are both secure and valid.

Get more for Q Y Y Y Y

Find out other Q Y Y Y Y

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document