Sample Letter to Disclaim Inherited Ira 2012-2026

What is the sample letter to disclaim inherited IRA

A sample letter to disclaim inherited IRA serves as a formal document that allows a beneficiary to refuse an inheritance from an Individual Retirement Account (IRA). This letter is essential for individuals who wish to decline their rights to the inherited funds, often for tax or personal reasons. By submitting this letter, the beneficiary ensures that the assets will pass to the next designated beneficiary, in accordance with the account holder's wishes. The letter must clearly state the beneficiary's intent to disclaim the inheritance and include relevant details about the IRA and the deceased account holder.

Steps to complete the sample letter to disclaim inherited IRA

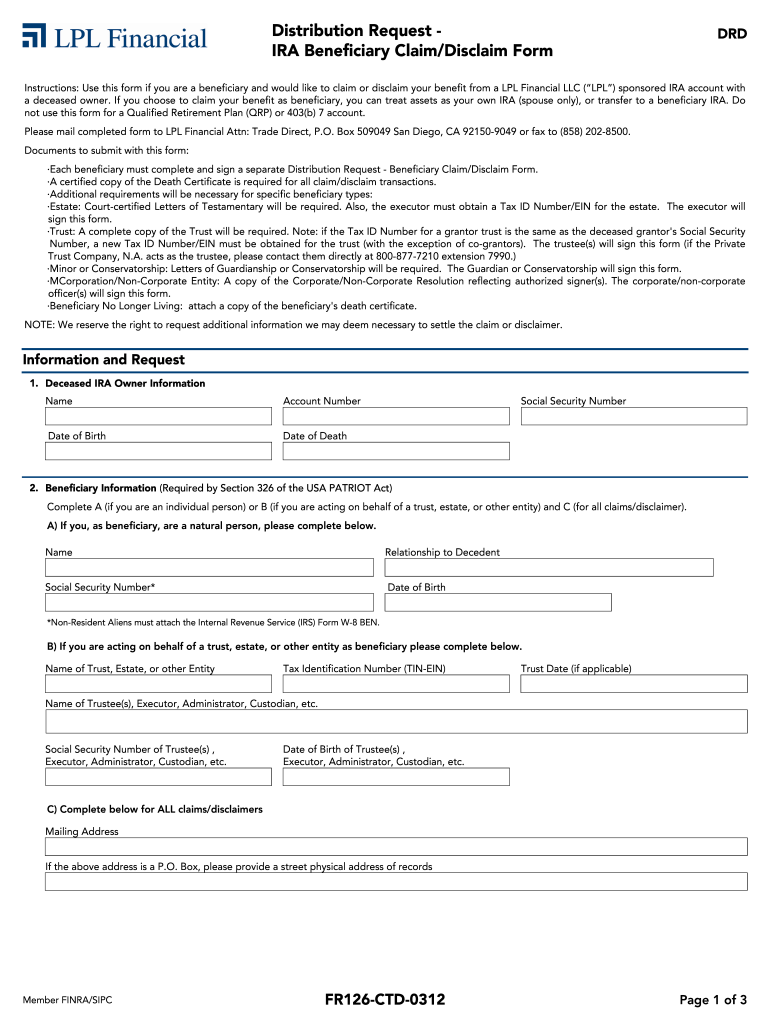

Completing a sample letter to disclaim inherited IRA involves several key steps to ensure that it is legally valid and effective. First, the beneficiary should gather necessary information, including the name of the deceased, the account number, and the date of death. Next, the letter should be structured clearly, starting with a statement of intent to disclaim the inheritance. It is important to include the beneficiary's personal information, such as their name and address, along with a signature. Finally, the completed letter should be submitted within the required timeframe to the appropriate financial institution or IRA custodian to ensure compliance with IRS regulations.

Legal use of the sample letter to disclaim inherited IRA

The legal use of the sample letter to disclaim inherited IRA is governed by specific IRS guidelines. According to IRS regulations, a disclaimer must be made in writing and must be irrevocable. This means that once the beneficiary submits the letter, they cannot change their mind. Additionally, the disclaimer must be executed within nine months of the account holder's death to be valid for tax purposes. It is crucial for beneficiaries to understand these legal requirements to avoid any unintended tax consequences or complications in the distribution of the IRA assets.

Key elements of the sample letter to disclaim inherited IRA

Key elements of the sample letter to disclaim inherited IRA include several important components that must be present for the letter to be considered valid. These elements typically include:

- The full name and address of the beneficiary.

- The name of the deceased IRA account holder.

- The account number of the inherited IRA.

- A clear statement indicating the intent to disclaim the inheritance.

- The date of the deceased's passing.

- The beneficiary's signature and date of signing.

Including these elements ensures that the letter is comprehensive and meets the necessary legal standards.

Filing deadlines / Important dates

Filing deadlines for a disclaimer of inheritance form, particularly for an inherited IRA, are critical for beneficiaries to observe. The IRS requires that the disclaimer be filed within nine months of the account holder's death. This timeframe is essential to avoid any tax implications that could arise from accepting the inheritance. It is advisable for beneficiaries to act promptly and ensure that all necessary documents are completed and submitted within this period to maintain compliance with IRS regulations.

Examples of using the sample letter to disclaim inherited IRA

Examples of using the sample letter to disclaim inherited IRA can provide clarity on its application. For instance, if a beneficiary learns that they will incur significant tax liabilities by accepting the inherited IRA, they may choose to disclaim it in favor of a secondary beneficiary. Another example is when a beneficiary feels unprepared to manage the inherited funds and prefers that the assets pass directly to another family member. In both cases, utilizing the sample letter allows the beneficiary to formally refuse the inheritance while adhering to legal requirements.

Quick guide on how to complete sample letter to disclaim inherited ira

Complete Sample Letter To Disclaim Inherited Ira effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Sample Letter To Disclaim Inherited Ira on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Sample Letter To Disclaim Inherited Ira with ease

- Obtain Sample Letter To Disclaim Inherited Ira and click on Get Form to begin.

- Make use of the tools we provide to fill in your form.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Sample Letter To Disclaim Inherited Ira and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample letter to disclaim inherited ira

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample letter to disclaim inherited IRA?

A sample letter to disclaim inherited IRA is a formal template used to notify the custodian of the IRA that the beneficiary is choosing to refuse their inheritance. This letter helps ensure that the inherited assets pass to the next eligible beneficiary as per the decedent's wishes. Using a sample letter can simplify the process and ensure compliance with IRS regulations.

-

Why should I use a sample letter to disclaim inherited IRA?

Using a sample letter to disclaim inherited IRA is essential to protect your financial interests and adhere to legal requirements. It ensures that the disclaimed assets are properly redirected to the next beneficiary and can prevent complications down the road. This simple step can save you and your heirs from potential tax liabilities.

-

Are there costs associated with using airSlate SignNow to create my sample letter to disclaim inherited IRA?

While drafting your sample letter to disclaim inherited IRA may be free, using airSlate SignNow involves a subscription fee that is cost-effective compared to other eSigning solutions. Our plans provide unlimited document signing and storage, ensuring your letter is securely managed. You can choose from various pricing options to best fit your needs.

-

Can I customize a sample letter to disclaim inherited IRA using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your sample letter to disclaim inherited IRA according to your specific needs. You can easily edit the template, add your personal information, and ensure the letter reflects your unique situation. This flexibility is a key benefit of using our platform.

-

Is it easy to eSign a sample letter to disclaim inherited IRA with airSlate SignNow?

Yes, eSigning your sample letter to disclaim inherited IRA with airSlate SignNow is quick and easy. Our user-friendly interface allows you to complete the signing process in just a few clicks, without the need for printing or scanning. This makes it convenient for busy individuals seeking efficient solutions.

-

What integrations does airSlate SignNow offer for managing my sample letter to disclaim inherited IRA?

airSlate SignNow offers robust integrations with various platforms such as Google Drive, Dropbox, and Microsoft Office, enabling seamless management of your sample letter to disclaim inherited IRA. These integrations streamline your workflow and enhance document accessibility. You can easily store, share, and access your letter from wherever you are.

-

How can airSlate SignNow help me ensure my sample letter to disclaim inherited IRA is legally valid?

airSlate SignNow follows industry-standard security and compliance protocols to ensure your sample letter to disclaim inherited IRA is legally valid. Our platform incorporates legally binding eSignature technology that meets federal regulations. This gives you confidence that your document will be accepted by financial institutions.

Get more for Sample Letter To Disclaim Inherited Ira

Find out other Sample Letter To Disclaim Inherited Ira

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template