Gct Form 2014-2026

What is the GCT Form?

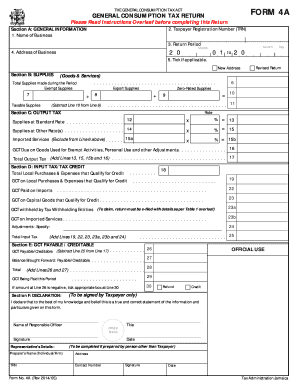

The GCT Form, or General Consumption Tax Form, is a crucial document used in Jamaica for reporting and paying consumption taxes. This form is essential for businesses that are registered for General Consumption Tax, as it allows them to declare their taxable sales and purchases. The completion of the GCT Form ensures compliance with tax regulations and helps businesses maintain accurate financial records.

How to Use the GCT Form

Using the GCT Form involves several steps to ensure accurate reporting. First, gather all necessary financial records, including sales invoices and purchase receipts. Next, fill out the form with details such as total sales, total purchases, and the applicable tax rates. Be sure to calculate the tax owed accurately. Finally, submit the completed form to the relevant tax authority by the specified deadline to avoid penalties.

Steps to Complete the GCT Form

Completing the GCT Form requires careful attention to detail. Follow these steps:

- Collect all relevant sales and purchase documentation.

- Enter your business information at the top of the form.

- List total sales for the reporting period in the designated section.

- Record total purchases and any adjustments if applicable.

- Calculate the total tax due based on the provided tax rates.

- Review the form for accuracy before submission.

Legal Use of the GCT Form

The GCT Form is legally binding and must be filled out accurately to comply with tax laws. Submitting incorrect information can lead to penalties or legal repercussions. It is essential to ensure that all entries are truthful and reflect the actual financial activities of the business. Compliance with tax regulations not only avoids penalties but also builds trust with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the GCT Form are crucial for businesses to adhere to. Typically, the form must be submitted on a monthly basis, with specific due dates set by the tax authority. Missing these deadlines can result in late fees and additional penalties. It is advisable to keep a calendar of important dates to ensure timely submissions.

Required Documents

To complete the GCT Form accurately, certain documents are required. These include:

- Sales invoices that detail taxable sales.

- Purchase receipts for goods and services.

- Previous GCT forms for reference and consistency.

- Any relevant financial statements that support the reported figures.

Form Submission Methods (Online / Mail / In-Person)

The GCT Form can be submitted through various methods, depending on the preferences of the business and the regulations of the tax authority. Common submission methods include:

- Online submission through the tax authority's official website.

- Mailing a hard copy of the completed form to the designated tax office.

- In-person submission at local tax offices for immediate processing.

Quick guide on how to complete gct form

Complete Gct Form effortlessly on any device

Online document administration has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Gct Form across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Gct Form with minimal effort

- Obtain Gct Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere moments and has the same legal validity as a traditional signature with ink.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign Gct Form while ensuring clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gct form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 4a and how does airSlate SignNow facilitate its use?

A form 4a is an essential document often used for various administrative purposes. airSlate SignNow empowers businesses to effortlessly create, send, and eSign form 4a, ensuring a streamlined process that saves time and enhances efficiency.

-

Is there a cost associated with using airSlate SignNow for form 4a?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can access powerful features for handling form 4a, all while enjoying a cost-effective solution for managing your documents.

-

What features does airSlate SignNow offer for managing form 4a?

airSlate SignNow provides numerous features tailored for form 4a, including custom templates, document tracking, and real-time collaboration. These tools enable users to effectively manage and eSign their form 4a without hassle.

-

How does eSigning a form 4a work with airSlate SignNow?

eSigning a form 4a using airSlate SignNow is simple. Users can upload the document, add signature fields, and invite signers, facilitating a secure and legal electronic signature process in just a few clicks.

-

Are there integrations available for airSlate SignNow to enhance form 4a processing?

Absolutely! airSlate SignNow integrates seamlessly with numerous apps, allowing you to automate workflows involving form 4a. This integration capability enhances your business’s efficiency, enabling you to connect with tools you already use.

-

What are the benefits of using airSlate SignNow for form 4a?

Using airSlate SignNow for form 4a brings multiple benefits, including increased speed in processing, reduced paperwork, and enhanced security for your documents. These advantages not only streamline your workflow but also improve overall productivity.

-

Can I customize my form 4a within airSlate SignNow?

Yes, airSlate SignNow allows users to easily customize their form 4a. You can add your branding, modify fields, and create a unique layout that meets your specific business needs, ensuring compliance with your requirements.

Get more for Gct Form

- Dd form 2558 100086163

- Certificate of liability insurance form

- Formulario para pasaporte

- Google hidden valley lake fitness center membership application and agreement form

- School bus cleaning checklist form

- Alabama iep examples form

- Registrar office ogeechee technical college form

- Adms 08 request for transcript of academic record rappahannock community college 12745 college drive glenns va 23149 804 758 form

Find out other Gct Form

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT