Publication 4134 2022

What is the Publication 4134

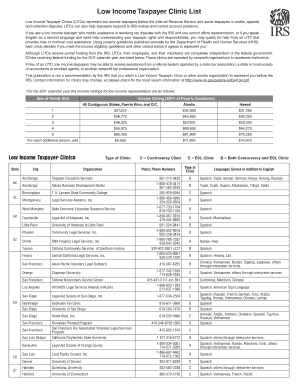

IRS Publication 4134 provides essential information regarding the Low Income Taxpayer Clinic (LITC) program. This publication outlines the services offered by LITCs, which assist low-income taxpayers in resolving disputes with the IRS. It also details eligibility criteria for taxpayers seeking help, ensuring that those who qualify can access the necessary support. Understanding this publication is crucial for anyone looking to navigate tax issues while facing financial constraints.

How to use the Publication 4134

Using IRS Publication 4134 involves several steps. First, taxpayers should review the publication to understand the services available through LITCs. Next, they can find a clinic in their area by consulting the clinic list provided in the publication. It is important to gather all relevant documents, such as tax returns and correspondence with the IRS, before contacting a clinic. This preparation will help ensure that the clinic can provide the most effective assistance.

How to obtain the Publication 4134

Taxpayers can obtain IRS Publication 4134 through various methods. The publication is available for download directly from the IRS website, where it can be accessed in PDF format. Additionally, printed copies can be requested by contacting the IRS or visiting local IRS offices. Ensuring you have the latest version of the publication is important, as it contains updated information regarding available clinics and services.

Key elements of the Publication 4134

Several key elements are included in IRS Publication 4134. These elements encompass the following:

- Eligibility criteria: Defines who qualifies for assistance from LITCs.

- Clinic services: Describes the types of support offered, including representation in disputes and education on taxpayer rights.

- Contact information: Provides details on how to reach local clinics, including phone numbers and addresses.

- IRS guidelines: Outlines the procedures and regulations governing the LITC program.

Steps to complete the Publication 4134

Completing the necessary steps outlined in IRS Publication 4134 involves gathering relevant information and following the guidelines provided. Taxpayers should:

- Review the eligibility criteria to ensure they qualify for assistance.

- Collect all necessary documentation related to their tax situation.

- Contact a local LITC for guidance and support.

- Follow the clinic's instructions for resolving their tax issues.

Legal use of the Publication 4134

The legal use of IRS Publication 4134 is essential for ensuring compliance with IRS regulations. Taxpayers must understand that the information provided in this publication is designed to guide them in accessing legitimate assistance. Utilizing the resources and clinics listed in the publication helps ensure that taxpayers receive accurate and lawful support in addressing their tax matters.

Quick guide on how to complete publication 4134

Complete Publication 4134 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without issues. Manage Publication 4134 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Publication 4134 without hassle

- Find Publication 4134 and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Publication 4134 to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 4134

Create this form in 5 minutes!

How to create an eSignature for the publication 4134

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Publication 4134 Low Income Taxpayer Clinic List?

The IRS Publication 4134 Low Income Taxpayer Clinic List provides information about clinics that offer free or low-cost legal assistance to low-income individuals in tax disputes. This resource is essential for those seeking help from qualified professionals who understand tax laws and can assist in representation before the IRS.

-

How can airSlate SignNow help with documents related to IRS Publication 4134?

With airSlate SignNow, you can easily eSign and send documents related to the IRS Publication 4134 Low Income Taxpayer Clinic List, streamlining the process of obtaining necessary signatures quickly and efficiently. This ensures that you can focus on your tax issues without the hassle of traditional paperwork.

-

Is airSlate SignNow affordable for low-income taxpayers?

Yes, airSlate SignNow offers a cost-effective solution designed to be accessible for everyone, including low-income taxpayers seeking guidance through the IRS Publication 4134 Low Income Taxpayer Clinic List. Our pricing plans are competitive, and we provide features that enhance your document management without breaking the bank.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow includes features such as customizable templates, advanced security, and real-time tracking for tax-related documents. These features enable users to efficiently manage their filings, making it easier to navigate the IRS Publication 4134 Low Income Taxpayer Clinic List and the accompanying documentation.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This compatibility ensures that you can leverage the IRS Publication 4134 Low Income Taxpayer Clinic List alongside your existing workflows for improved efficiency.

-

What benefits does using airSlate SignNow provide for low-income taxpayers?

Utilizing airSlate SignNow offers low-income taxpayers the benefit of enhanced accessibility to legal resources and support. By simplifying the signing process for documents associated with the IRS Publication 4134 Low Income Taxpayer Clinic List, we empower users to receive help more effectively and promptly.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security by employing state-of-the-art encryption and compliance with industry regulations, ensuring that all your sensitive tax documents are safe. When working with documents tied to the IRS Publication 4134 Low Income Taxpayer Clinic List, you can trust that your information remains confidential.

Get more for Publication 4134

- Tbs sct 330 47 form

- Form 23rm023e pa 23 b oklahoma department of human okdhs

- Apply for an id online form

- Dental clearance letter 454348889 form

- Isi rekam medis form

- Agent nomination form sun education group

- Awop 76 application for working in addition to university placements for provisional psychologists form

- Short study abroad program application form icte uq edu au

Find out other Publication 4134

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online