Where to Mail Arizona Tax Return Form 2012

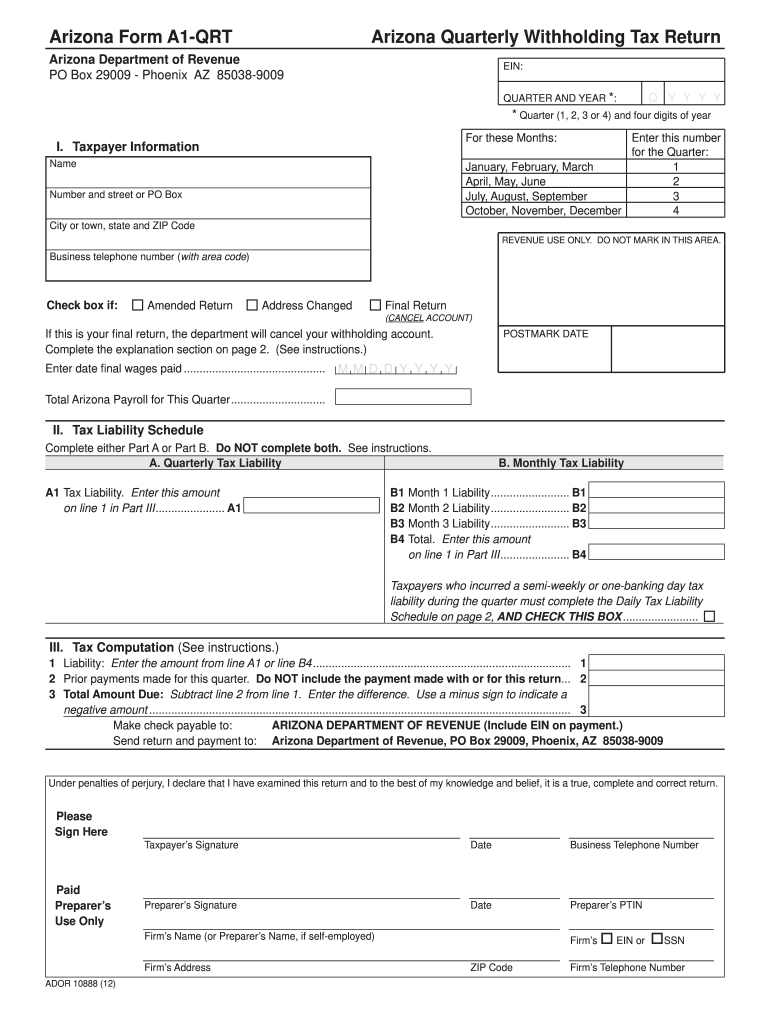

What is the Where To Mail Arizona Tax Return Form

The Where To Mail Arizona Tax Return Form is a crucial document for Arizona residents filing their state taxes. This form provides taxpayers with the necessary information on where to send their completed tax returns to ensure proper processing by the Arizona Department of Revenue. Understanding the correct mailing address is essential to avoid delays and potential penalties associated with late submissions.

How to use the Where To Mail Arizona Tax Return Form

Using the Where To Mail Arizona Tax Return Form involves several steps. First, complete your Arizona tax return accurately, ensuring all necessary information is included. After filling out the form, locate the specific mailing address based on your residency and the type of return you are submitting. This information is typically provided on the form itself or the Arizona Department of Revenue website. Once you have the correct address, print and sign your return, then mail it to the designated location.

Steps to complete the Where To Mail Arizona Tax Return Form

Completing the Where To Mail Arizona Tax Return Form requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Fill out the Arizona tax return form accurately, including personal information, income, deductions, and credits.

- Review your completed form for any errors or omissions.

- Find the correct mailing address for your specific situation, which may vary based on your county or the type of return.

- Sign and date the form.

- Mail the completed form to the appropriate address, ensuring it is sent well before the filing deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona tax return are critical to ensure compliance and avoid penalties. Typically, the deadline for submitting your Arizona state tax return aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to check the Arizona Department of Revenue's official announcements for any changes or specific dates relevant to your tax situation.

Required Documents

When preparing to mail your Arizona tax return, several documents are required to ensure accuracy and completeness. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Documentation for any tax credits claimed

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process and help avoid issues with your submission.

Digital vs. Paper Version

Choosing between a digital and paper version of the Arizona tax return can impact your filing experience. Filing digitally offers several advantages, including faster processing times and the ability to eSign your documents securely. Digital submissions can often be completed from the comfort of your home, while paper submissions require mailing time. However, some individuals prefer paper versions for their tangible nature and ease of review. Regardless of the method chosen, ensure that all forms are completed accurately and submitted by the deadline.

Quick guide on how to complete where to mail arizona tax return form

Your assistance manual on how to prepare your Where To Mail Arizona Tax Return Form

If you’re curious about how to finalize and send your Where To Mail Arizona Tax Return Form, here are a few brief instructions on how to make tax filing less challenging.

To start, you simply need to sign up for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to modify, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures, and return to edit details as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and easy sharing options.

Follow the steps below to complete your Where To Mail Arizona Tax Return Form in just a few minutes:

- Establish your account and start editing PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Press Get form to access your Where To Mail Arizona Tax Return Form in our editor.

- Complete the necessary fillable sections with your details (text, numbers, checkmarks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if applicable).

- Examine your document and rectify any mistakes.

- Store changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting in paper format can increase return mistakes and delay refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct where to mail arizona tax return form

FAQs

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

How do you know where to file your tax return forms?

The proposed GST (goods and services tax) regime is likely to provide for monthly filing of returns for business to business dealings through a set of eight forms for different categories of transactions.The joint committee on Business Process for GST in relation to GST Return has suggested filing of a periodic e-return for Central GST, State GST and Integrated GST.According to the proposal, the returns can be filed on a specific date of a month, like on 10th of next month for outward supplies, 15th for inward supplies and 20th in case of monthly returns.The Committee suggested that in the GST regime there should be eight forms for filing of returns by tax payers.There will also be provision for filing of GST returns by non-resident tax payers in form GSTR-5. Non-resident tax payers could include taxi aggregators like Uber.The report also said there will be a defaulters list of those who will be failing to file returns periodically and such details would be forwarded to GST authorities for necessary action.The Joint Committee also suggested that the GST law should provide for automatic imposition of late fees for non-filers and late filers of returns.In case the return is filed without full payment of taxes, the report said they should be rendered invalid. There will, however, no provision for revision of GST returns.The Finance Ministry had earlier put up three reports of the Empowered Committee, pertaining to registration, payment process and refunds in the GST regime in the public domain for stakeholder comments.The proposed GST envisages taxation of the same taxable event — supply of goods and services, simultaneously by both the Centre and the states.GST seeks to subsume many indirect taxes at the Central and state levels.Although the government had planned to roll out the GST — touted as the most comprehensive indirect tax reform since the independence — from April 1, it seems difficult as the Constitution Amendment Bill is stuck in the Rajya Sabha where the ruling NDA does not have a majority.The government, however, is going ahead with the preparatory work necessary for smooth implementation of the GST, which will subsume various levies like excise, service tax, sales tax, octroi, etc, and will ensure a single indirect tax regime for the entire country.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

Create this form in 5 minutes!

How to create an eSignature for the where to mail arizona tax return form

How to create an electronic signature for your Where To Mail Arizona Tax Return Form in the online mode

How to generate an electronic signature for the Where To Mail Arizona Tax Return Form in Chrome

How to create an eSignature for signing the Where To Mail Arizona Tax Return Form in Gmail

How to generate an electronic signature for the Where To Mail Arizona Tax Return Form right from your smart phone

How to create an eSignature for the Where To Mail Arizona Tax Return Form on iOS devices

How to create an eSignature for the Where To Mail Arizona Tax Return Form on Android

People also ask

-

Where To Mail Arizona Tax Return Form if I’m using airSlate SignNow?

When using airSlate SignNow to complete your Arizona Tax Return Form, you can easily find the mailing address based on the form's instructions. Typically, taxpayers should refer to the Arizona Department of Revenue's website for the specific address. Additionally, our platform ensures that all your documents are neatly organized for easy reference.

-

What features does airSlate SignNow offer to help with tax documents?

airSlate SignNow provides an intuitive interface for eSigning and managing your tax documents, including the Arizona Tax Return Form. Features like document templates, secure cloud storage, and collaboration tools streamline the process. This means you can complete your forms efficiently while knowing where to mail Arizona Tax Return Form with all necessary documents attached.

-

How can airSlate SignNow enhance my tax return process?

By using airSlate SignNow, you can enhance your tax return process signNowly. You can prepare, eSign, and track all your tax-related documents in one place, ensuring you never miss out on critical deadlines. Knowing where to mail Arizona Tax Return Form enhances your efficiency and keeps you organized.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans catering to different needs, from individuals to businesses. Each plan includes essential features needed for managing your tax return documents effectively. By investing in our service, you also gain peace of mind knowing where to mail Arizona Tax Return Form when you're ready.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is fully compliant with required tax regulations, ensuring that all your documents, including the Arizona Tax Return Form, meet legal standards. This compliance guarantees that when you eSign and submit your forms, they are recognized and accepted by the state. You can confidently know where to mail Arizona Tax Return Form after creating it with our platform.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with several accounting and tax preparation software, enhancing your workflow and efficiency. This means that once you've prepared your Arizona Tax Return Form, you can easily coordinate with your accounting tools. You’ll always be informed about where to mail Arizona Tax Return Form after finalizing your documents.

-

Does airSlate SignNow support multiple users for tax preparation?

Yes, airSlate SignNow supports multiple users, making it ideal for teams preparing tax documents collectively. You can collaborate in real-time, ensuring everyone is on the same page regarding the Arizona Tax Return Form. This shared access also ensures clarity about where to mail Arizona Tax Return Form when the time comes.

Get more for Where To Mail Arizona Tax Return Form

Find out other Where To Mail Arizona Tax Return Form

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now