Declaration of Zero Income Form Md

What is the Declaration of Zero Income Form MD

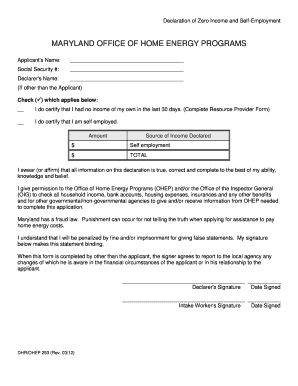

The Declaration of Zero Income Form MD is a specific document used by residents of Maryland to officially declare that they have no income for a given period. This form is often required for various state assistance programs, including health care and housing support. By submitting this declaration, individuals can demonstrate their financial situation to relevant authorities, ensuring eligibility for necessary services. It is essential to complete the form accurately to avoid complications with assistance programs.

How to Use the Declaration of Zero Income Form MD

Using the Declaration of Zero Income Form MD involves several steps to ensure that it is filled out correctly and submitted properly. First, obtain the form from a reliable source, such as a government website or local assistance office. Next, fill in the required information, including personal details and the period of zero income. Once completed, review the form for accuracy. Finally, submit the form according to the instructions provided, which may include online submission, mailing, or in-person delivery.

Steps to Complete the Declaration of Zero Income Form MD

Completing the Declaration of Zero Income Form MD requires careful attention to detail. Follow these steps:

- Download or obtain the form from an official source.

- Fill in your personal information, including your name, address, and contact details.

- Clearly state the period during which you had zero income.

- Sign and date the form to affirm its accuracy.

- Submit the form according to the specified method.

Legal Use of the Declaration of Zero Income Form MD

The Declaration of Zero Income Form MD is legally recognized when completed and submitted in compliance with state regulations. It serves as a formal statement of one’s financial status and can be used in various legal and administrative contexts, such as applying for public assistance or verifying eligibility for certain programs. Ensuring that the form is filled out correctly and submitted on time is crucial to maintain its legal validity.

Required Documents

When submitting the Declaration of Zero Income Form MD, certain documents may be required to support your claim. These can include:

- Identification documents, such as a driver's license or state ID.

- Proof of residency in Maryland.

- Any additional documentation requested by the agency reviewing your form.

Having these documents ready can facilitate a smoother application process and help prevent delays in receiving assistance.

Form Submission Methods

The Declaration of Zero Income Form MD can be submitted through various methods to accommodate different preferences. These methods include:

- Online submission through designated state portals.

- Mailing the completed form to the appropriate agency.

- In-person delivery at local assistance offices.

Each method may have specific instructions, so it is important to follow the guidelines provided to ensure successful submission.

Quick guide on how to complete declaration of zero income form md

Complete Declaration Of Zero Income Form Md effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the resources you need to create, alter, and eSign your documents quickly without complications. Manage Declaration Of Zero Income Form Md on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest way to modify and eSign Declaration Of Zero Income Form Md with ease

- Find Declaration Of Zero Income Form Md and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, either via email, SMS, invite link, or download it to your computer.

Eliminate the hassles of missing or lost documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any chosen device. Modify and eSign Declaration Of Zero Income Form Md and ensure excellent communication throughout the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the declaration of zero income form md

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How does airSlate SignNow simplify the process of managing income taxes?

airSlate SignNow streamlines the process of managing income taxes by allowing users to easily send and eSign tax documents electronically. This ensures that you can quickly gather necessary signatures and keep your documentation organized. Eliminating paper trails accelerates the filing process, thus helping you meet deadlines efficiently.

-

What features does airSlate SignNow offer to assist with income tax documentation?

airSlate SignNow offers essential features like customizable templates, real-time collaboration, and secure document storage that are beneficial for handling income taxes. You can create templates specifically for tax forms, reducing the time spent on paperwork. Additionally, the platform provides audit trails to track changes made to tax documents.

-

Is airSlate SignNow compliant with tax laws related to income taxes?

Yes, airSlate SignNow is designed to comply with various regulations and legal standards required for electronic signatures and documentation, including those related to income taxes. This ensures that the signed documents are legally binding and can be used confidently during audits or inspections. Staying compliant means you can focus on your business rather than worrying about legal issues.

-

What are the pricing options for airSlate SignNow in relation to income tax management?

airSlate SignNow offers various subscription plans that are cost-effective and cater to different business sizes, making it an excellent choice for income tax management. Each plan provides access to features that help streamline tax processes, allowing you to choose a package that fits your budget. This flexibility ensures you only pay for what you need.

-

Can I integrate airSlate SignNow with accounting software for income tax purposes?

Absolutely! airSlate SignNow offers integrations with popular accounting software like QuickBooks and Xero, which can be particularly beneficial for managing income taxes. These integrations enable you to seamlessly transfer documents to your accounting system for better tracking and reporting. This way, you enhance your efficiency in preparing and filing your income taxes.

-

What benefits does airSlate SignNow provide for small businesses dealing with income taxes?

Small businesses can greatly benefit from airSlate SignNow's affordability and user-friendly interface when handling income taxes. By digitizing the signing and documentation process, it reduces time spent on administrative tasks. This means small business owners can focus more on their core operations instead of tax filings, ultimately improving productivity.

-

How secure is airSlate SignNow when handling sensitive income tax documents?

Security is a top priority with airSlate SignNow, which employs industry-standard encryption and security protocols to protect sensitive income tax documents. All signed documents are stored securely with access controls, ensuring that only authorized users can view or modify them. This robust security framework helps maintain confidentiality and trust.

Get more for Declaration Of Zero Income Form Md

- Agreement to pay for healthcare services form

- Blank rma form

- Taxpayer exemption application form

- Sample completed irs form 709

- U s usda form usda ad 287 2 usa federal forms com

- Noun clause self test answers form

- Vietnam visa application formembassy of vietnam in wien austria vietnamese visa application form for getting visa at the

- Certificate of solvency companies ordinance cap 7 form

Find out other Declaration Of Zero Income Form Md

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple