T1 General Sample 2021

What is the T1 General Sample

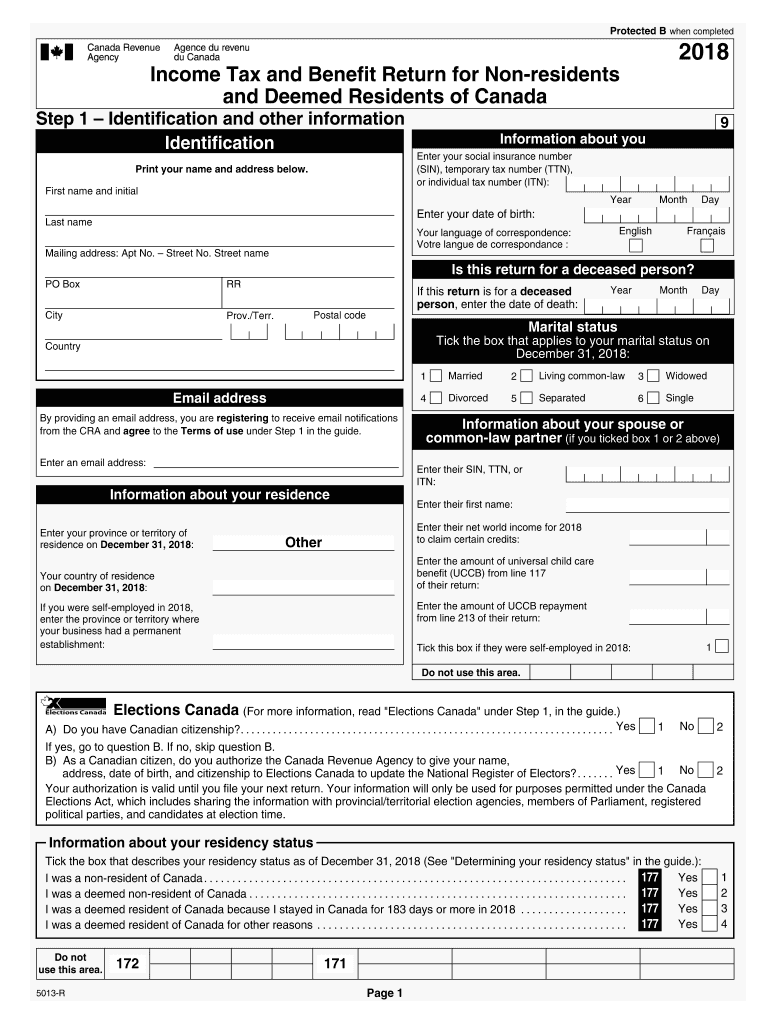

The T1 General Sample is a tax form used by individuals in Canada to report their income and calculate their tax obligations. This form is essential for filing personal income tax returns and includes various sections for reporting different types of income, deductions, and credits. It serves as a comprehensive overview of an individual's financial situation for the tax year.

Key elements of the T1 General Sample

The T1 General Sample consists of several key elements that taxpayers must understand to complete it accurately. These elements include:

- Identification Information: Personal details such as name, address, and Social Insurance Number (SIN).

- Income Reporting: Sections for reporting various income types, including employment income, rental income, and investment income.

- Deductions: Areas to claim eligible deductions, such as RRSP contributions and childcare expenses.

- Tax Credits: Sections for claiming non-refundable and refundable tax credits, which can reduce the overall tax liability.

- Total Tax Calculation: A summary section that calculates the total tax owed or refund due based on the information provided.

Steps to complete the T1 General Sample

Completing the T1 General Sample involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather all necessary documents, including T4 slips, receipts for deductions, and any other relevant financial information.

- Fill out the identification section with your personal details.

- Report your total income in the appropriate sections, ensuring all sources are included.

- Claim deductions by entering eligible amounts in the designated areas.

- Calculate your tax credits and enter them in the corresponding sections.

- Review your completed form for accuracy, ensuring all calculations are correct.

- Submit the form either electronically or by mail, depending on your preference and eligibility.

Form Submission Methods (Online / Mail / In-Person)

There are various methods available for submitting the T1 General Sample, which include:

- Online Submission: Many individuals choose to file their taxes online using certified tax software, which often simplifies the process and ensures accuracy.

- Mail Submission: Taxpayers can print the completed form and mail it to the appropriate tax office. Ensure to send it well before the deadline to avoid penalties.

- In-Person Submission: Some may prefer to submit their forms in person at designated tax offices, where assistance may be available.

Legal use of the T1 General Sample

The T1 General Sample is legally binding when completed accurately and submitted on time. It must comply with the regulations set forth by the Canada Revenue Agency (CRA). Failure to submit the form or providing false information can result in penalties, including fines or legal action. It's crucial to ensure that all information is truthful and complete to avoid any legal repercussions.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the T1 General Sample is vital for compliance. Generally, the deadline for individual taxpayers is April 30 of the following year. If April 30 falls on a weekend or holiday, the deadline may be extended to the next business day. Self-employed individuals have until June 15 to file their returns but must pay any taxes owed by April 30 to avoid interest charges.

Quick guide on how to complete t1 general sample 470414798

Complete T1 General Sample effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It presents an ideal eco-conscious substitute for conventional printed and signed papers, as you can locate the suitable form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents rapidly without delays. Handle T1 General Sample on any system with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign T1 General Sample without hassle

- Locate T1 General Sample and click Get Form to get going.

- Utilize the tools we offer to finish your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which takes seconds and carries the same legal value as a traditional handwritten signature.

- Review all the details and click on the Done button to store your updates.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced papers, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device of your preference. Modify and eSign T1 General Sample and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1 general sample 470414798

Create this form in 5 minutes!

How to create an eSignature for the t1 general sample 470414798

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Canada Revenue TD1 forms?

Canada Revenue TD1 forms are tax forms used to determine the amount of income tax to be deducted from an employee's pay. These forms are essential for both employers and employees in Canada to ensure accurate tax withholding. Using airSlate SignNow, you can easily send and eSign Canada Revenue TD1 forms, streamlining the process.

-

How can airSlate SignNow help with Canada Revenue TD1 forms?

airSlate SignNow provides a simple and efficient way to manage Canada Revenue TD1 forms. Our platform allows users to send, sign, and store these documents securely, ensuring compliance and ease of access. By using airSlate SignNow, you can save time and reduce paperwork, ultimately improving your workflow.

-

What features does airSlate SignNow offer for Canada Revenue TD1 forms?

airSlate SignNow offers features such as customizable templates, secure electronic signatures, and easy document sharing specifically for Canada Revenue TD1 forms. Additionally, you can track document status in real-time, making it easier to manage your paperwork efficiently. This enhances productivity and keeps your tax documents organized.

-

Is airSlate SignNow suitable for small businesses handling Canada Revenue TD1 forms?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. It provides an affordable and user-friendly solution for managing Canada Revenue TD1 forms, helping small business owners save time and reduce costs in their tax processing. Our scalable pricing ensures that everyone can benefit from our services.

-

Can I integrate airSlate SignNow with other software for Canada Revenue TD1 forms?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to manage Canada Revenue TD1 forms alongside your existing tools. You can connect with popular productivity and finance applications to automate workflows and enhance document management. This integration capability allows for increased efficiency in handling tax documents.

-

What are the benefits of using airSlate SignNow for Canada Revenue TD1 forms?

Using airSlate SignNow for Canada Revenue TD1 forms provides numerous benefits, including faster processing times, enhanced security, and improved accuracy. Our platform eliminates the need for paper documents and manual signatures, which reduces the likelihood of errors. Enjoy peace of mind knowing your tax documents are managed efficiently and securely.

-

How does eSigning Canada Revenue TD1 forms work on airSlate SignNow?

eSigning Canada Revenue TD1 forms on airSlate SignNow is straightforward. Simply upload your form, add the necessary recipients, and send the document for signature. Signers can easily review and eSign directly through the platform, ensuring a quick turnaround on critical tax documents.

Get more for T1 General Sample

- Doh 2225k mass gathering and public function fee determination schedule form

- Ce form for renewal alabama board of dental examiners dentalboard

- Rubric for assessing group members ability to participate bb form

- Functional tests amp measures for acute care practice samuelmerritt form

- Event submission form

- Non tax filer39s statement southern university new orleans form

- R0277x state of michigan michigan form

- Animation contract template form

Find out other T1 General Sample

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free