New Aid After Loan Discharge New Aid After Loan Discharge 2020-2026

What is the aid discharge form?

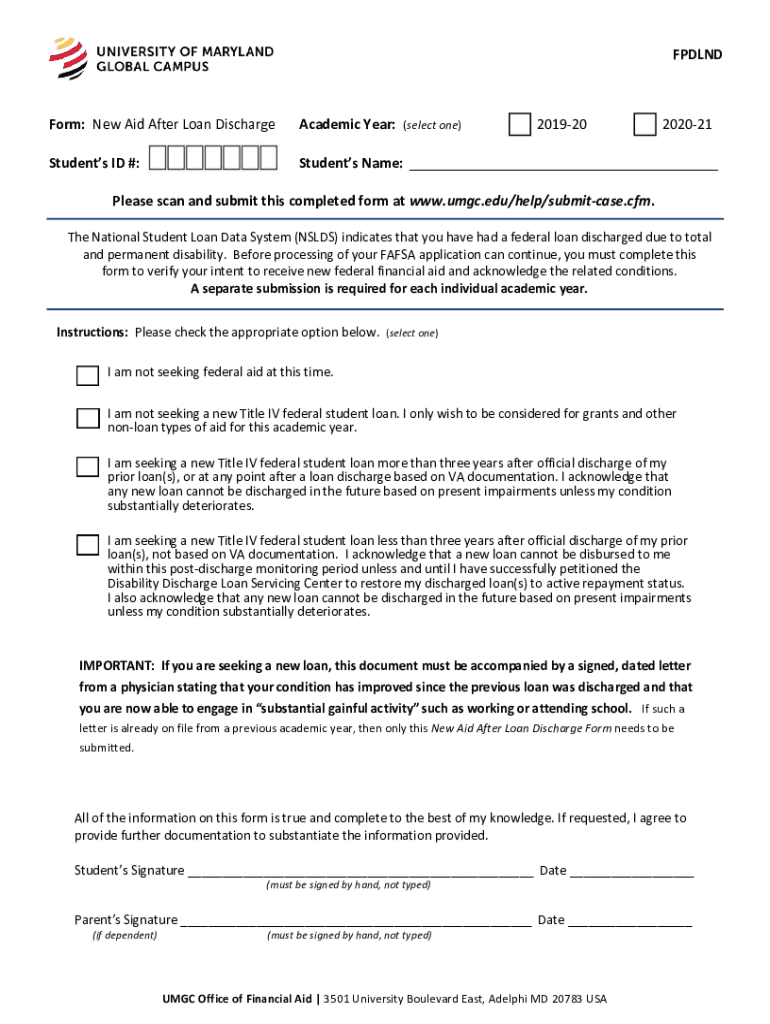

The aid discharge form is a legal document used to request the cancellation of student loan debt under specific circumstances. This form is particularly relevant for borrowers who have experienced significant financial hardship or have met certain eligibility criteria established by the U.S. Department of Education. Understanding the purpose and implications of this form is crucial for borrowers seeking relief from their student loan obligations.

How to use the aid discharge form

Using the aid discharge form involves several steps to ensure that all necessary information is accurately provided. Start by gathering relevant documentation, such as proof of income, employment status, and any other information that supports your claim for discharge. Complete the form carefully, ensuring that all sections are filled out as required. Once completed, submit the form to the appropriate department as indicated in the instructions, either online or via mail, depending on the submission options available.

Key elements of the aid discharge form

The aid discharge form includes several key elements that must be addressed for it to be considered valid. Essential components typically include:

- Borrower Information: Personal details such as name, address, and Social Security number.

- Loan Information: Details about the loans being discharged, including loan numbers and types.

- Eligibility Criteria: Information that demonstrates the borrower's eligibility for discharge, such as financial hardship or disability status.

- Signature: A signature is required to validate the form, confirming that the information provided is accurate and complete.

Steps to complete the aid discharge form

Completing the aid discharge form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all necessary documentation that supports your request for discharge.

- Carefully fill out the form, paying close attention to each section.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate your submission.

- Submit the form according to the provided instructions, either online or by mail.

Legal use of the aid discharge form

The legal use of the aid discharge form is governed by federal regulations that outline the conditions under which student loan debt can be discharged. It is essential for borrowers to understand their rights and obligations when using this form. Compliance with all legal requirements ensures that the discharge request is processed correctly and that the borrower is protected under applicable laws.

Eligibility criteria for the aid discharge form

Eligibility for using the aid discharge form varies based on specific circumstances. Common criteria include:

- Proving financial hardship, such as unemployment or underemployment.

- Demonstrating a permanent disability that prevents the borrower from working.

- Meeting specific criteria related to the type of loans held, such as Direct Loans or FFEL Program Loans.

It is important for borrowers to review the eligibility requirements carefully to ensure they qualify before submitting the form.

Quick guide on how to complete new aid after loan discharge new aid after loan discharge

Effortlessly Prepare New Aid After Loan Discharge New Aid After Loan Discharge on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage New Aid After Loan Discharge New Aid After Loan Discharge on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign New Aid After Loan Discharge New Aid After Loan Discharge with Ease

- Locate New Aid After Loan Discharge New Aid After Loan Discharge and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign New Aid After Loan Discharge New Aid After Loan Discharge to ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new aid after loan discharge new aid after loan discharge

Create this form in 5 minutes!

How to create an eSignature for the new aid after loan discharge new aid after loan discharge

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What should I do after loan discharge?

After loan discharge, it's essential to confirm that your loan has been officially cleared. You may also want to review your credit report to ensure that the loan is marked as discharged. Utilize services like airSlate SignNow to securely sign and send any necessary documentation related to your loan discharge.

-

How can airSlate SignNow help after loan discharge?

airSlate SignNow provides an easy-to-use platform for eSigning and sending important documents after loan discharge. This simplifies the process of completing any additional paperwork that may be required, making your post-discharge experience seamless and efficient.

-

Are there any costs associated with airSlate SignNow after loan discharge?

While there are subscription plans for airSlate SignNow, the costs are reasonable and designed to fit various budgets. After loan discharge, using our service can save you time and ensure your documents are handled securely and efficiently. Explore our pricing plans to find the right option for your needs.

-

What features does airSlate SignNow offer that are beneficial after loan discharge?

airSlate SignNow offers features such as customizable templates, secure document storage, and real-time status updates. These features are particularly beneficial after loan discharge, as they allow you to manage your post-loan documents effectively. Utilizing these tools can help you stay organized and ensure all paperwork is completed promptly.

-

How does airSlate SignNow ensure document security after loan discharge?

Security is a top priority for airSlate SignNow. We use bank-level encryption and secure servers to protect your documents after loan discharge. You can confidently send and eSign sensitive information, knowing that your data is safeguarded against unauthorized access.

-

Can I integrate airSlate SignNow with other tools I use after loan discharge?

Yes, airSlate SignNow offers integrations with various third-party applications, which can be particularly useful after loan discharge. Whether you use cloud storage services or project management tools, our platform connects seamlessly with them, allowing for a smooth workflow in handling post-discharge documentation.

-

What benefits can I gain from using airSlate SignNow after loan discharge?

By using airSlate SignNow after loan discharge, you can benefit from a faster document turnaround, enhanced security, and reduced paperwork chaos. Our platform’s user-friendly interface makes it easy to manage and sign documents digitally, helping you focus on what matters most in your financial journey.

Get more for New Aid After Loan Discharge New Aid After Loan Discharge

- Bacone college transcript request form

- Sherlock holmes ielts reading pdf form

- Surat peoples bank rtgs form pdf

- Silverts return policy form

- Oklahoma automatic temporary injunction form

- Fax to work education placement agreementpost secondary form

- Karaoke westheimer form

- Sleep studies to qualify for a license as a technologist form

Find out other New Aid After Loan Discharge New Aid After Loan Discharge

- Help Me With Install eSignature in ServiceNow

- How Can I Install eSignature in ServiceNow

- How To Use eSignature in WorkDay

- How Do I Use eSignature in WorkDay

- Help Me With Use eSignature in WorkDay

- How Can I Use eSignature in WorkDay

- Can I Use eSignature in WorkDay

- How To Install eSignature in Word

- How Do I Install eSignature in Word

- How To Install eSignature in Oracle

- Help Me With Install eSignature in Oracle

- How To Integrate eSignature in Word

- Can I Install eSignature in Word

- How Do I Integrate eSignature in Word

- Can I Install eSignature in G Suite

- Can I Integrate eSignature in Word

- How To Use eSignature in ServiceNow

- Help Me With Use eSignature in ServiceNow

- Help Me With Install eSignature in PaperWise

- Can I Use eSignature in ServiceNow