Siddhartha Bank Demat Account Form

What is the Siddhartha Bank Demat Account

The Siddhartha Bank Demat Account is a financial service that allows investors to hold their securities in electronic form. This account simplifies the process of buying, selling, and managing shares, bonds, and mutual funds. Instead of dealing with physical certificates, a demat account provides a secure and efficient way to manage investments. It is particularly useful for those who actively trade or invest in the stock market, as it reduces the risk of loss or theft associated with physical documents.

How to obtain the Siddhartha Bank Demat Account

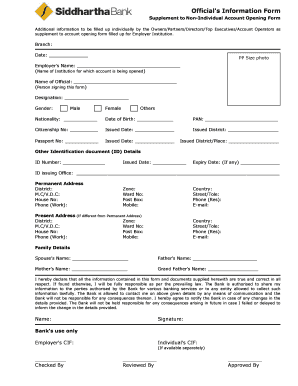

To obtain a Siddhartha Bank Demat Account, individuals need to follow a straightforward process. First, they must gather the necessary documents, which typically include proof of identity, proof of address, and a passport-sized photograph. Next, applicants should visit a Siddhartha Bank branch or their official website to fill out the application form. After submission, the bank will verify the documents and, upon approval, the demat account will be activated, allowing users to start trading electronically.

Steps to complete the Siddhartha Bank Demat Account

Completing the Siddhartha Bank Demat Account involves several key steps:

- Document Preparation: Collect all required documents, such as identification and address proof.

- Application Form: Fill out the demat account application form accurately.

- Submission: Submit the completed form along with the necessary documents to the bank.

- Verification: Wait for the bank to verify the submitted information.

- Activation: Once approved, the account will be activated, and you will receive account details.

Key elements of the Siddhartha Bank Demat Account

The Siddhartha Bank Demat Account includes several key elements that enhance its functionality:

- Electronic Holding: Securities are held in electronic format, eliminating the need for physical certificates.

- Easy Transactions: Facilitates seamless buying and selling of securities through online platforms.

- Account Statements: Regular statements provide a clear overview of holdings and transactions.

- Security Features: Advanced security measures protect against unauthorized access and fraud.

Legal use of the Siddhartha Bank Demat Account

The legal use of the Siddhartha Bank Demat Account is governed by financial regulations that ensure compliance and security. Users must adhere to the guidelines set forth by regulatory bodies overseeing securities trading. This includes maintaining accurate records of transactions and reporting any suspicious activities. The demat account serves as a legally recognized mechanism for holding and trading securities, providing investors with the necessary legal framework to operate confidently in the financial markets.

Required Documents

When applying for a Siddhartha Bank Demat Account, applicants need to provide specific documents to ensure compliance with regulatory requirements. The typical documents required include:

- Government-issued photo ID (such as a driver's license or passport)

- Proof of address (utility bill, bank statement, or lease agreement)

- Passport-sized photographs

- PAN card (if applicable)

Quick guide on how to complete siddhartha bank demat account

Effortlessly Prepare Siddhartha Bank Demat Account on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, enabling you to access the appropriate format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your paperwork quickly and without complications. Manage Siddhartha Bank Demat Account on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Steps to Edit and eSign Siddhartha Bank Demat Account Seamlessly

- Locate Siddhartha Bank Demat Account and click Get Form to begin.

- Utilize the available tools to complete your form submission.

- Highlight pertinent sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether it's via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassles of lost or misfiled documents, tiresome searches for forms, or errors that lead to reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Siddhartha Bank Demat Account and ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the siddhartha bank demat account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Siddhartha Bank demat account?

A Siddhartha Bank demat account is a digital account that allows you to hold and manage your securities electronically. This account is essential for trading shares and other forms of investment without the hassle of physical certificates. By opting for a Siddhartha Bank demat account, you simplify your investment process signNowly.

-

How can I open a Siddhartha Bank demat account?

To open a Siddhartha Bank demat account, you need to visit the bank's branch or their website and fill out the necessary application forms. You'll need to provide identification and financial documents for verification. Once your application is approved, you will receive the details of your demat account.

-

What are the fees associated with a Siddhartha Bank demat account?

The fees for a Siddhartha Bank demat account typically include annual maintenance charges and transaction fees. These charges can vary based on the bank's policies and your trading activity. It's advisable to check the latest fee structure on the Siddhartha Bank website or consult with a bank representative for detailed information.

-

What are the benefits of having a Siddhartha Bank demat account?

A Siddhartha Bank demat account offers several benefits, including ease of trading, reduced paperwork, and enhanced security for your securities. You can conveniently buy, sell, or transfer your investments without the risk of loss or theft associated with physical certificates. It's a great tool for anyone looking to streamline their investment strategy.

-

Can I link my Siddhartha Bank demat account to other investment platforms?

Yes, you can link your Siddhartha Bank demat account to various investment platforms for seamless trading. This integration allows you to manage your investments in one place and execute trades more efficiently. Always ensure that the platform you choose is compatible with your Siddhartha Bank demat account.

-

What documents do I need to provide to open a Siddhartha Bank demat account?

To open a Siddhartha Bank demat account, you typically need to provide KYC documents such as a passport-sized photograph, proof of identity (like a passport or national ID), and proof of address (such as a utility bill). It's wise to check with Siddhartha Bank for any additional documentation requirements before application.

-

Is there any transaction limit on a Siddhartha Bank demat account?

There may be transaction limits on a Siddhartha Bank demat account, depending on the bank's policies and regulations. These limits can vary based on the type of transaction and your account status. It's recommended to review these limits and discuss them with a bank representative for clarity.

Get more for Siddhartha Bank Demat Account

- Eng form 5055

- Dd 369 24430056 form

- Gre exam fee reduction certificate request usc form

- Proquest embargo request form page 1 of 1

- Fiddler on the roof jr script pdf form

- The merancas education assistance loangrant program atlantatech form

- Concordia university wisconsin special education form

- Letter of recommendation fordham university bnet fordham form

Find out other Siddhartha Bank Demat Account

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form