Kentucky K 4 Form 2022

What is the Kentucky K 4 Form

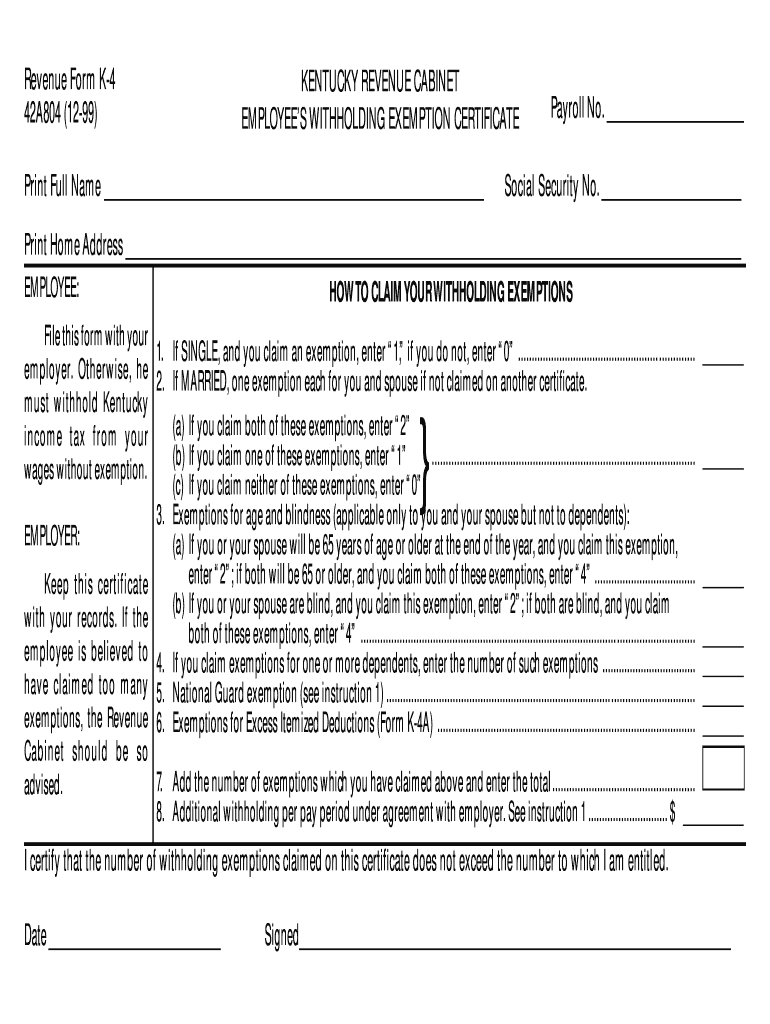

The Kentucky K 4 Form is a state-specific tax form used by employers to determine the amount of state income tax to withhold from employees' paychecks. This form is essential for ensuring compliance with Kentucky's tax regulations and is typically filled out by employees when they start a new job or when their tax situation changes. The K 4 form collects information such as filing status, number of exemptions, and additional withholding amounts, which directly influence the tax deductions from an employee's wages.

How to use the Kentucky K 4 Form

Using the Kentucky K 4 Form involves several straightforward steps. First, employees should obtain the form from their employer or download it from the Kentucky Department of Revenue’s website. After filling out the necessary personal information, employees must indicate their filing status and exemptions. Once completed, the form should be submitted to the employer, who will use the information to calculate the correct amount of state tax to withhold from each paycheck. It is advisable to review the form periodically, especially after significant life changes such as marriage or the birth of a child.

Steps to complete the Kentucky K 4 Form

Completing the Kentucky K 4 Form requires attention to detail. Here are the steps to follow:

- Obtain the Kentucky K 4 Form from your employer or the Kentucky Department of Revenue.

- Fill in your personal information, including your name, address, and Social Security number.

- Select your filing status: single, married, or head of household.

- Indicate the number of exemptions you are claiming.

- Specify any additional amount you wish to withhold, if applicable.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer.

Legal use of the Kentucky K 4 Form

The Kentucky K 4 Form is legally recognized for tax withholding purposes in the state of Kentucky. Employers are required to keep this form on file for each employee and use it to ensure accurate tax withholding. The information provided on the K 4 form must comply with state tax laws, and any inaccuracies can result in penalties for both the employee and the employer. Therefore, it is crucial to complete the form accurately and update it as necessary to reflect any changes in your tax situation.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky K 4 Form are typically aligned with the start of employment or when a change in tax situation occurs. Employees should submit the form promptly to ensure that the correct amount of state tax is withheld from their first paycheck. Additionally, employers must retain the K 4 forms for a specified period, usually for at least four years, in case of audits or inquiries from the Kentucky Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

The Kentucky K 4 Form is primarily submitted to employers rather than directly to the state. Employees can hand-deliver the completed form to their employer or submit it via email, depending on the employer’s policies. While there is no online submission option for the K 4 form itself, employers may have electronic systems in place for collecting and managing tax forms. It is important to follow your employer's specific submission guidelines to ensure compliance.

Quick guide on how to complete kentucky k 4 form

Complete Kentucky K 4 Form effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Kentucky K 4 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to edit and eSign Kentucky K 4 Form without hassle

- Find Kentucky K 4 Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Edit and eSign Kentucky K 4 Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky k 4 form

Create this form in 5 minutes!

How to create an eSignature for the kentucky k 4 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the Kentucky K4 2018 form?

The Kentucky K4 2018 form is essential for individuals seeking to properly report their income tax withholdings in the state of Kentucky. This form helps ensure that you are withholding the correct amount of taxes throughout the year, contributing to accurate tax filings. Utilizing an electronic signature solution like airSlate SignNow can streamline the completion and submission of the Kentucky K4 2018.

-

How can airSlate SignNow help with the Kentucky K4 2018?

airSlate SignNow simplifies the process of filling out and signing the Kentucky K4 2018 form by providing an intuitive platform for electronic signatures. Users can easily prepare and send their documents securely, ensuring compliance with Kentucky tax regulations. This efficiency reduces the time and hassle associated with paper forms.

-

Is airSlate SignNow cost-effective for managing Kentucky K4 2018 documents?

Yes, airSlate SignNow offers a cost-effective solution for managing the Kentucky K4 2018 and other documents. With competitive pricing plans, businesses and individuals can save money while ensuring a smooth workflow for their document management needs. The affordability combined with ease of use makes it a great choice for managing tax-related documents.

-

What features does airSlate SignNow offer for the Kentucky K4 2018?

airSlate SignNow includes features such as customizable templates, secure storage, and real-time collaboration to effectively manage the Kentucky K4 2018 form. Users can easily track the status of their documents, ensuring that all parties are informed and engaged in the signing process. These features enhance efficiency and accuracy.

-

Can I integrate airSlate SignNow with other applications for handling the Kentucky K4 2018?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as Google Drive, Dropbox, and CRM systems, to streamline the management of your Kentucky K4 2018 documents. This integration allows for a more cohesive workflow, making it easy to access and share necessary files across platforms.

-

What are the benefits of using airSlate SignNow for Kentucky K4 2018 submissions?

Using airSlate SignNow for submitting Kentucky K4 2018 forms offers numerous benefits, including increased efficiency, reduced paper waste, and enhanced security. The platform ensures that your sensitive information is protected while providing convenience through electronic signatures. This results in a faster turnaround time for approvals and decreased errors in document processing.

-

Is it easy to track submissions of Kentucky K4 2018 with airSlate SignNow?

Yes, airSlate SignNow makes it easy to track the submissions of Kentucky K4 2018 forms. Users receive notifications when documents are viewed and signed, providing full transparency throughout the process. This tracking feature allows you to stay informed and ensure that all necessary documentation is completed on time.

Get more for Kentucky K 4 Form

Find out other Kentucky K 4 Form

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple