Huntington National Bank Subordination Requirements Form

What are the Huntington National Bank Subordination Requirements?

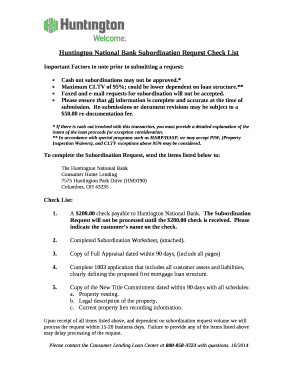

The Huntington National Bank subordination requirements outline the necessary conditions for a subordination request, typically involving a home equity loan or mortgage. Subordination occurs when a lender agrees to allow another loan to take precedence over their existing loan. This process is crucial for homeowners seeking to refinance or obtain additional financing without jeopardizing their current mortgage terms.

Key elements include the borrower's creditworthiness, the loan-to-value ratio, and the specific terms of the existing mortgage. Understanding these requirements is essential for ensuring that the subordination request is processed smoothly and meets all legal standards.

How to Obtain the Huntington National Bank Subordination Requirements

To obtain the Huntington National Bank subordination requirements, borrowers can start by contacting the Huntington Bank subordination department directly. They can provide detailed information about necessary documentation and the specific criteria for approval. Additionally, borrowers can visit the Huntington Bank website for resources related to subordination requests.

It is advisable to gather all relevant financial documents, including income verification, current mortgage statements, and any existing loan agreements, to facilitate the process. This preparation can help streamline communication with the bank and ensure that all requirements are met.

Steps to Complete the Huntington National Bank Subordination Requirements

Completing the Huntington National Bank subordination requirements involves several important steps:

- Gather necessary documents, including your current mortgage statement and proof of income.

- Contact the Huntington Bank subordination department to request the subordination request form.

- Fill out the form carefully, ensuring all information is accurate and complete.

- Submit the completed form along with any required documentation to the bank, either online or via mail.

- Await confirmation from the bank regarding the status of your subordination request.

Following these steps can help ensure a smooth process and increase the likelihood of approval.

Legal Use of the Huntington National Bank Subordination Requirements

The legal use of the Huntington National Bank subordination requirements is governed by various state and federal regulations. It is essential for borrowers to understand that any subordination agreement must comply with applicable laws to be considered valid. This includes adherence to the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Additionally, ensuring that all parties involved are properly identified and that the agreement is executed with the necessary signatures is crucial for legal enforceability.

Required Documents for the Huntington National Bank Subordination Request

When submitting a subordination request to Huntington National Bank, several documents are typically required:

- Current mortgage statement to verify existing loan details.

- Proof of income, such as recent pay stubs or tax returns.

- Identification documents, like a driver's license or passport.

- Any additional documentation requested by the bank, which may vary based on individual circumstances.

Having these documents prepared in advance can help expedite the approval process and ensure that all necessary information is provided.

Form Submission Methods for Huntington National Bank Subordination Requests

Huntington National Bank offers multiple methods for submitting subordination requests:

- Online Submission: Borrowers can complete and submit the subordination request form through the bank's online portal.

- Mail: Completed forms can be printed and mailed to the designated address provided by the bank.

- In-Person: Borrowers may also visit a local Huntington Bank branch to submit their request directly.

Choosing the most convenient submission method can help facilitate a quicker response from the bank regarding the status of the request.

Quick guide on how to complete huntington national bank subordination requirements

Effortlessly Prepare Huntington National Bank Subordination Requirements on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an exceptional environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Huntington National Bank Subordination Requirements on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign Huntington National Bank Subordination Requirements with Ease

- Locate Huntington National Bank Subordination Requirements and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Huntington National Bank Subordination Requirements and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the huntington national bank subordination requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Huntington mortgage subordination request?

A Huntington mortgage subordination request is a formal process where homeowners seek to have their existing mortgage modified in relation to a new mortgage. This is typically necessary when refinancing or obtaining a second mortgage. Understanding how to navigate this request can ensure a smoother financial transition.

-

How can airSlate SignNow assist with Huntington mortgage subordination requests?

airSlate SignNow provides a seamless platform for preparing, sending, and eSigning documents relevant to your Huntington mortgage subordination request. With easy-to-use features, users can efficiently handle the necessary paperwork, ensuring that all documents are completed correctly and promptly.

-

What are the costs associated with a Huntington mortgage subordination request?

The costs for a Huntington mortgage subordination request can vary, typically including application fees, processing fees, and possibly appraisal fees. By using airSlate SignNow, you can save on additional costs related to document management, making your request process more cost-effective.

-

What features does airSlate SignNow offer for managing mortgage documents?

airSlate SignNow offers an array of features tailored for managing mortgage documents including customizable templates and automated workflows. These functionalities streamline the process of handling your Huntington mortgage subordination request, reducing the time spent on paperwork.

-

Are there any benefits to using airSlate SignNow for my mortgage needs?

Using airSlate SignNow for your Huntington mortgage subordination request provides several benefits, such as enhanced efficiency and improved accuracy in document handling. Additionally, the platform's secure environment ensures that all sensitive information is protected during the process.

-

Can I integrate airSlate SignNow with other financial management tools?

Yes, airSlate SignNow can easily integrate with various financial management tools, which can be beneficial when processing your Huntington mortgage subordination request. This integration allows for a more cohesive workflow and easier access to necessary financial data.

-

How long does it take to process a Huntington mortgage subordination request?

The processing time for a Huntington mortgage subordination request can vary based on several factors, including lender response times and document completeness. Using airSlate SignNow, you can expedite this process by ensuring all necessary documents are readily available and correctly filled out.

Get more for Huntington National Bank Subordination Requirements

- Data sharing consent form template

- The book thief worksheets pdf form

- List of creditors template form

- Fibromyalgia checklist pdf 45033799 form

- Special education parent survey form

- Non disclosure software agreement template form

- Non disclosure when leaving a job agreement template form

- Non disclosure and confidentiality agreement template form

Find out other Huntington National Bank Subordination Requirements

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament