Inirp L 2004

What is the Inirp L

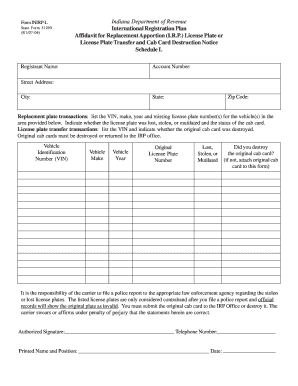

The Inirp L is a specific form utilized in Indiana for reporting and documenting certain tax-related information. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It serves as a means to report income, deductions, and other pertinent financial data to the Indiana Department of Revenue. Understanding the purpose of the Inirp L is crucial for accurate tax filing and maintaining good standing with state authorities.

How to use the Inirp L

Using the Inirp L involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and deduction records. Next, carefully fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the Inirp L through the appropriate channels, which may include online submission or mailing it to the designated office.

Steps to complete the Inirp L

Completing the Inirp L requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Begin filling out the form by providing personal information, such as your name, address, and Social Security number.

- Report your total income for the year, including wages, self-employment income, and any other earnings.

- List any deductions you are eligible for, ensuring you have documentation to support each claim.

- Double-check all entries for accuracy and completeness before submission.

Legal use of the Inirp L

The Inirp L must be used in accordance with Indiana state tax laws to be considered legally valid. This includes accurately reporting income and deductions, as well as adhering to filing deadlines. Failure to comply with these regulations can result in penalties or audits. It is essential to understand the legal implications of the information reported on the form to avoid potential legal issues.

Required Documents

To complete the Inirp L accurately, certain documents are necessary. These typically include:

- W-2 forms from employers, detailing your annual earnings.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as business-related costs or medical expenses.

- Any previous year tax returns for reference and consistency.

Who Issues the Form

The Inirp L is issued by the Indiana Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It provides the necessary forms and guidelines for individuals and businesses to report their financial information accurately.

Quick guide on how to complete inirp l

Complete Inirp L effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage Inirp L on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Inirp L seamlessly

- Locate Inirp L and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review all details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Inirp L and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct inirp l

Create this form in 5 minutes!

How to create an eSignature for the inirp l

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow for inirp l integration?

The pricing for airSlate SignNow varies based on the features you choose. For inirp l integration, we offer flexible plans tailored to your business needs, ensuring you get the best value for your investment. You can start with a free trial to explore the features before committing.

-

How does airSlate SignNow simplify the inirp l document signing process?

airSlate SignNow streamlines the inirp l document signing process by providing an intuitive interface that allows users to send and sign documents quickly. With automated workflows and customizable templates, you can manage your documents with ease, reducing turnaround times signNowly.

-

What features does airSlate SignNow offer for inirp l users?

airSlate SignNow offers a robust suite of features for inirp l users, including document templates, secure cloud storage, and real-time tracking of document status. These features help businesses manage their eSignatures efficiently and enhance their overall document management experience.

-

Is airSlate SignNow secure for handling inirp l sensitive documents?

Yes, airSlate SignNow prioritizes security for all users, including those handling inirp l sensitive documents. We employ advanced encryption methods and comply with industry standards to ensure your data is safe and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for inirp l purposes?

Absolutely! airSlate SignNow supports various integrations with popular applications to enhance your workflow for inirp l. Whether you're using CRMs, cloud storage solutions, or other business tools, you can easily connect them with our platform for seamless document management.

-

What are the benefits of using airSlate SignNow for inirp l?

Using airSlate SignNow for inirp l offers numerous benefits, including increased efficiency, reduced paper waste, and improved compliance. Businesses can enhance their productivity by automating document workflows and ensuring that all signatures are collected promptly.

-

How do I get started with airSlate SignNow and inirp l?

Getting started with airSlate SignNow for inirp l is simple. You can sign up for a free trial on our website and explore the features available. Once registered, you can easily upload your documents, set up templates, and begin sending them for eSignature.

Get more for Inirp L

Find out other Inirp L

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form