City of Boston Jobs and Living Wage Ordinance Cityofboston 2009

Understanding the City of Boston Jobs and Living Wage Ordinance

The City of Boston Jobs and Living Wage Ordinance establishes minimum wage standards for workers in the city. This ordinance aims to ensure that employees receive fair compensation that meets their basic living expenses. It applies to various sectors, including city contracts and private employers, creating a more equitable work environment. The ordinance outlines specific wage rates that employers must adhere to, ensuring that all workers can sustain themselves and their families.

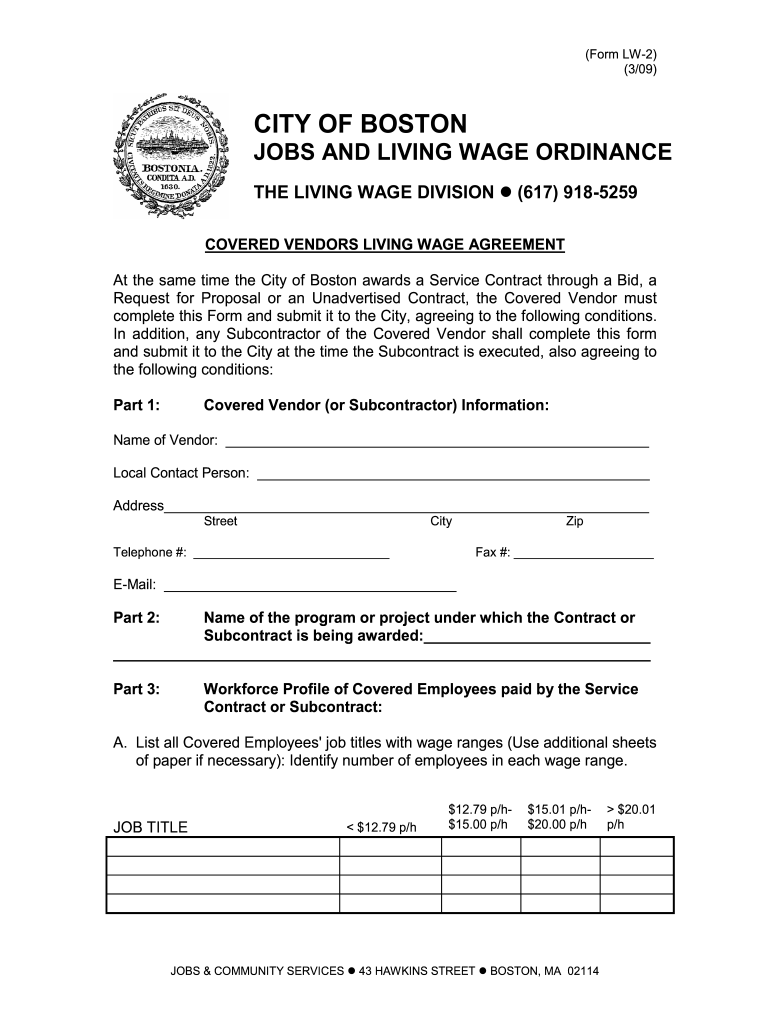

Steps to Complete the City of Boston Jobs and Living Wage Ordinance Form

Completing the City of Boston Jobs and Living Wage Ordinance form involves several key steps to ensure compliance with the ordinance. First, gather all necessary information about your business, including your employer identification number and details about your workforce. Next, accurately fill out the form with the required data, ensuring that all fields are completed. It is crucial to review the information for accuracy before submission. Finally, submit the form through the designated method, whether online or via mail, to ensure it is processed in a timely manner.

Key Elements of the City of Boston Jobs and Living Wage Ordinance

Several key elements define the City of Boston Jobs and Living Wage Ordinance. These include the minimum wage rates set for different categories of workers, stipulations regarding paid sick leave, and provisions for wage transparency. The ordinance also includes guidelines for enforcement and penalties for non-compliance, ensuring that employers adhere to the established standards. Understanding these elements is essential for both employers and employees to navigate their rights and responsibilities under the ordinance.

Legal Use of the City of Boston Jobs and Living Wage Ordinance Form

To ensure the legal use of the City of Boston Jobs and Living Wage Ordinance form, it is important to follow specific guidelines. The form must be filled out accurately and completely, reflecting the current wage rates and employment conditions. Additionally, employers should maintain records of compliance, including payroll documentation and employee communications regarding wages. Utilizing a compliant electronic signature tool can further enhance the legal validity of the form, ensuring that all electronic submissions meet the necessary legal standards.

Eligibility Criteria for the City of Boston Jobs and Living Wage Ordinance

Eligibility for the City of Boston Jobs and Living Wage Ordinance primarily depends on the nature of the employment relationship and the type of work performed. Generally, all employees working within the city limits are covered under this ordinance, including part-time and full-time workers. Employers who have contracts with the city or receive city funds are also required to comply with the ordinance, ensuring that all workers benefit from the established wage standards.

Examples of Using the City of Boston Jobs and Living Wage Ordinance

Practical examples of using the City of Boston Jobs and Living Wage Ordinance can provide clarity on its application. For instance, a city contractor must ensure that all employees receive at least the minimum wage set by the ordinance. Another example includes a business that must adjust its payroll practices to comply with the new wage standards, ensuring that all workers are compensated fairly. These scenarios illustrate the importance of the ordinance in promoting fair labor practices within the city.

Quick guide on how to complete city of boston jobs and living wage ordinance cityofboston

Simplify Your HR Operations with City Of Boston Jobs And Living Wage Ordinance Cityofboston Template

Every HR professional recognizes the importance of maintaining organized and orderly employee records. With airSlate SignNow, you gain access to an extensive collection of state-specific labor documents that streamline the creation, handling, and storage of all work-related paperwork in one location. airSlate SignNow facilitates your City Of Boston Jobs And Living Wage Ordinance Cityofboston management from start to finish, offering thorough editing and eSignature tools at your convenience. Enhance your precision, document security, and eliminate minor manual errors in just a few clicks.

How to Modify and eSign City Of Boston Jobs And Living Wage Ordinance Cityofboston:

- Select the appropriate state and search for the form you need.

- Access the form page and click on Get Form to start working on it.

- Allow City Of Boston Jobs And Living Wage Ordinance Cityofboston to load in our editor and follow the prompts that indicate required fields.

- Input your information or add additional fillable fields to the document.

- Utilize our tools and features to customize your form as necessary: annotate, redact sensitive details, and create an eSignature.

- Review your form for errors before proceeding with its submission.

- Click Done to save changes and download your form.

- Alternatively, send your document directly to your recipients to gather signatures and information.

- Safely archive completed documents within your airSlate SignNow account and access them whenever needed.

Employing a versatile eSignature solution is essential when handling City Of Boston Jobs And Living Wage Ordinance Cityofboston. Make even the most intricate workflows as straightforward as possible with airSlate SignNow. Start your free trial today to explore the possibilities for your department.

Create this form in 5 minutes or less

Find and fill out the correct city of boston jobs and living wage ordinance cityofboston

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How difficult is it to live in the city of Portland and what's the minimum wage?

Minimum wage is around $12 but the cost of living is pretty high. On average 1 bedroom apartments cost between 1000–1500 dollars a month, but that’s actually in the city of Portland. The suburbs of Portland about 15–20 minuets away from the city are cheaper.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How does the view of not supporting minimum wage hikes fit in with the rising cost of living? How do cities like San Francisco have a high cost of living and expect a minimum wage worker to survive and better themselves to get a non-minimum wage job?

Wages and rents, like all other prices, are set by supply and demand.In San Francisco rents are incredibly high because virtually nobody has been allowed by build any housing there for the last 30 years.A minimum wage increase won’t help poor people afford those rents - it would just throw more of them out of work. Beside, even people making $100k/year struggle to pay San Francisco rents - do you really think any imaginable minimum wage is going to match that?Except for price controls (like minimum wages), prices are not set by people who “expect” anything at all. Buyers bid up prices, sellers push them down. They meet in the middle somewhere.In free countries, there is no “master controller” who decides all the prices and can be appealed to (the Communist countries did have that; it didn’t work out well).What will happen in San Francisco is that poor people won’t be able to afford the rents, and will move elsewhere. This has been happening for a while, and will keep on happening.As this happens, there aren’t enough people left to do the jobs that need doing. So employers have to pay higher wages to get people to take those jobs. Wages will go up.But so will prices. Those employers will have to raise prices on the stuff they sell to pay those wages.The rich people in San Francisco might be willing to pay those higher prices - up to a point. But at some point they won’t, and will move out. Which will free up housing, which will come down in price.Or, the rich people will get tired of paying high prices, and will change the rules to allow more housing to be built (fat chance, but they could). That would also bring down rents.The key thing to understand is that prices are set by supply and demand, and prices are always moving and seeking equilibrium - if there aren’t enough workers, wages rise. If there aren’t enough apartments, rents rise. And vice-versa.Until the there are enough.

-

I live in a city that has no job opportunities (16% unemployed with average pay around minimum wage) and is one of the most expensive provinces to live in the country. What can I do to make a decent living?

There are no cities in India which has no job opportunities. There are always some opportunities, some places have more and some have less. If low job opportunity is the problem, the obvious answer is , move over to a place which does. I assume that there must be good reasons why you can't.A job is not the only way to earn a living. The other two are:Business/ commerce.A profession.Labour.But all of them require some skills . The main reason for unemployment/ underemployment is lack or inadequacy of skills. No able bodied person need be unemployed. The problem starts when a personDoesn't have any useful skill and is unwilling to learnWants only certain kind of jobs.For months I was looking for a domestic help with no precondition attached. I was offering my servant quarter without rent in lieu of a part of their time. But didn't get one for a long time. I saw an able bodied begger. I offered her food and and money for work but she didn't want that, not once, many times.I don't know what your situation is but if you have some minimum skill, move out. If not ,acquire some.

-

Coming away from news coverage of the US government shutdown, is anybody else surprised at how many people with apparently living-wage government jobs turn out to be living paycheck-to-paycheck?

When you say apparently living-wage you are making a lot of assumptions. Like all these employees have been working long enough to have put money away. Many of these government workers are relatively new and haven’t been working long enough to put away several months worth of salary for a rainy day. The biggest being a living wage for where? A living wage in Washington DC, or any large metropolitan area like Boston, NYC, San Diego California is a lot more money than a rural area or smaller city in the rust belt. Trying to live on say $40,000 a year in DC and have money at the end of the month isn’t all that easy. Here in Rochester NY where I live that would be plenty to live comfortably on. You have to take into account the cost of living in some of the areas where these Federal Employees are living when you look at the wages. Are there some that could do a better job of saving sure there are, as well as the same number in the private sector. My question is what would happen if a private sector employee was asked to come in to work like the TSA and Coast Guard are doing now, without any idea when they will be paid for that labor. It isn’t right that someone should be told we are requiring you to work, and we’ll pay you eventually but for the mean time you should raid your retirement fund, and savings so you can make ends meet, oh and we aren’t going to reimburse you for any penalties, or lost interest. The idea that it’s the government workers fault they can’t get by without their paycheck because they should have been saving for it is preposterous. It wouldn’t fly if you required this of a private sector employee.

Create this form in 5 minutes!

How to create an eSignature for the city of boston jobs and living wage ordinance cityofboston

How to create an eSignature for the City Of Boston Jobs And Living Wage Ordinance Cityofboston online

How to create an electronic signature for the City Of Boston Jobs And Living Wage Ordinance Cityofboston in Chrome

How to make an eSignature for putting it on the City Of Boston Jobs And Living Wage Ordinance Cityofboston in Gmail

How to generate an eSignature for the City Of Boston Jobs And Living Wage Ordinance Cityofboston straight from your smartphone

How to make an electronic signature for the City Of Boston Jobs And Living Wage Ordinance Cityofboston on iOS

How to create an eSignature for the City Of Boston Jobs And Living Wage Ordinance Cityofboston on Android

People also ask

-

What is the city of Boston jobs and living wage ordinance?

The city of Boston jobs and living wage ordinance is a regulation that establishes minimum wage standards for workers in the city. This ordinance aims to ensure that all employees earn a fair wage that supports their basic needs. Understanding this ordinance is crucial for businesses aiming to comply with local laws.

-

How does the city of Boston jobs and living wage ordinance affect employee compensation?

The city of Boston jobs and living wage ordinance directly influences employee compensation by mandating that employers pay their workers a minimum wage that aligns with the cost of living. This helps to lift workers out of poverty and promotes economic stability. Companies must adapt their payroll practices to meet these requirements.

-

Are there exceptions to the city of Boston jobs and living wage ordinance?

Yes, there are specific exemptions in the city of Boston jobs and living wage ordinance. Certain types of organizations, such as nonprofit entities and small businesses with limited revenue, may have different wage requirements. It's essential for businesses to review the ordinance for applicable exemptions to ensure compliance.

-

What features does airSlate SignNow offer to assist with the city of Boston jobs and living wage ordinance?

airSlate SignNow provides features that streamline document management and eSigning, making it easier for businesses to create and handle wage compliance documentation. With customizable templates and secure storage, you can keep your compliance records organized and accessible while adhering to the city of Boston jobs and living wage ordinance.

-

How do I integrate airSlate SignNow to manage compliance with the city of Boston jobs and living wage ordinance?

Integrating airSlate SignNow into your workflow is straightforward and can be done with existing HR and payroll systems. This integration allows you to efficiently manage employment documents that comply with the city of Boston jobs and living wage ordinance. With robust APIs, you can automate and streamline your compliance processes.

-

What are the benefits of using airSlate SignNow for compliance with the city of Boston jobs and living wage ordinance?

Using airSlate SignNow provides businesses with a cost-effective solution to manage compliance with the city of Boston jobs and living wage ordinance. It simplifies the eSigning process, reduces paper usage, and enhances security for sensitive documents, ultimately saving time and resources while ensuring compliance.

-

Can airSlate SignNow help track changes related to the city of Boston jobs and living wage ordinance?

Yes, airSlate SignNow offers tracking features that allow you to monitor document revisions related to the city of Boston jobs and living wage ordinance. This ensures that all parties are updated on compliance changes and can act promptly. Such transparency is vital for maintaining organizational accountability.

Get more for City Of Boston Jobs And Living Wage Ordinance Cityofboston

Find out other City Of Boston Jobs And Living Wage Ordinance Cityofboston

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast