USA State Taxes 2020

Understanding the Arizona A1 QRT Form

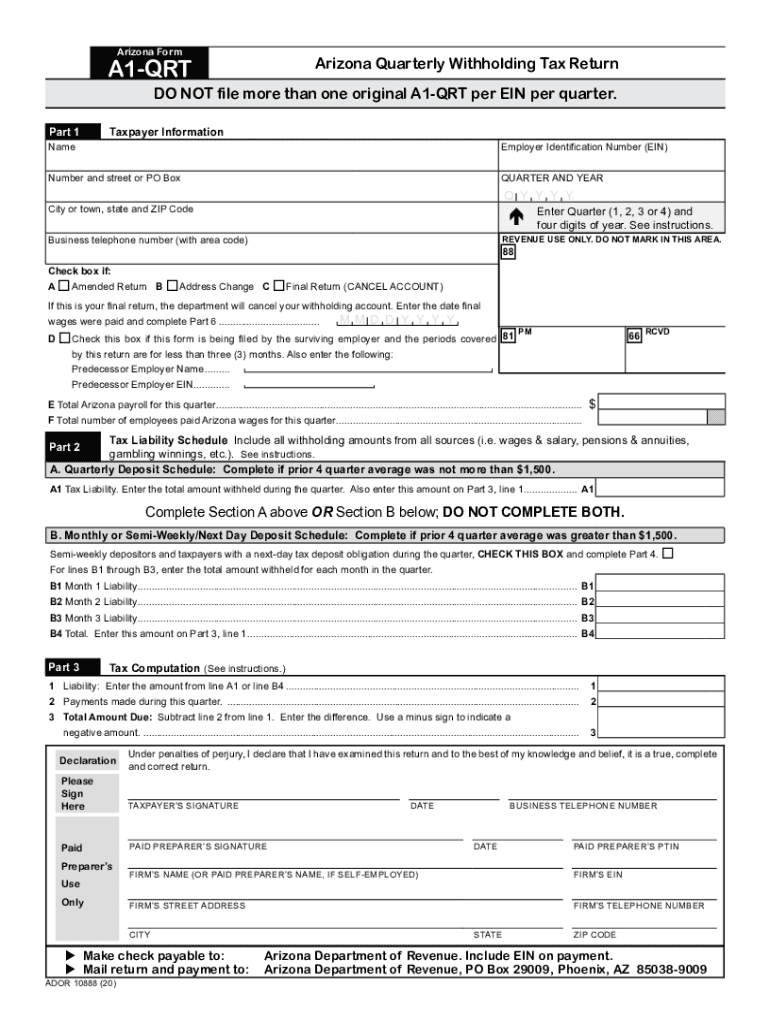

The Arizona A1 QRT form is a crucial document for businesses that need to report and pay state withholding taxes. This form is specifically designed for employers to report the amount of income tax withheld from employees’ wages. It plays a significant role in ensuring compliance with Arizona state tax laws and helps maintain accurate records of tax obligations. Understanding this form is essential for any business operating in Arizona.

Steps to Complete the Arizona A1 QRT Form

Completing the Arizona A1 QRT form involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including employee wages and the amount withheld. Next, accurately fill out the form, ensuring that all figures are correct and match your payroll records. After completing the form, review it for any errors before submission. Finally, submit the form by the designated deadline to avoid penalties.

Legal Use of the Arizona A1 QRT Form

The Arizona A1 QRT form must be completed and submitted in accordance with state regulations to be considered legally valid. It is essential for employers to understand the legal implications of this form, including the requirement to file it on time and the need for accurate reporting of withheld taxes. Non-compliance can lead to penalties, making it vital to adhere to the established guidelines.

Filing Deadlines for the Arizona A1 QRT Form

Timely submission of the Arizona A1 QRT form is critical for compliance. The filing deadlines typically align with the state’s quarterly tax schedule. Employers must ensure that the form is submitted by the end of the month following the end of each quarter. For example, the deadline for the first quarter is usually April 30. Keeping track of these deadlines helps avoid late fees and penalties.

Required Documents for the Arizona A1 QRT Form

To complete the Arizona A1 QRT form accurately, employers need several key documents. These include payroll records that detail employee wages and the corresponding amounts withheld for state income tax. Additionally, any previous tax filings may be required for reference. Having these documents on hand ensures that the form is filled out correctly and submitted without errors.

Penalties for Non-Compliance with the Arizona A1 QRT Form

Failure to comply with the requirements associated with the Arizona A1 QRT form can result in significant penalties. These may include fines for late submissions or inaccuracies in reporting. It is essential for employers to understand these potential penalties and take proactive steps to ensure timely and accurate filing to avoid unnecessary financial burdens.

Examples of Using the Arizona A1 QRT Form

The Arizona A1 QRT form is utilized by various types of businesses, from small startups to large corporations. For instance, a small business owner may use the form to report withholding for a handful of employees, while a larger company may need to report for hundreds. Understanding how different businesses utilize this form can provide valuable insights into its importance in maintaining compliance with state tax laws.

Quick guide on how to complete usa state taxes

Complete USA State Taxes effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage USA State Taxes on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to alter and electronically sign USA State Taxes with ease

- Find USA State Taxes and click Get Form to initiate the process.

- Use the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign USA State Taxes to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct usa state taxes

Create this form in 5 minutes!

How to create an eSignature for the usa state taxes

The best way to generate an e-signature for your PDF document online

The best way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the a1 qrt form and how can it be used in airSlate SignNow?

The a1 qrt form is a document template that streamlines the data collection process. In airSlate SignNow, users can create and manage a1 qrt forms to capture signatures and essential information quickly. This ensures improved efficiency for both individuals and businesses when handling various documentation tasks.

-

How much does airSlate SignNow cost for using the a1 qrt form?

The pricing for airSlate SignNow is flexible, offering several plans that start at a competitive rate. Users can access the a1 qrt form feature in these plans, helping businesses manage their documents cost-effectively. For custom enterprise solutions, pricing can be tailored based on specific needs.

-

What are the key features of the a1 qrt form in airSlate SignNow?

Key features of the a1 qrt form in airSlate SignNow include customizable templates, eSignature options, and real-time collaboration. Users can personalize their a1 qrt forms to suit their branding needs. Additionally, the integration of data analytics helps businesses track their document processes efficiently.

-

Can the a1 qrt form be integrated with other applications?

Yes, the a1 qrt form in airSlate SignNow supports integrations with various applications, enhancing productivity. Users can seamlessly connect their a1 qrt forms with CRM systems, cloud storage, and other business tools. This connectivity ensures a smooth workflow across different platforms.

-

What are the benefits of using the a1 qrt form for my business?

Using the a1 qrt form can signNowly reduce the time and effort spent on document management. It allows for faster data gathering and eSigning, leading to a more streamlined workflow. By integrating the a1 qrt form into your operations, you can enhance customer satisfaction with faster turnaround times.

-

Is it easy to create an a1 qrt form in airSlate SignNow?

Absolutely! Creating an a1 qrt form in airSlate SignNow is a straightforward process with a user-friendly interface. Users can choose from pre-built templates or customize their own, making it accessible even for those without technical expertise. This simplicity encourages more efficient document workflows.

-

Are there any security measures for the a1 qrt form in airSlate SignNow?

Yes, airSlate SignNow ensures that the a1 qrt form is secured through advanced encryption and compliance with industry standards. This protects sensitive data shared in the a1 qrt forms, giving users peace of mind. The platform also includes audit trails to monitor access and usage.

Get more for USA State Taxes

Find out other USA State Taxes

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document