It 215 Form

What is the IT 215 Form

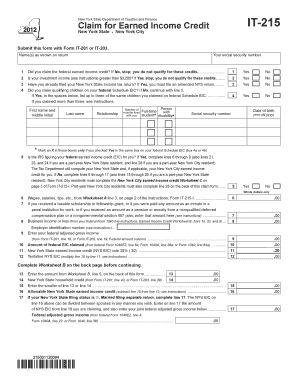

The IT 215 form is a tax document used in the United States for specific tax-related purposes. It is primarily associated with the reporting of certain tax credits and deductions. Understanding the IT 215 form is essential for individuals and businesses seeking to ensure compliance with tax regulations while maximizing their eligible benefits. This form plays a critical role in the tax filing process, providing necessary information to the IRS and state tax authorities.

How to use the IT 215 Form

Using the IT 215 form effectively involves several key steps. First, gather all relevant financial documents that pertain to the tax year in question. This may include income statements, previous tax returns, and any documentation related to deductions or credits you plan to claim. Next, carefully fill out the IT 215 form, ensuring that all information is accurate and complete. It is advisable to review the form multiple times before submission to avoid errors that could lead to delays or penalties.

Steps to complete the IT 215 Form

Completing the IT 215 form involves a systematic approach:

- Begin by downloading the form from the official IRS website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income and any applicable deductions or credits.

- Double-check all entries for accuracy, ensuring that figures are correctly calculated.

- Sign and date the form to certify its authenticity.

- Submit the completed form to the appropriate tax authority, either online or via mail.

Legal use of the IT 215 Form

The IT 215 form is legally recognized as a valid document for tax reporting purposes. To ensure its legal use, it must be filled out accurately and submitted within the designated deadlines. Compliance with IRS regulations is crucial, as improper use of the form can lead to penalties or audits. Utilizing a reliable eSignature solution, such as airSlate SignNow, can enhance the legal standing of your completed form by providing a secure and verifiable signature process.

Filing Deadlines / Important Dates

Filing deadlines for the IT 215 form are critical to avoid penalties. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, this date may vary depending on specific circumstances, such as weekends or holidays. It is essential to stay informed about any updates to filing dates to ensure timely submission and compliance with tax laws.

Required Documents

To complete the IT 215 form accurately, certain documents are required. These may include:

- W-2 forms from employers detailing annual income.

- 1099 forms for any freelance or contract work.

- Receipts or documentation for deductions and credits claimed.

- Previous tax returns for reference.

Having these documents on hand will streamline the completion process and help ensure that all necessary information is included.

Quick guide on how to complete it 215 form

Easily Prepare It 215 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct template and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage It 215 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to Edit and eSign It 215 Form with Ease

- Locate It 215 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign It 215 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 215 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the It 215 Form?

The It 215 Form is a tax document used for specific tax credits and deductions in certain jurisdictions. airSlate SignNow simplifies the process of sending and eSigning the It 215 Form, making it easier for businesses and individuals to manage their tax-related documents efficiently.

-

How does airSlate SignNow assist with the It 215 Form?

airSlate SignNow provides a user-friendly platform to securely send, receive, and eSign the It 215 Form. With features like templates and reminders, businesses can streamline their document workflow, ensuring all tax forms are submitted on time and accurately.

-

What are the pricing options for using airSlate SignNow for the It 215 Form?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you require basic eSigning capabilities or advanced features to handle documents like the It 215 Form, there's an option that suits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for the It 215 Form?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms, enabling users to manage the It 215 Form alongside their existing workflows. This integration capability ensures that you can easily connect with popular tools like CRM systems and cloud storage services.

-

What are the benefits of using airSlate SignNow for the It 215 Form?

Using airSlate SignNow for the It 215 Form offers multiple benefits, including increased efficiency, time savings, and enhanced security. The platform allows users to create, send, and eSign documents with minimal hassle, ensuring a smooth experience during tax preparation.

-

Is airSlate SignNow compliant with legal standards for the It 215 Form?

Absolutely! airSlate SignNow complies with all legal standards for electronic signatures, ensuring that the It 215 Form and other documents are valid and recognized by authorities. This compliance provides peace of mind when managing sensitive financial information.

-

How long does it take to complete the It 215 Form using airSlate SignNow?

Completing the It 215 Form with airSlate SignNow can be done in just a few minutes. The platform's intuitive interface allows users to fill out necessary fields quickly and send the document out for eSignature without any delays.

Get more for It 215 Form

- How to log on to ladder logic on automax rockwell form

- Fulton county dispossessory form

- Ficha de acreedor ejemplo form

- Pch payment form

- Medication treatment authorization form

- Group benefits vision care claim form liuna

- Assignment of the beneficial interest form

- Artist commission contract template form

Find out other It 215 Form

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement