Form 10i Income Tax

What is the Form 10i Income Tax

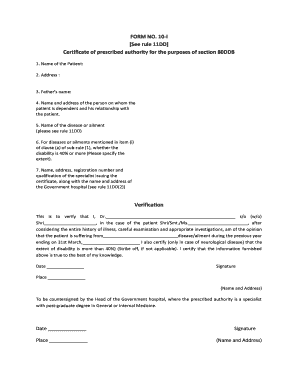

The Form 10i is a specific income tax form used in the United States for claiming deductions under Section 80DDB, which pertains to medical expenses incurred for the treatment of specified diseases. This form is essential for taxpayers who wish to avail themselves of tax benefits related to medical expenditures. It is crucial to understand the eligibility criteria and the type of expenses that qualify for deductions under this section.

How to use the Form 10i Income Tax

Using the Form 10i involves several straightforward steps. First, gather all necessary documents, including medical bills, prescriptions, and any other relevant paperwork that supports your claim for deductions. Next, accurately fill out the form, ensuring that all required information is included. This includes personal details, the amount spent on medical treatment, and the nature of the illness. Finally, submit the completed form along with your tax return to the appropriate tax authority.

Steps to complete the Form 10i Income Tax

Completing the Form 10i requires careful attention to detail. Follow these steps for a successful submission:

- Collect all relevant medical documents and receipts.

- Fill in your personal information, including your name, address, and Social Security number.

- Detail the medical expenses incurred, specifying the type of treatment and the amount paid.

- Ensure that the form is signed and dated before submission.

- Attach the form to your tax return and submit it by the filing deadline.

Legal use of the Form 10i Income Tax

The Form 10i is legally recognized for claiming deductions under Section 80DDB. To ensure compliance with tax laws, it is essential to maintain accurate records of all medical expenses claimed. This includes keeping copies of receipts and any supporting documentation that may be requested by tax authorities. Failure to comply with the legal requirements may result in penalties or disallowance of the claimed deductions.

Required Documents

When preparing to file the Form 10i, certain documents are required to substantiate your claims. These include:

- Medical bills and invoices from healthcare providers.

- Prescriptions for medications related to the treatment.

- Any additional documentation that verifies the nature of the illness and the expenses incurred.

Eligibility Criteria

To qualify for deductions using the Form 10i, taxpayers must meet specific eligibility criteria. These typically include:

- Being a resident of the United States.

- Having incurred medical expenses for specified diseases as defined by tax regulations.

- Providing appropriate documentation to support the claims made on the form.

Quick guide on how to complete form 10i income tax

Effortlessly Complete Form 10i Income Tax on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without any hold-ups. Manage Form 10i Income Tax from any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and eSign Form 10i Income Tax Seamlessly

- Find Form 10i Income Tax and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to finalize your changes.

- Select your preferred method to send your form—via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 10i Income Tax while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10i income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 80ddb certificate format?

The 80ddb certificate format is a digital format used for securely signing documents and ensuring their authenticity. It helps businesses verify the integrity of the signed content and provides a tamper-proof audit trail for seamless compliance.

-

How does airSlate SignNow support the 80ddb certificate format?

airSlate SignNow supports the 80ddb certificate format by allowing users to easily upload and sign documents in this format. This functionality ensures that your electronic signatures are compatible with industry standards, boosting trust and acceptance.

-

Is there a cost associated with using 80ddb certificate format in airSlate SignNow?

Using the 80ddb certificate format within airSlate SignNow is included in our pricing plans, which provide a cost-effective solution for businesses. Our flexible pricing options are designed to cater to various needs, making it affordable to implement secure digital signatures.

-

What are the benefits of using the 80ddb certificate format for e-signatures?

The 80ddb certificate format offers numerous benefits, including enhanced security and validation of documents. By using this format, businesses can ensure that their e-signatures are legally binding and compliant with international standards.

-

Can I integrate airSlate SignNow with other applications while using 80ddb certificate format?

Yes, airSlate SignNow offers seamless integrations with various third-party applications while supporting the 80ddb certificate format. This allows you to streamline your workflow and enhance productivity by combining different tools.

-

How secure is the 80ddb certificate format in airSlate SignNow?

The 80ddb certificate format used in airSlate SignNow provides top-tier security measures to protect your documents and data. Advanced encryption protocols ensure that your information remains confidential while allowing for secure e-signatures.

-

Do I need special software to handle the 80ddb certificate format?

No, you do not need special software to handle the 80ddb certificate format when using airSlate SignNow. Our user-friendly platform provides all the necessary tools to easily create, send, and sign documents in this format.

Get more for Form 10i Income Tax

Find out other Form 10i Income Tax

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy