St119 1 Form

What is the St119 1 Form

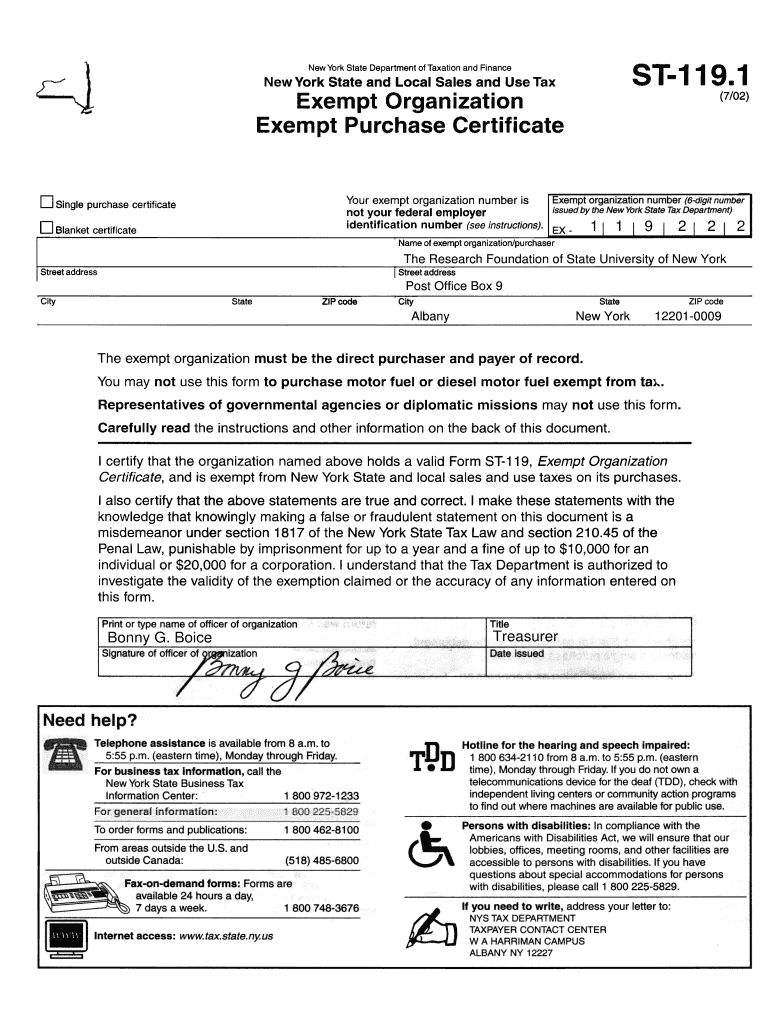

The St119 1 form, also known as the New York State Exempt Organization Certification, is a crucial document for organizations seeking tax-exempt status in New York. This form is primarily used by nonprofit organizations, charities, and other entities that qualify under specific IRS regulations. By completing the St119 1 form, organizations can certify their exempt status, allowing them to operate without paying certain state taxes. This certification is essential for compliance with New York state tax laws and helps organizations maintain their tax-exempt status.

How to Obtain the St119 1 Form

To obtain the St119 1 form, individuals or organizations can visit the New York State Department of Taxation and Finance website. The form is available for download in a fillable PDF format, making it easy to complete electronically. Additionally, physical copies can be requested from local tax offices or through official state government offices. It is important to ensure that the most current version of the form is used, as updates may occur periodically.

Steps to Complete the St119 1 Form

Completing the St119 1 form involves several key steps:

- Begin by entering the organization's name, address, and identification number.

- Provide details about the organization’s purpose and activities, ensuring alignment with tax-exempt criteria.

- Complete the certification section, affirming that the organization meets the necessary requirements for tax exemption.

- Review all information for accuracy and completeness before signing the form.

- Submit the completed form to the appropriate state tax authority as directed.

Legal Use of the St119 1 Form

The legal use of the St119 1 form is critical for organizations wishing to maintain their tax-exempt status in New York. By submitting this form, organizations certify that they operate exclusively for exempt purposes as defined by the IRS. This legal certification protects the organization from potential tax liabilities and ensures compliance with state regulations. It is essential for organizations to understand that any misrepresentation on the form can lead to penalties, including the loss of tax-exempt status.

Form Submission Methods

The St119 1 form can be submitted through various methods to accommodate different preferences. Organizations can choose to submit the form online via the New York State Department of Taxation and Finance’s e-filing system, which offers a streamlined and efficient process. Alternatively, the form can be mailed to the designated tax office or submitted in person at local tax offices. It is advisable to keep a copy of the submitted form for the organization’s records.

Eligibility Criteria

To be eligible for completing the St119 1 form, organizations must meet specific criteria set forth by the IRS and New York state laws. Generally, eligible organizations include charitable, educational, religious, and scientific entities that operate exclusively for exempt purposes. Additionally, organizations must not engage in activities that are contrary to the interests of the public or that generate substantial unrelated business income. Understanding these eligibility criteria is essential for ensuring compliance and maintaining tax-exempt status.

Quick guide on how to complete st119 1 form 100056860

Complete St119 1 Form effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle St119 1 Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

The easiest way to adjust and eSign St119 1 Form without difficulty

- Locate St119 1 Form and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant parts of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign St119 1 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st119 1 form 100056860

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form st119 1 and how can I use it?

The form st119 1 is a tax document that allows businesses to claim a refund on sales tax paid to vendors. With airSlate SignNow, you can easily fill out, eSign, and send the form st119 1, ensuring compliance and streamlining your tax refund process.

-

Is airSlate SignNow suitable for completing the form st119 1?

Yes, airSlate SignNow is an excellent solution for completing the form st119 1. Our user-friendly interface allows you to fill in the necessary information quickly, eSign the document, and send it securely to the required recipient.

-

What are the features available for the form st119 1 on airSlate SignNow?

With airSlate SignNow, you benefit from features like customizable templates, real-time collaboration, and secure cloud storage when working with the form st119 1. These features simplify the process and make tracking edits and signatures easy.

-

How does airSlate SignNow help in reducing costs while using the form st119 1?

Using airSlate SignNow can signNowly reduce costs associated with paper, printing, and mailing when completing the form st119 1. Our digital solution allows you to handle everything online, minimizing overhead and maximizing efficiency.

-

Can I integrate airSlate SignNow with other tools for managing the form st119 1?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, including CRM systems and cloud storage providers. This enables you to efficiently manage the form st119 1 alongside your other business processes.

-

How secure is airSlate SignNow when handling the form st119 1?

Security is a top priority at airSlate SignNow. When handling the form st119 1, your data is protected with advanced encryption, ensuring that all signatures and personal information remain secure throughout the entire process.

-

What pricing plans does airSlate SignNow offer for using the form st119 1?

airSlate SignNow offers a range of pricing plans that suit different business needs. You can choose a plan based on your usage of the form st119 1, ensuring you get the best value for your investment while accessing all essential features.

Get more for St119 1 Form

- Customs declaration form approved omb no 1651 cbp

- Affidavit template new york form

- Staffs biodata form royal college masaka

- Ldss 2521 form

- Sryxxx form

- Sh7005pago del impuesto cedular a los ingresos por form

- Authorization to release information on financial aid

- Civ 105 anch fed summons 6 10 state of alaska form

Find out other St119 1 Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF