104 Colorado Form 2020

What is the 104 Colorado Form

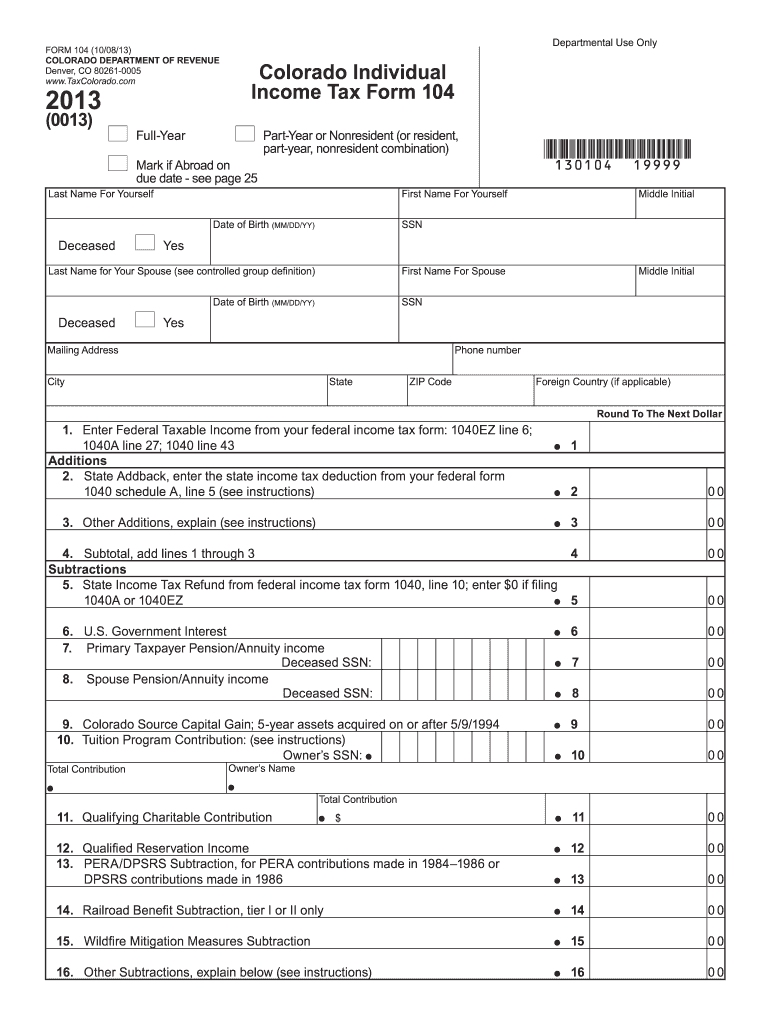

The 104 Colorado Form is a state-specific tax form used by residents of Colorado to report their income and calculate their state tax liability. This form is essential for individuals and businesses operating within the state, as it ensures compliance with Colorado tax regulations. The form collects various types of income, deductions, and credits applicable to the taxpayer's situation, ultimately determining the amount owed or refunded.

How to use the 104 Colorado Form

Using the 104 Colorado Form involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. After collecting this information, individuals can fill out the form, entering their income, deductions, and credits in the appropriate sections. It is crucial to double-check all entries for accuracy before submission to avoid delays or penalties.

Steps to complete the 104 Colorado Form

Completing the 104 Colorado Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all necessary documents, including income statements and deduction receipts.

- Download the 104 Colorado Form from the Colorado Department of Revenue website or use an electronic filing service.

- Fill in your personal information, including name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any eligible deductions and credits, ensuring you have documentation to support your claims.

- Calculate your total tax liability or refund based on the information provided.

- Review the completed form for accuracy before submitting it.

Legal use of the 104 Colorado Form

The 104 Colorado Form is legally binding and must be filled out accurately to comply with state tax laws. Failure to provide truthful information can result in penalties, including fines and interest on unpaid taxes. It is essential to keep records of all submitted forms and supporting documents for at least three years, as the Colorado Department of Revenue may audit taxpayers during this period.

Filing Deadlines / Important Dates

Timely submission of the 104 Colorado Form is crucial to avoid penalties. The standard filing deadline for individual tax returns is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available and the necessary procedures to follow if they require additional time to file.

Who Issues the Form

The 104 Colorado Form is issued by the Colorado Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. Individuals can access the form directly from the Department's website, where they can also find additional resources and guidance on completing their tax returns.

Quick guide on how to complete 2013 104 colorado form

Prepare 104 Colorado Form effortlessly on any device

Online document management has gained greater popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Handle 104 Colorado Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign 104 Colorado Form with ease

- Find 104 Colorado Form and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Select important sections of the documents or obscure sensitive data with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Edit and eSign 104 Colorado Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 104 colorado form

Create this form in 5 minutes!

How to create an eSignature for the 2013 104 colorado form

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is the 104 Colorado Form?

The 104 Colorado Form is used by residents of Colorado to report their state income tax. It allows taxpayers to detail income, claim deductions, and determine their state tax obligations. Understanding this form is crucial for proper tax filing and compliance.

-

How can airSlate SignNow help with the 104 Colorado Form?

airSlate SignNow provides an efficient platform for electronically signing and sending the 104 Colorado Form. With its easy-to-use interface, you can complete your forms and ensure they are securely signed and submitted on time, streamlining your tax filing process.

-

What features does airSlate SignNow offer for managing the 104 Colorado Form?

airSlate SignNow offers various features to manage the 104 Colorado Form, including customizable templates, real-time tracking, and reminders for submission deadlines. These features help ensure that you stay organized and meet your tax obligations without stress.

-

Is airSlate SignNow cost-effective for filing the 104 Colorado Form?

Yes, airSlate SignNow is a cost-effective solution for filing the 104 Colorado Form. With flexible pricing plans, you can choose the subscription that best fits your needs, providing great value for businesses looking to simplify document management and e-signatures.

-

Can airSlate SignNow integrate with other tools for the 104 Colorado Form?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your efficiency when managing the 104 Colorado Form. This integration allows you to leverage existing software and workflows, making the filing process even smoother.

-

What benefits does using airSlate SignNow for the 104 Colorado Form provide?

Using airSlate SignNow for the 104 Colorado Form offers numerous benefits, including improved accuracy, enhanced security, and faster turnaround times. By digitizing your e-signature and document management processes, you can avoid common pitfalls associated with paper forms.

-

How secure is the process of signing the 104 Colorado Form with airSlate SignNow?

The process of signing the 104 Colorado Form with airSlate SignNow is highly secure. The platform employs advanced encryption and compliance measures to protect sensitive information, ensuring your tax documents remain confidential and secure throughout the signing process.

Get more for 104 Colorado Form

Find out other 104 Colorado Form

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe