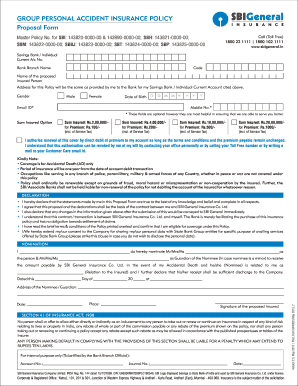

Sbi Accidental Insurance Form

What is the SBI Accidental Insurance?

The SBI Accidental Insurance is a financial product designed to provide coverage in the event of accidental death or disability. This insurance aims to offer financial security to policyholders and their families during unforeseen circumstances. The policy typically covers a range of incidents, ensuring that beneficiaries receive compensation that can help with medical expenses, rehabilitation, or daily living costs following an accident. Understanding the specifics of this insurance is crucial for individuals seeking to protect themselves and their loved ones.

How to Obtain the SBI Accidental Insurance

Obtaining SBI Accidental Insurance involves a straightforward process. Interested individuals can start by visiting the official SBI website or contacting a local branch. Here are the general steps:

- Research the different plans available to understand the coverage options and premiums.

- Fill out the application form, providing necessary personal information and details about the desired coverage.

- Submit the application along with any required documents, such as identification and proof of income.

- Once the application is processed, the insurer will provide a policy document outlining the terms and conditions.

It is advisable to review the policy thoroughly before making a commitment to ensure it meets your needs.

Steps to Complete the SBI Accidental Insurance Form

Completing the SBI Accidental Insurance form requires careful attention to detail to ensure accuracy. Follow these steps for a seamless experience:

- Gather all necessary documents, including identification and any prior insurance information.

- Begin filling out the form with accurate personal details, including your full name, address, and contact information.

- Provide information about your occupation and lifestyle, as this may affect your premium.

- Review the coverage options and select the amount that best fits your needs.

- Sign the form electronically or in person, depending on your submission method.

- Submit the completed form through the preferred method, ensuring you keep a copy for your records.

Legal Use of the SBI Accidental Insurance

The legal use of SBI Accidental Insurance is governed by various regulations that ensure the policy is valid and enforceable. To be considered legally binding, the policy must adhere to specific requirements, such as:

- Clear terms and conditions that outline the coverage and exclusions.

- Proper documentation and signatures from all parties involved.

- Compliance with state laws regarding insurance policies.

Understanding these legal aspects is essential for policyholders to ensure they are adequately protected under the law.

Key Elements of the SBI Accidental Insurance

Several key elements define the SBI Accidental Insurance, making it essential for potential policyholders to be aware of them:

- Coverage Amount: The total sum assured in case of an accident.

- Premium: The amount payable for the insurance coverage, which may vary based on factors like age and occupation.

- Exclusions: Specific situations or conditions that are not covered by the policy.

- Claim Process: The procedure to follow in the event of an accident to receive compensation.

Familiarity with these elements can help individuals make informed decisions about their insurance needs.

Eligibility Criteria for SBI Accidental Insurance

To qualify for SBI Accidental Insurance, applicants must meet certain eligibility criteria, which typically include:

- Age: Applicants usually need to fall within a specific age range, often between eighteen and sixty-five years.

- Residency: Applicants must be legal residents of the United States.

- Health Status: Some insurers may require a health assessment or declaration regarding existing medical conditions.

Meeting these criteria is essential to ensure a smooth application process and secure coverage.

Quick guide on how to complete sbi accidental insurance

Complete Sbi Accidental Insurance with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the essential tools to create, alter, and electronically sign your documents swiftly without delays. Manage Sbi Accidental Insurance on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented operation today.

The easiest way to alter and electronically sign Sbi Accidental Insurance effortlessly

- Locate Sbi Accidental Insurance and click on Obtain Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or obscure confidential information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Signature tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Finish button to save your changes.

- Select how you would prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Sbi Accidental Insurance and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sbi accidental insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SBI accidental insurance form?

The SBI accidental insurance form is a document you need to fill out to apply for an accidental insurance policy offered by State Bank of India. This form captures essential personal information and details regarding your insurance needs. Ensuring accurate completion of the SBI accidental insurance form is crucial for a smooth application process.

-

How can I obtain the SBI accidental insurance form?

You can obtain the SBI accidental insurance form through the official SBI website or by visiting your nearest SBI branch. Additionally, airSlate SignNow streamlines the process by allowing you to upload and sign your forms electronically, making it easier to manage your insurance applications.

-

What information is required in the SBI accidental insurance form?

The SBI accidental insurance form typically requires personal details such as your name, address, age, and occupation. You may also need to provide information about beneficiaries and any pre-existing medical conditions. Make sure to complete the form accurately to avoid delays in processing your insurance application.

-

Are there any fees associated with the SBI accidental insurance form?

Filling out the SBI accidental insurance form itself is free; however, there may be applicable premiums for the insurance policy you choose. Understanding the costs involved is vital for selecting the right plan for your needs. Make sure to review all pricing details before applying.

-

What are the benefits of filling out the SBI accidental insurance form?

Completing the SBI accidental insurance form allows you to gain access to valuable financial protection in case of accidents. It ensures peace of mind for you and your loved ones, knowing that they are covered. By using airSlate SignNow, you can sign the form securely and efficiently, further ensuring your application is processed quickly.

-

Can I submit my SBI accidental insurance form online?

Yes, you can submit your SBI accidental insurance form online through the SBI website or by using airSlate SignNow for electronic signing and submission. This convenience saves time and ensures that your forms are securely transmitted. Be sure to follow the instructions provided for online submissions.

-

Is it possible to modify the SBI accidental insurance form after submission?

Once you submit the SBI accidental insurance form, making modifications may be challenging. It is advisable to contact SBI customer service for any necessary changes. Ensure all details are accurate before submission to minimize the need for amendments.

Get more for Sbi Accidental Insurance

- How to fill antrag auf steuerklassenwechsel bei ehegatten form

- Pediatric occupational therapy parent consent to treat form

- Instrument data form forms bahamas gov

- Committee charter template form

- Fill out amendment for police report form online

- South carolina form fr 402

- Health card tarlac city form

- Epcor landlord agreement form

Find out other Sbi Accidental Insurance

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation