Eswatini Revenue Authority Contact Details 2012

Required Documents for the SRA VAT Return Form

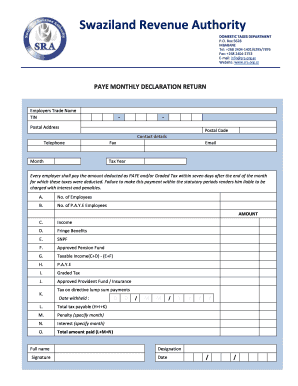

When preparing to fill out the SRA VAT return form, it is essential to gather all necessary documentation to ensure accuracy and compliance. The required documents typically include:

- Sales records for the reporting period

- Purchase invoices and receipts

- Any previous VAT returns submitted

- Bank statements that reflect VAT-related transactions

- Documentation for any exemptions or special schemes applied

Having these documents ready will streamline the process and help avoid any potential errors during submission.

Steps to Complete the SRA VAT Return Form

Completing the SRA VAT return form involves several key steps to ensure that all information is accurately reported. Follow these steps:

- Gather all required documents, including sales and purchase records.

- Fill in the form with your business details, including the name, address, and VAT registration number.

- Report the total sales and purchases for the period, ensuring that all figures are accurate.

- Calculate the VAT due or reclaimable based on the reported figures.

- Review the completed form for any errors or omissions before submission.

Completing these steps carefully will help ensure compliance with VAT regulations.

Form Submission Methods

The SRA VAT return form can be submitted through various methods, allowing flexibility based on your preference. The available submission methods include:

- Online submission through the Eswatini Revenue Authority's official portal

- Mailing a physical copy of the completed form to the designated address

- In-person submission at the nearest SRA office

Choosing the right submission method can depend on factors such as convenience and the need for confirmation of receipt.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the SRA VAT return form to avoid penalties. The deadlines typically include:

- Quarterly filing deadlines, which are usually set for the end of the month following the end of each quarter

- Annual filing deadlines for businesses that opt for annual VAT returns

- Any specific deadlines related to special circumstances or extensions

Keeping track of these dates will help ensure timely submissions and compliance with regulations.

Penalties for Non-Compliance

Failure to submit the SRA VAT return form on time or inaccuracies in reporting can lead to significant penalties. Common penalties include:

- Financial fines based on the amount of VAT due

- Interest charges on late payments

- Potential audits or further scrutiny from the Eswatini Revenue Authority

Understanding these penalties emphasizes the importance of accurate and timely submissions.

Who Issues the Form

The SRA VAT return form is issued by the Eswatini Revenue Authority, which is responsible for the administration of tax laws in Eswatini. This authority oversees the collection of VAT and ensures compliance with tax regulations. It is essential to refer to the official SRA guidelines for any updates or changes regarding the form and its requirements.

Quick guide on how to complete eswatini revenue authority contact details

Effortlessly create Eswatini Revenue Authority Contact Details on any gadget

Managing documents online has gained traction among both companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents swiftly, without holdups. Handle Eswatini Revenue Authority Contact Details on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Eswatini Revenue Authority Contact Details effortlessly

- Obtain Eswatini Revenue Authority Contact Details and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes only moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Eswatini Revenue Authority Contact Details and ensure effective communication at any phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct eswatini revenue authority contact details

Create this form in 5 minutes!

How to create an eSignature for the eswatini revenue authority contact details

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow sra vat return form?

The airSlate SignNow sra vat return form is a digital document that allows businesses to prepare and submit their VAT returns efficiently. With this form, users can streamline their tax submission process while ensuring compliance with local tax regulations. The intuitive interface of SignNow makes completing the sra vat return form straightforward and hassle-free.

-

How much does the airSlate SignNow sra vat return form cost?

The pricing for the airSlate SignNow sra vat return form varies based on the subscription plan chosen. SignNow offers flexible pricing options that can accommodate individual and business needs. Users can take advantage of free trials to evaluate the service before committing financially.

-

What features does the airSlate SignNow sra vat return form include?

The airSlate SignNow sra vat return form includes features such as electronic signatures, document editing, and secure cloud storage. Users can collaborate on the form in real-time, ensuring that all necessary information is included before submission. These features enhance the overall efficiency of the VAT return process.

-

Can I integrate the sra vat return form with other tools?

Yes, the airSlate SignNow sra vat return form can be seamlessly integrated with various third-party applications. This integration allows for easy data transfer and synchronization with accounting software and CRMs. By connecting your tools, you can manage your VAT return process more effectively.

-

What are the benefits of using the airSlate SignNow sra vat return form?

Using the airSlate SignNow sra vat return form offers numerous benefits, including increased efficiency and reduced errors in your VAT submissions. It allows businesses to save time and avoid costly penalties related to tax compliance. The electronic format ensures that documents are securely stored and easily retrievable.

-

Is the airSlate SignNow sra vat return form compliant with regulations?

Yes, the airSlate SignNow sra vat return form is designed to comply with local tax regulations, ensuring that your submissions meet all legal requirements. SignNow continually updates its platform to reflect any changes in tax laws, so you can be confident that you are using a compliant solution. This commitment to compliance helps reduce the risk of audits and penalties.

-

How secure is my information when using the sra vat return form?

Security is a top priority for airSlate SignNow, and the sra vat return form is built with multiple layers of protection. Data is encrypted during transmission and stored securely in compliance with industry standards. Users can trust that their sensitive VAT information is safe while using the platform.

Get more for Eswatini Revenue Authority Contact Details

Find out other Eswatini Revenue Authority Contact Details

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA