Social Security Benefits Worksheet PDF Form

What is the IRS Form 915 Worksheet PDF?

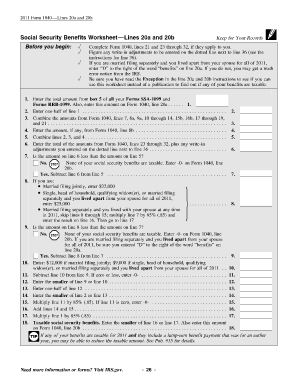

The IRS Form 915 Worksheet PDF is a document used to calculate the taxable portion of Social Security benefits. This worksheet is essential for individuals who receive Social Security income and need to determine how much of that income is subject to federal income tax. It assists taxpayers in understanding their tax obligations and ensuring compliance with IRS regulations. By accurately completing this form, individuals can avoid overpaying or underpaying their taxes.

How to Use the IRS Form 915 Worksheet PDF

Using the IRS Form 915 Worksheet PDF involves several steps to ensure accurate calculations. First, gather all necessary financial documents, including your Social Security benefits statement and any other income sources. Next, follow the instructions on the worksheet carefully, filling in your total income and any applicable deductions. The worksheet will guide you through the process of determining the taxable amount of your Social Security benefits, which is crucial for your tax return. Ensure that you double-check your entries for accuracy before submission.

Steps to Complete the IRS Form 915 Worksheet PDF

Completing the IRS Form 915 Worksheet PDF requires a systematic approach. Start by entering your total Social Security benefits received for the year. Then, include any other income you may have, such as wages or pensions. The worksheet will prompt you to calculate your combined income, which is essential for determining the taxable portion of your benefits. Follow the calculations as outlined in the form, ensuring each step is completed accurately. Finally, review the completed worksheet to confirm that all information is correct before using it to prepare your tax return.

Legal Use of the IRS Form 915 Worksheet PDF

The IRS Form 915 Worksheet PDF is legally recognized for determining the taxable amount of Social Security benefits. It adheres to IRS guidelines, ensuring that taxpayers fulfill their tax obligations accurately. Using this worksheet is crucial for compliance with federal tax laws, as it helps prevent discrepancies in reported income. Taxpayers should retain a copy of the completed worksheet for their records, as it may be required in case of an audit or for future reference when filing taxes.

Filing Deadlines / Important Dates

Filing deadlines for tax returns, including those using the IRS Form 915 Worksheet PDF, typically fall on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to be aware of these dates to avoid penalties and interest on late filings. Additionally, taxpayers should consider any extensions that may be available if they need more time to prepare their returns.

Required Documents

To complete the IRS Form 915 Worksheet PDF accurately, certain documents are necessary. Taxpayers should have their Social Security benefits statement, which details the total benefits received for the year. Other relevant documents include any W-2 forms, 1099 forms, and records of other income sources. Having these documents on hand ensures that the information entered into the worksheet is accurate and complete, which is essential for proper tax reporting.

IRS Guidelines

The IRS provides specific guidelines for using the Form 915 Worksheet PDF, outlining how to calculate the taxable portion of Social Security benefits. These guidelines include instructions on determining combined income, which factors into the calculation of taxable benefits. Taxpayers should familiarize themselves with these guidelines to ensure compliance and accuracy in their tax filings. Adhering to IRS instructions helps prevent errors that could lead to audits or penalties.

Quick guide on how to complete social security benefits worksheet pdf

Effortlessly Prepare Social Security Benefits Worksheet Pdf on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Social Security Benefits Worksheet Pdf on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Social Security Benefits Worksheet Pdf with Ease

- Find Social Security Benefits Worksheet Pdf and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Social Security Benefits Worksheet Pdf to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the social security benefits worksheet pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the social security worksheet 2015 image and how can it be used?

The social security worksheet 2015 image is a crucial document for individuals applying for social security benefits. It provides a clear visual guide to fill out the necessary information accurately. Using airSlate SignNow, you can easily upload, eSign, and share this worksheet securely for quicker processing.

-

How much does it cost to use airSlate SignNow for signing the social security worksheet 2015 image?

airSlate SignNow offers various pricing plans to accommodate different needs, starting from a free trial to more comprehensive packages. This cost-effective solution allows you to manage your documents, including the social security worksheet 2015 image, efficiently without breaking the bank.

-

What features does airSlate SignNow provide for handling the social security worksheet 2015 image?

airSlate SignNow provides features like document uploading, customizable eSignature fields, and template creation for the social security worksheet 2015 image. Additionally, you can track document status in real time and send reminders to ensure timely completion and submission.

-

Are there any benefits to using airSlate SignNow for the social security worksheet 2015 image?

Using airSlate SignNow for the social security worksheet 2015 image enhances convenience by allowing you to sign documents electronically from anywhere. This not only saves time but also reduces the risk of lost paperwork, ensuring that your application process remains smooth and efficient.

-

Can I integrate airSlate SignNow with other applications for my social security worksheet 2015 image?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and Microsoft Teams. This allows for an enhanced workflow when managing your social security worksheet 2015 image, making it easier to access and share your documents across platforms.

-

Is airSlate SignNow secure for handling sensitive documents like the social security worksheet 2015 image?

Absolutely! airSlate SignNow prioritizes security and compliance, implementing encryption and secure storage for documents including the social security worksheet 2015 image. You can trust that your personal information is protected throughout the signing process.

-

How do I get started with airSlate SignNow for the social security worksheet 2015 image?

To get started with airSlate SignNow for the social security worksheet 2015 image, simply sign up for an account on our website. After setting up your account, you can easily upload the image, customize your signing fields, and send it out to be signed digitally within minutes.

Get more for Social Security Benefits Worksheet Pdf

- Quitclaim deed from individual to corporation louisiana form

- Warranty deed from individual to corporation louisiana form

- Movables form

- Notice of nonpayment seller of movables individual louisiana form

- Quitclaim deed from individual to llc louisiana form

- La llc company form

- Notice nonpayment template form

- Louisiana notice form

Find out other Social Security Benefits Worksheet Pdf

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document