Ethiopian Pension Form

What is the Ethiopian Pension Form

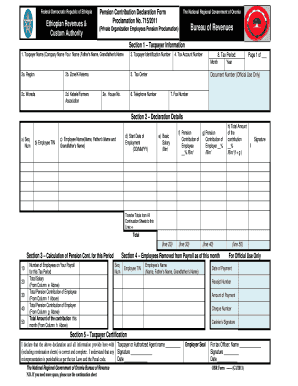

The Ethiopian Pension Form is a crucial document used by individuals seeking to access their pension benefits from the Ethiopian Pension Agency. This form collects essential information about the applicant's employment history, contributions, and personal details necessary for processing pension claims. It serves as a formal request for the disbursement of pension funds, ensuring that retirees receive the financial support they are entitled to after years of service.

How to obtain the Ethiopian Pension Form

The Ethiopian Pension Form can typically be obtained directly from the Ethiopian Pension Agency's official website or local offices. Additionally, individuals may request the form through phone communication with the agency. It is advisable to confirm the most current version of the form, as updates may occur periodically. For residents in the United States, contacting the Ethiopian consulate may also provide access to the necessary documentation.

Steps to complete the Ethiopian Pension Form

Completing the Ethiopian Pension Form involves several key steps:

- Gather all required documents, including identification, proof of employment, and contribution records.

- Fill out the form accurately, ensuring all personal and employment details are correct.

- Review the completed form for any errors or omissions.

- Submit the form to the Ethiopian Pension Agency through the designated method, whether online, by mail, or in person.

Legal use of the Ethiopian Pension Form

The Ethiopian Pension Form must be completed and submitted in accordance with the legal requirements set forth by the Ethiopian government. This includes ensuring that all information provided is truthful and that the form is signed where required. Failing to comply with these legal standards may result in delays or denial of pension benefits.

Required Documents

To successfully complete the Ethiopian Pension Form, applicants must provide several supporting documents. These typically include:

- A valid form of identification, such as a national ID or passport.

- Proof of employment, which may include employment letters or contracts.

- Records of pension contributions made during the employment period.

- Any additional documents specified by the Ethiopian Pension Agency.

Form Submission Methods

The Ethiopian Pension Form can be submitted through various methods, depending on the applicant's preference and location. Common submission methods include:

- Online submission via the Ethiopian Pension Agency's official website.

- Mailing the completed form to the agency's designated address.

- In-person submission at local offices of the Ethiopian Pension Agency.

Who Issues the Form

The Ethiopian Pension Form is issued by the Ethiopian Pension Agency, which is responsible for managing pension funds and ensuring that retirees receive their entitled benefits. This agency oversees the processing of pension applications and maintains records related to pension contributions and disbursements.

Quick guide on how to complete ethiopian pension form

Effortlessly Prepare Ethiopian Pension Form on Any Device

Managing documents online has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Ethiopian Pension Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest way to edit and eSign Ethiopian Pension Form with minimal effort

- Obtain Ethiopian Pension Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure private information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only a few seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ethiopian Pension Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ethiopian pension form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ehe ethiopia pension declaration?

The ehe ethiopia pension declaration is a legally binding document that outlines the pension scheme provided by employers to their employees in Ethiopia. It ensures compliance with national regulations and protects both the rights of employees and the interests of employers. Understanding this declaration is crucial for effective employee management and pension planning.

-

How can airSlate SignNow assist with creating and signing the ehe ethiopia pension declaration?

AirSlate SignNow offers an intuitive platform that allows businesses to create, send, and eSign the ehe ethiopia pension declaration quickly and efficiently. The user-friendly interface ensures that employers can customize the declaration to meet specific needs while facilitating seamless collaboration between parties. This streamlines the process and reduces the time required for document management.

-

What are the costs associated with using airSlate SignNow for the ehe ethiopia pension declaration?

AirSlate SignNow provides a variety of pricing plans tailored to different business sizes and needs. These plans offer flexibility in terms of usage, features, and support options. For businesses looking to manage the ehe ethiopia pension declaration efficiently, investing in SignNow can lead to substantial long-term savings compared to traditional document processing methods.

-

What features does airSlate SignNow offer for the ehe ethiopia pension declaration?

AirSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage, specifically designed to simplify the management of the ehe ethiopia pension declaration. Additionally, the platform supports real-time tracking of document status and provides advanced security measures to protect sensitive employee information. These features enhance efficiency and compliance.

-

Can airSlate SignNow integrate with other software for managing the ehe ethiopia pension declaration?

Yes, airSlate SignNow integrates seamlessly with various business software applications, including HR systems, CRMs, and productivity tools. This compatibility enables businesses to manage the ehe ethiopia pension declaration alongside other essential processes, ensuring a cohesive workflow and enhanced organizational efficiency. Integration helps eliminate manual data entry errors and saves time.

-

What are the benefits of using airSlate SignNow for the ehe ethiopia pension declaration?

Using airSlate SignNow for the ehe ethiopia pension declaration offers numerous benefits, such as reducing paperwork, speeding up the signing process, and enhancing compliance. The digital signature feature accelerates the approval workflow, allowing employers to focus on their core responsibilities. Moreover, the platform's security measures provide peace of mind regarding sensitive employee data.

-

Is airSlate SignNow secure for handling the ehe ethiopia pension declaration?

Absolutely, airSlate SignNow prioritizes security and employs industry-standard encryption and authentication methods to protect the ehe ethiopia pension declaration. The platform complies with regulatory requirements, ensuring that documents are stored and transmitted securely. Businesses can have confidence in using SignNow to manage their pension declarations without compromising data integrity.

Get more for Ethiopian Pension Form

Find out other Ethiopian Pension Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe