Form it 196 2022

What is the Form IT-196?

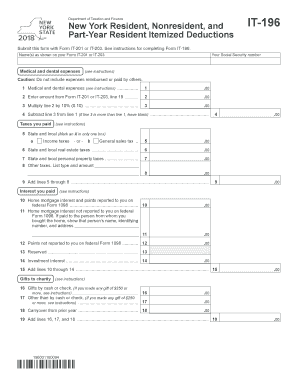

The Form IT-196 is a New York State tax form used primarily to report itemized deductions for personal income tax purposes. This form allows taxpayers to detail various deductions they may qualify for, which can ultimately reduce their taxable income. Understanding the purpose and structure of the IT-196 is essential for individuals looking to maximize their tax benefits while ensuring compliance with state regulations.

How to Use the Form IT-196

Using the Form IT-196 involves several steps to ensure accurate completion. Taxpayers must first gather all necessary documentation, including receipts and records of expenses that qualify for deductions. The form itself requires detailed entries regarding medical expenses, mortgage interest, property taxes, and other deductible items. It is crucial to follow the instructions carefully to avoid errors that could lead to delays or penalties.

Steps to Complete the Form IT-196

Completing the Form IT-196 requires a systematic approach:

- Begin by entering your personal information, including your name, address, and Social Security number.

- List all itemized deductions in the appropriate sections, ensuring that you provide accurate amounts.

- Attach any necessary documentation that supports your deductions, such as W-2 forms or 1099s.

- Review the completed form for accuracy before submission.

Legal Use of the Form IT-196

The Form IT-196 is legally recognized as a valid document for reporting itemized deductions in New York State. To ensure its validity, taxpayers must adhere to the guidelines set forth by the New York State Department of Taxation and Finance. This includes providing truthful information and retaining copies of all submitted documents for future reference.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines associated with the Form IT-196 to avoid penalties. Generally, the form should be filed by the due date of the personal income tax return, which is typically April fifteenth. If additional time is needed, taxpayers can file for an extension, but it is essential to understand that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods

The Form IT-196 can be submitted in several ways. Taxpayers have the option to file electronically through approved tax software, which often streamlines the process and reduces the likelihood of errors. Alternatively, individuals can print the completed form and mail it to the appropriate address as specified by the New York State Department of Taxation and Finance. In-person submissions may also be possible at designated tax offices.

Quick guide on how to complete form it 196

Effortlessly Prepare Form It 196 on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Form It 196 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign Form It 196 Without Stress

- Locate Form It 196 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or cover sensitive information with the tools that airSlate SignNow offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you would like to send your form—via email, SMS, invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device. Edit and eSign Form It 196 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 196

Create this form in 5 minutes!

How to create an eSignature for the form it 196

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to it196 instructions?

airSlate SignNow offers a user-friendly interface that simplifies the eSigning process. With robust features like customizable templates and cloud storage integration, you can efficiently manage your documents aligned with it196 instructions.

-

How does airSlate SignNow ensure the security of documents signed with it196 instructions?

Security is a top priority at airSlate SignNow. All documents signed using it196 instructions are protected with bank-level encryption and comply with major eSignature laws, ensuring the confidentiality and integrity of your information.

-

What is the pricing structure for using airSlate SignNow with it196 instructions?

airSlate SignNow offers flexible pricing plans to suit various business needs. Whether you're a small startup or a large enterprise, you can find a plan that fits your budget while effectively managing your eSigning tasks with it196 instructions.

-

Can airSlate SignNow integrate with other software while using it196 instructions?

Yes, airSlate SignNow seamlessly integrates with multiple platforms like Salesforce, Google Workspace, and Microsoft Office. This integration enhances your workflow, allowing you to utilize it196 instructions across different applications.

-

What benefits does airSlate SignNow provide for remote teams using it196 instructions?

For remote teams, airSlate SignNow simplifies document signing from anywhere in the world. It enables efficient collaboration and quick completion of agreements that require it196 instructions, boosting productivity and reducing delays.

-

Is training available for using airSlate SignNow with it196 instructions?

Yes, airSlate SignNow offers comprehensive training resources, including tutorials and webinars. These materials help users understand how to effectively utilize the platform, especially when navigating it196 instructions.

-

What types of documents can be signed using it196 instructions in airSlate SignNow?

Users can sign various document types with airSlate SignNow, including contracts, agreements, and forms. The platform supports multiple file formats, making it adaptable for any document that requires it196 instructions.

Get more for Form It 196

- Philadd form

- Minnesota standard consent form to release health information 11320753

- Cit 0458 e statutory declaration of common law union cic gc form

- Form c notification appointment of proxy and acceptance of mandate

- Imgurl 5721603 form

- Lhhs reportcard form

- Form project review committee eecs ucf

- V1 verification worksheet 20232024 form

Find out other Form It 196

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself