PRINT FORMAR2210CLEAR FORM2024ITPE241 ARKANSAS IND 2024-2026

Understanding the Arkansas AR2210 Form

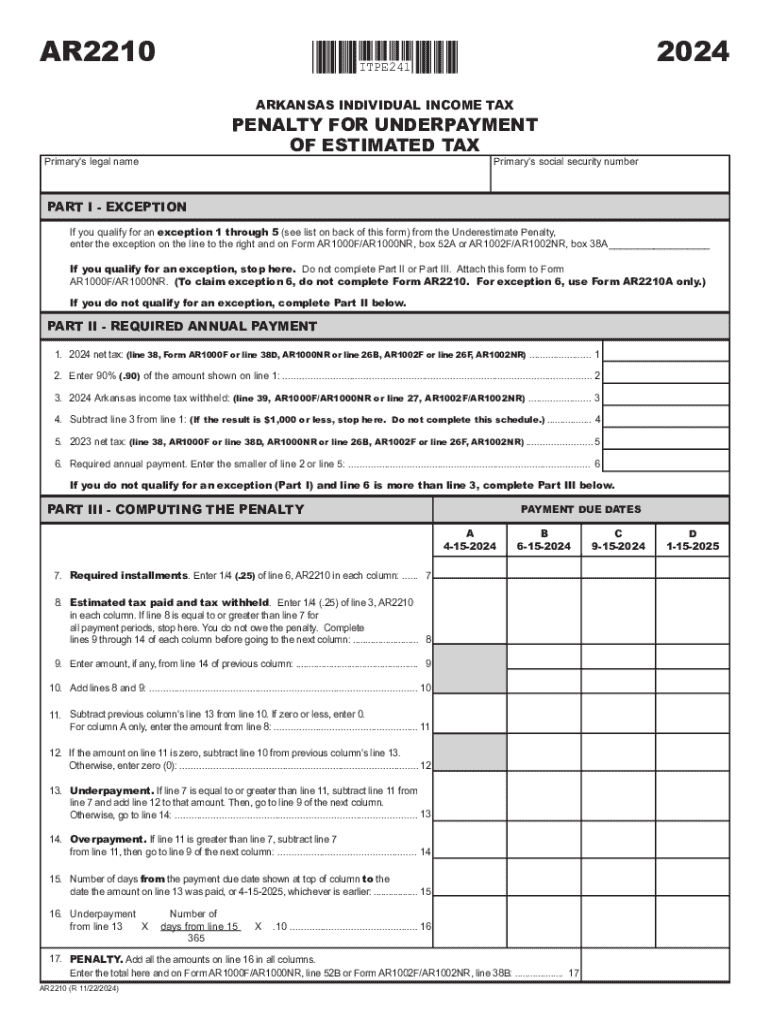

The Arkansas AR2210 form is utilized by taxpayers to report underpayment of estimated tax. This form is essential for individuals who have not paid enough tax throughout the year and need to calculate any penalties associated with underpayment. The AR2210 helps ensure compliance with Arkansas tax laws, allowing taxpayers to rectify any discrepancies in their estimated tax payments.

Steps to Complete the Arkansas AR2210 Form

Completing the AR2210 form involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year.

- Determine the amount of estimated tax you have already paid.

- Use the AR2210 form to calculate any underpayment and the corresponding penalty, if applicable.

- Review your calculations for accuracy before submitting the form.

Filing Deadlines and Important Dates

Taxpayers should be aware of the filing deadlines associated with the AR2210 form. Typically, the form must be submitted along with your income tax return by April 15 of the following year. If you are unable to meet this deadline, consider filing for an extension to avoid penalties.

Penalties for Non-Compliance

Failing to file the AR2210 form or underpaying estimated taxes can result in penalties. The Arkansas Department of Finance and Administration imposes penalties based on the amount of underpayment and the duration of the underpayment period. Understanding these penalties is crucial for taxpayers to avoid unnecessary financial burdens.

Eligibility Criteria for Using the Arkansas AR2210 Form

To use the AR2210 form, taxpayers must meet specific eligibility criteria. This includes having a tax liability that exceeds a certain threshold and having made insufficient estimated tax payments throughout the year. Individuals who are self-employed or have multiple income sources should pay particular attention to their estimated tax obligations.

Obtaining the Arkansas AR2210 Form

The AR2210 form can be obtained directly from the Arkansas Department of Finance and Administration's website or through authorized tax preparation software. It is available in both printable and digital formats, allowing for easy access and completion.

Examples of Using the Arkansas AR2210 Form

Consider a scenario where a self-employed individual underestimates their tax liability and fails to make adequate estimated payments. In this case, the AR2210 form would be necessary to calculate the penalty for underpayment. Another example involves individuals who receive unexpected income, such as bonuses or freelance payments, which may require them to adjust their estimated tax payments and file the AR2210 accordingly.

Create this form in 5 minutes or less

Find and fill out the correct print formar2210clear form2024itpe241 arkansas ind

Create this form in 5 minutes!

How to create an eSignature for the print formar2210clear form2024itpe241 arkansas ind

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ar2210 feature in airSlate SignNow?

The ar2210 feature in airSlate SignNow allows users to streamline their document signing process. It provides an intuitive interface for sending and eSigning documents, making it easier for businesses to manage their workflows efficiently.

-

How does pricing work for the ar2210 plan?

The ar2210 plan offers competitive pricing tailored to meet the needs of various businesses. Users can choose from different subscription tiers, ensuring they only pay for the features they need while benefiting from the cost-effective solutions airSlate SignNow provides.

-

What are the key benefits of using ar2210?

Using the ar2210 feature in airSlate SignNow enhances productivity by reducing the time spent on document management. It also improves security and compliance, ensuring that all signed documents are stored safely and can be accessed easily.

-

Can I integrate ar2210 with other applications?

Yes, the ar2210 feature in airSlate SignNow supports integrations with various applications. This allows businesses to connect their existing tools and streamline their workflows, making document management even more efficient.

-

Is there a mobile app for the ar2210 feature?

Absolutely! The ar2210 feature is accessible via the airSlate SignNow mobile app, allowing users to send and eSign documents on the go. This flexibility ensures that you can manage your documents anytime, anywhere.

-

What types of documents can I manage with ar2210?

With the ar2210 feature, you can manage a wide variety of documents, including contracts, agreements, and forms. This versatility makes airSlate SignNow a valuable tool for businesses across different industries.

-

How secure is the ar2210 feature?

The ar2210 feature in airSlate SignNow prioritizes security with advanced encryption and compliance measures. This ensures that all documents are protected, giving users peace of mind when handling sensitive information.

Get more for PRINT FORMAR2210CLEAR FORM2024ITPE241 ARKANSAS IND

- Wwwtaxformfinderorgfederalform 4562federal form 4562 depreciation and amortization including

- Get the free form 8949 department of the treasury internal

- Application for license as an oti form fmc 18

- Form 8868 rev january 2022 application for automatic extension of time to file an exempt organization return

- Electronic filing of form 1065 us partnership return of

- 2021 schedule a form 990 public charity status and public support

- F1041pdf form 1041 department of the treasuryinternal

- Form911 rev 1 2022 request for taxpayer advocate service assistance and application for taxpayer assistance order

Find out other PRINT FORMAR2210CLEAR FORM2024ITPE241 ARKANSAS IND

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT