Swaziland Revenue Authority S R a 2022-2026

What is the Eswatini Revenue Authority?

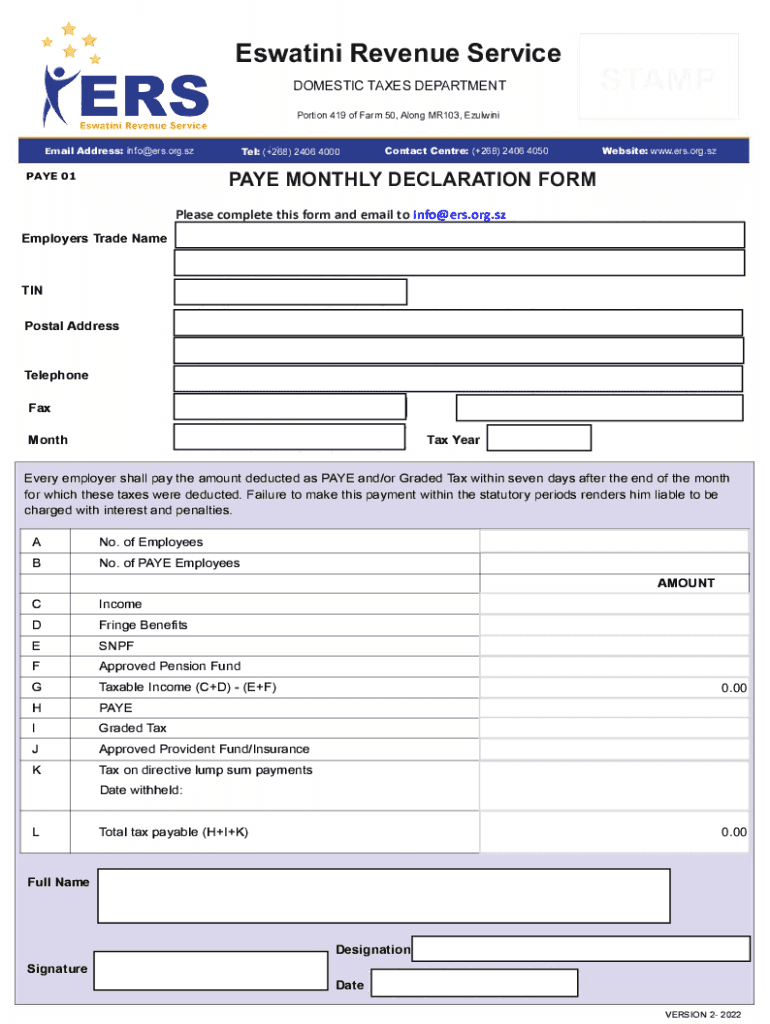

The Eswatini Revenue Authority (SRA) is the government agency responsible for the administration and collection of taxes in Eswatini. It plays a crucial role in ensuring compliance with tax laws and regulations, facilitating trade, and promoting economic development. The SRA oversees various tax types, including income tax, value-added tax (VAT), and customs duties. Its mission is to enhance revenue collection while providing efficient services to taxpayers.

How to Obtain the Eswatini Revenue Authority Tax Clearance Certificate

To obtain a tax clearance certificate from the Eswatini Revenue Authority, individuals and businesses must follow a specific process. This generally involves submitting an application through the SRA’s online platform. Applicants must provide relevant identification and tax information, ensuring all tax obligations are met. Once the application is submitted, the SRA reviews it for compliance before issuing the certificate, which can be downloaded as a PDF for official use.

Steps to Complete the Eswatini Revenue Authority Tax Clearance Certificate Application

Completing the application for the Eswatini Revenue Authority tax clearance certificate involves several key steps:

- Access the SRA online application portal.

- Create or log into your account.

- Fill out the required application form with accurate personal or business information.

- Attach any necessary documentation, such as proof of tax payments.

- Submit the application for review.

- Wait for confirmation and download your tax clearance certificate once approved.

Legal Use of the Eswatini Revenue Authority Tax Clearance Certificate

The tax clearance certificate issued by the Eswatini Revenue Authority serves as an official document confirming that an individual or business has fulfilled their tax obligations. It is often required for various legal and financial transactions, such as applying for loans, participating in government tenders, or registering a business. Ensuring that the certificate is up-to-date is essential for maintaining compliance with local regulations.

Required Documents for the Eswatini Revenue Authority Tax Clearance Certificate

When applying for a tax clearance certificate, applicants typically need to provide several key documents. These may include:

- Identification documents (e.g., national ID or passport).

- Tax identification number (TIN).

- Proof of tax payments or filings.

- Any other supporting documents as specified by the SRA.

Form Submission Methods for the Eswatini Revenue Authority

The Eswatini Revenue Authority allows for multiple submission methods for tax clearance certificate applications. The primary method is through the SRA's online application portal, which offers a streamlined and efficient process. Alternatively, applicants may also have the option to submit forms via mail or in-person at designated SRA offices, although online submission is generally preferred for its convenience.

Quick guide on how to complete swaziland revenue authority s r a

Complete Swaziland Revenue Authority S R A effortlessly on any device

Web-based document management has become increasingly prevalent among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without delays. Handle Swaziland Revenue Authority S R A on any device using the airSlate SignNow Android or iOS apps and streamline any document-based operation today.

The easiest method to modify and eSign Swaziland Revenue Authority S R A seamlessly

- Locate Swaziland Revenue Authority S R A and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and eSign Swaziland Revenue Authority S R A and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct swaziland revenue authority s r a

Create this form in 5 minutes!

How to create an eSignature for the swaziland revenue authority s r a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the eswatini revenue authority tax clearance certificate pdf?

The eswatini revenue authority tax clearance certificate pdf is an official document issued by the Eswatini Revenue Authority confirming that an individual or business is in good standing with tax obligations. It is essential for various transactions, including business registrations and bidding for tenders.

-

How can I obtain the eswatini revenue authority tax clearance certificate pdf?

To obtain the eswatini revenue authority tax clearance certificate pdf, you need to submit a request to the Eswatini Revenue Authority, along with any required documentation and fees. You can typically do this online for convenience, ensuring a swift processing time.

-

Are there any fees associated with obtaining the eswatini revenue authority tax clearance certificate pdf?

Yes, there are fees associated with obtaining the eswatini revenue authority tax clearance certificate pdf. These fees may vary depending on the specific requirements and processing speed selected, so it's advisable to check the official guidelines provided by the Eswatini Revenue Authority.

-

How does the eswatini revenue authority tax clearance certificate pdf benefit my business?

Having the eswatini revenue authority tax clearance certificate pdf demonstrates your business's compliance with tax laws, helping to establish credibility with clients and partners. It is often necessary for obtaining loans, applying for licenses, or participating in government contracts.

-

Can airSlate SignNow assist in preparing documents for the eswatini revenue authority tax clearance certificate pdf?

Yes, airSlate SignNow can help streamline the process of preparing and sending necessary documents for the eswatini revenue authority tax clearance certificate pdf. With its robust document management features, you can easily create, sign, and store your records securely.

-

Is the eswatini revenue authority tax clearance certificate pdf valid for a specific duration?

Yes, the eswatini revenue authority tax clearance certificate pdf is typically valid for a limited duration, often one year. It is important to keep this in mind and renew your certificate timely to avoid any interruptions in your business operations.

-

What integrations does airSlate SignNow offer that can help with tax documentation related to the eswatini revenue authority tax clearance certificate pdf?

AirSlate SignNow offers various integrations with popular financial and accounting software, which can assist you in managing tax documentation related to the eswatini revenue authority tax clearance certificate pdf. This ensures a smooth flow of information and improves overall efficiency.

Get more for Swaziland Revenue Authority S R A

Find out other Swaziland Revenue Authority S R A

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors