Underpayment of Estimated Tax by Corporation 2020

Understanding the Underpayment of Estimated Tax by Corporation

The Underpayment of Estimated Tax by Corporation refers to the situation where a corporation fails to pay enough estimated tax throughout the year. Corporations are generally required to estimate their tax liability and make quarterly payments to avoid penalties. This obligation is crucial for maintaining compliance with federal tax laws and ensuring that the corporation does not face unexpected tax liabilities at year-end.

Steps to Complete the Underpayment of Estimated Tax by Corporation

To complete the Underpayment of Estimated Tax by Corporation, follow these steps:

- Determine the total expected tax liability for the year.

- Calculate the required estimated tax payments, which are typically one-fourth of the expected liability.

- Make the quarterly payments by the specified deadlines to avoid penalties.

- Keep accurate records of all payments made and any adjustments to the estimated tax liability throughout the year.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines for estimated tax payments. Generally, these payments are due on the fifteenth day of April, June, September, and December. It is essential to mark these dates on your calendar to ensure timely payments and avoid penalties associated with underpayment.

Penalties for Non-Compliance

Failure to comply with the estimated tax payment requirements can result in penalties. The IRS typically imposes a penalty based on the amount of underpayment and the duration of the underpayment period. Understanding these penalties can help corporations avoid unnecessary costs and maintain compliance.

Eligibility Criteria

To be subject to the Underpayment of Estimated Tax by Corporation, the entity must generally be classified as a corporation for tax purposes. This includes C corporations and S corporations that expect to owe tax of a certain amount for the year. Corporations should evaluate their tax situation to determine if they meet the eligibility criteria for estimated tax payments.

IRS Guidelines

The IRS provides specific guidelines regarding the Underpayment of Estimated Tax by Corporation. These guidelines outline how to calculate estimated tax payments, the required forms to use, and the consequences of failing to meet payment obligations. Corporations should refer to the IRS publications relevant to their tax situation for detailed instructions.

Who Issues the Form

The Underpayment of Estimated Tax by Corporation form is issued by the Internal Revenue Service (IRS). Corporations must use this form to report their estimated tax payments and ensure compliance with federal tax laws. It is important to keep up to date with any changes to the form or filing requirements as issued by the IRS.

Quick guide on how to complete underpayment of 2014 estimated tax by corporation

Prepare Underpayment Of Estimated Tax By Corporation effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It presents an ideal environmentally friendly substitute to traditional printed and signed documents, as it allows you to easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents promptly without any holdups. Manage Underpayment Of Estimated Tax By Corporation on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Underpayment Of Estimated Tax By Corporation with ease

- Find Underpayment Of Estimated Tax By Corporation and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with features that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as an ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Select how you wish to send your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Underpayment Of Estimated Tax By Corporation and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct underpayment of 2014 estimated tax by corporation

Create this form in 5 minutes!

How to create an eSignature for the underpayment of 2014 estimated tax by corporation

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

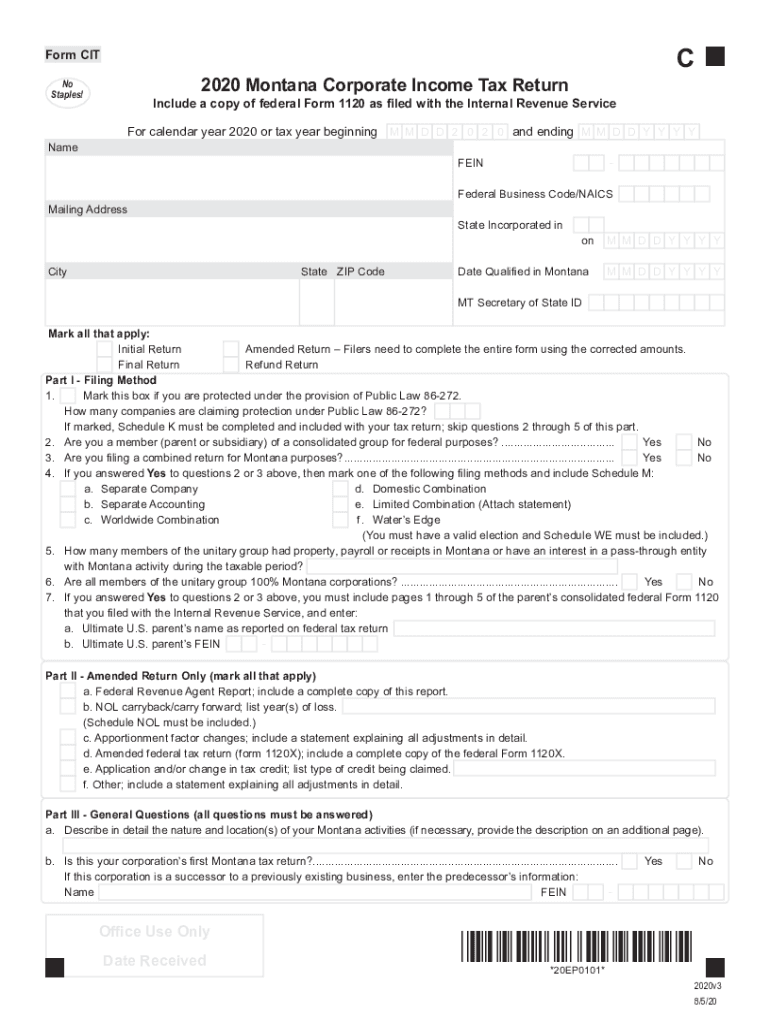

What is the montana form cit 2018 used for?

The montana form cit 2018 is specifically used for filing corporate income tax returns in Montana. It helps businesses report their income accurately and ensures compliance with state tax regulations. Completing this form is essential for any corporation looking to operate in Montana.

-

How can airSlate SignNow help with the montana form cit 2018?

airSlate SignNow simplifies the process of completing and signing the montana form cit 2018 by providing an intuitive eSignature solution. Users can easily fill out the form, add digital signatures, and send it securely to necessary parties. This streamlines the filing process and ensures that all necessary documentation is well-organized.

-

Is there a cost associated with using airSlate SignNow for the montana form cit 2018?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there's a reasonable cost associated with using their services, many users find it cost-effective given the time savings and efficiency it provides, especially when managing documents like the montana form cit 2018.

-

What features does airSlate SignNow offer for the montana form cit 2018?

airSlate SignNow offers features such as customizable templates, in-app reminders, and secure cloud storage that enhance the use of the montana form cit 2018. These features enable users to edit, send, and manage documents seamlessly. Additionally, the platform ensures that all transactions are secure and compliant with regulations.

-

Can I integrate airSlate SignNow with other tools while completing the montana form cit 2018?

Yes, airSlate SignNow offers various integrations with popular business tools and applications. This allows users to import data and automate workflows, making it easier to prepare and file the montana form cit 2018. Integrating with your existing tools enables a more cohesive document management process.

-

What are the benefits of using airSlate SignNow for businesses filing the montana form cit 2018?

Using airSlate SignNow for the montana form cit 2018 provides several benefits, including enhanced efficiency, improved accuracy, and compliance with filing requirements. The platform's user-friendly interface allows businesses to quickly manage documents without hassle. Additionally, the electronic signature feature ensures timely approvals.

-

How does airSlate SignNow ensure the security of the montana form cit 2018?

airSlate SignNow takes security seriously, employing advanced encryption methods to protect sensitive information within the montana form cit 2018. The platform also complies with industry standards and regulations to ensure that your data remains secure during transmission and storage. This gives users peace of mind when dealing with important tax documents.

Get more for Underpayment Of Estimated Tax By Corporation

Find out other Underpayment Of Estimated Tax By Corporation

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free