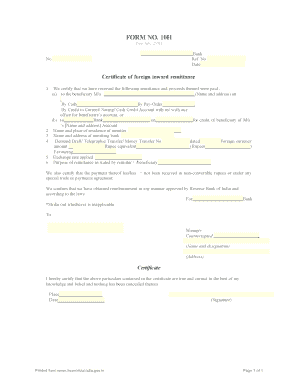

Form 10h of Income Tax Act

What is the Form 10h Of Income Tax Act

The Form 10h is a specific document under the Income Tax Act in the United States, primarily used for reporting certain types of income. This form is essential for taxpayers who need to declare income that may not be captured through standard reporting methods. Understanding the 10h meaning is crucial for compliance with tax regulations and ensuring accurate reporting of financial information.

How to use the Form 10h Of Income Tax Act

Using the Form 10h involves several steps to ensure that all required information is accurately reported. Taxpayers must fill out the form with details regarding their income sources, deductions, and other relevant financial data. It is important to follow the guidelines provided by the IRS to avoid errors that could lead to penalties. Additionally, utilizing electronic filing options can streamline the process and enhance accuracy.

Steps to complete the Form 10h Of Income Tax Act

Completing the Form 10h requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and receipts for deductions.

- Fill out the personal information section, ensuring that your name, address, and Social Security number are correct.

- Report your income accurately, including any additional income not reported on other forms.

- Include any applicable deductions and credits that may reduce your taxable income.

- Review the completed form for accuracy before submitting it.

Legal use of the Form 10h Of Income Tax Act

The legal use of the Form 10h is governed by the regulations set forth in the Income Tax Act. This form must be filled out correctly to maintain compliance with tax laws. Failure to accurately report income using this form can lead to legal repercussions, including fines or audits by the IRS. It is advisable to consult with a tax professional if there are uncertainties regarding the form's completion or legal implications.

Required Documents

To successfully complete the Form 10h, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for any deductions claimed.

- Previous year's tax return for reference.

- Any relevant financial records that support income claims.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 10h. Generally, the form must be submitted by the tax filing deadline, which is typically April 15th of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any changes in deadlines that may arise due to legislative updates or IRS announcements.

Quick guide on how to complete form 10h of income tax act

Complete Form 10h Of Income Tax Act effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork since you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Form 10h Of Income Tax Act on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Form 10h Of Income Tax Act with ease

- Obtain Form 10h Of Income Tax Act and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Produce your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 10h Of Income Tax Act to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10h of income tax act

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 10h meaning in relation to airSlate SignNow?

The term '10h meaning' refers to the significance of timely document signing and management using airSlate SignNow. With our platform, businesses can achieve a quicker turnaround on their contracts and agreements, enhancing efficiency and workflow.

-

How does airSlate SignNow facilitate understanding of 10h meaning for businesses?

airSlate SignNow clarifies '10h meaning' by providing features that streamline the signing process, reducing the time needed for document execution. This ensures that users can complete their transactions and agreements within a standard timeframe, improving business operations.

-

What are the pricing options for airSlate SignNow?

Our pricing plans are designed to be cost-effective while addressing various business needs. Understanding '10h meaning' is integral to choosing the right plan, as timely document signing can signNowly impact your expenses and operational efficiency.

-

What features does airSlate SignNow offer to help with 10h meaning?

At airSlate SignNow, we offer advanced features such as templates, reminders, and real-time tracking that align with the '10h meaning.' These features ensure that users can manage deadlines effectively, thus expediting document workflows.

-

How can airSlate SignNow improve document management in relation to 10h meaning?

By utilizing airSlate SignNow, businesses can grasp '10h meaning' by ensuring that every document is efficiently managed from start to finish. Our platform automates notifications and integrations, allowing teams to focus on critical tasks while remaining compliant and timely.

-

Does airSlate SignNow integrate with other tools to support 10h meaning?

Yes, airSlate SignNow offers seamless integrations with various software solutions to enhance the '10h meaning.' This interoperability helps businesses maintain consistent workflows and prevents bottlenecks in document processing.

-

What benefits do users gain by understanding 10h meaning through airSlate SignNow?

By understanding '10h meaning' through our platform, users gain signNow advantages such as increased productivity, reduced turnaround times, and enhanced collaboration among team members. This holistic approach ultimately strengthens business relationships and improves outcomes.

Get more for Form 10h Of Income Tax Act

- Bond refund form tenancy servicessa gov au bond refundsbond refund form tenancy servicesbondtenancy services

- Ui49 form 564890364

- Din vde 0100 teil 600 prfprotokoll vorlage excel form

- Affidavit of non military service nj form

- Texas childrens medical records form

- Directors trustees and like officials worksheet form

- Goodyear rebate form

- Pre approved official reporters pro tempore list request form

Find out other Form 10h Of Income Tax Act

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe