Ss4 Form Example

What is the Ss4 Form Example

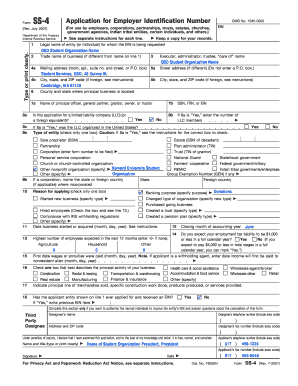

The SS-4 form is an application used to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This number is essential for businesses in the United States, as it is used for tax reporting and identification purposes. The form is required for various entities, including corporations, partnerships, and sole proprietorships, enabling them to operate legally and fulfill their tax obligations. Completing the SS-4 form accurately is crucial to ensure timely processing and compliance with federal regulations.

How to use the Ss4 Form Example

Using the SS-4 form involves several steps to ensure that all necessary information is provided correctly. First, determine your eligibility to apply for an EIN. Next, gather the required information, including the legal name of the entity, the type of entity, and the reason for applying for an EIN. After filling out the form, you can submit it electronically through the IRS website or by mail. Ensure that you review the form for accuracy before submission, as errors can lead to delays in receiving your EIN.

Steps to complete the Ss4 Form Example

Completing the SS-4 form requires careful attention to detail. Follow these steps:

- Identify the type of entity you are applying for, such as a corporation or partnership.

- Provide the legal name of the entity and any trade names.

- Enter the address where the business is located.

- Specify the reason for applying for an EIN, such as starting a new business or hiring employees.

- Complete the sections regarding the responsible party and any additional information required.

Once all sections are filled out, review the form for accuracy and submit it according to the preferred method.

Legal use of the Ss4 Form Example

The SS-4 form is legally recognized as the official application for obtaining an EIN. It must be completed in compliance with IRS guidelines to ensure its validity. The information provided on the form is used by the IRS to assign the EIN, which is necessary for tax reporting and compliance. Failure to properly complete the SS-4 form can result in delays or issues with your EIN, impacting your ability to operate legally.

Filing Deadlines / Important Dates

While there is no specific deadline for filing the SS-4 form, it is recommended to apply for an EIN as soon as you establish your business entity. This is particularly important if you plan to hire employees or open a business bank account. Delaying the application may lead to complications in meeting tax obligations or regulatory requirements. Additionally, be aware of any state-specific deadlines that may apply to your business operations.

Who Issues the Form

The SS-4 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the form and guidelines for its completion on their official website. Once the form is submitted, the IRS processes the application and issues an Employer Identification Number (EIN) if all requirements are met.

Quick guide on how to complete ss4 form example

Complete Ss4 Form Example effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents quickly without delays. Manage Ss4 Form Example on any platform with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to alter and electronically sign Ss4 Form Example with ease

- Obtain Ss4 Form Example and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your preference. Edit and electronically sign Ss4 Form Example and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ss4 form example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Ss4 Form Example and why is it important?

An Ss4 Form Example serves as a template for businesses to apply for an Employer Identification Number (EIN) with the IRS. This form is important because it helps streamline the registration process and ensures that all necessary information is provided correctly. Properly completing an Ss4 Form Example can enhance your business's tax compliance and operational efficiency.

-

How can airSlate SignNow help with completing an Ss4 Form Example?

airSlate SignNow simplifies the process of completing your Ss4 Form Example by providing an intuitive platform to fill out, sign, and send documents securely. With its user-friendly interface, you can easily enter your information, ensuring accuracy and compliance with IRS guidelines. Additionally, the platform tracks document status, making it easier to manage and organize your submissions.

-

Is there a cost associated with using airSlate SignNow for an Ss4 Form Example?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan includes features that facilitate eSignature and document management, including the ability to work with your Ss4 Form Example. The affordable pricing ensures that even small businesses can access advanced solutions without breaking the bank.

-

What features does airSlate SignNow provide for handling an Ss4 Form Example?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure electronic signatures specifically designed for forms like the Ss4 Form Example. Users can effortlessly share, track, and manage their documents, ensuring a seamless experience. Additionally, the platform includes audit trails for compliance and security.

-

Can I integrate airSlate SignNow with other tools while using an Ss4 Form Example?

Absolutely! airSlate SignNow supports integrations with numerous applications, such as Google Drive, Dropbox, and various CRM systems. This capability allows you to seamlessly import and export your Ss4 Form Example and collaborate with your existing workflows. Integration enhances productivity and keeps your documents organized in one place.

-

What are the benefits of using airSlate SignNow for an Ss4 Form Example?

Using airSlate SignNow for your Ss4 Form Example provides numerous benefits, including speed, efficiency, and secure electronic signatures. It reduces the time spent on paperwork and minimizes errors, ensuring that your form is process-ready. Moreover, the platform keeps your data secure, alleviating concerns about confidentiality.

-

How does airSlate SignNow ensure the security of my Ss4 Form Example?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance with industry standards. Your Ss4 Form Example is protected throughout the signing process, ensuring that sensitive information remains confidential. Additionally, the platform offers features such as access controls and audit trails for accountability.

Get more for Ss4 Form Example

- Application process 921 ky admin regs 3030 form

- Sample letter revoking hipaa authorization form

- Form rules

- Wtma patient portal login form

- Dental screening form new beginnings schools foundation newbeginningsnola

- Doctor sheet form

- Gulf coast occ med medical authorization form

- Www coursehero comfile43954397dispute form pdf dispute form please complete the form in

Find out other Ss4 Form Example

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF