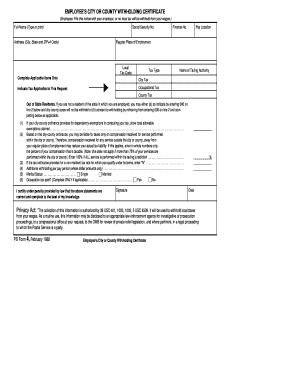

Ps Form 4

What is the Iowa Employee Withholding Form 2019?

The Iowa Employee Withholding Form 2019 is a critical document used by employers in Iowa to determine the amount of state income tax to withhold from employees' wages. This form collects essential information about the employee's filing status, allowances, and additional withholding preferences. Properly completing this form ensures that employees meet their tax obligations while avoiding under-withholding or over-withholding throughout the tax year.

Steps to Complete the Iowa Employee Withholding Form 2019

Completing the Iowa Employee Withholding Form 2019 involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Select your filing status, which may include options such as single, married, or head of household.

- Indicate the number of allowances you are claiming. This number directly impacts the amount withheld from your paycheck.

- If applicable, specify any additional amount you wish to withhold from each paycheck.

- Review the completed form for accuracy and sign it to certify the information provided.

Legal Use of the Iowa Employee Withholding Form 2019

The Iowa Employee Withholding Form 2019 is legally binding once completed and signed by the employee. It must be submitted to the employer, who is responsible for withholding the appropriate amount of state income tax based on the information provided. Employers must keep this form on file for record-keeping and compliance purposes. Adhering to the legal requirements associated with this form helps ensure that both employees and employers meet their tax obligations under Iowa law.

Filing Deadlines / Important Dates

Understanding the key deadlines associated with the Iowa Employee Withholding Form 2019 is essential for compliance:

- Employees should submit the completed form to their employer as soon as they start a new job or experience a change in their withholding status.

- Employers must ensure that the correct withholding begins with the first paycheck following the receipt of the completed form.

- Annual tax returns for Iowa should be filed by April 30 of the following year, which may necessitate adjustments based on the information provided in this form.

Who Issues the Iowa Employee Withholding Form 2019

The Iowa Department of Revenue is responsible for issuing the Iowa Employee Withholding Form 2019. This government agency provides guidelines and resources to assist employers and employees in understanding their withholding responsibilities. The form is typically available on the Iowa Department of Revenue's official website and can be obtained in both digital and printable formats.

Required Documents

To complete the Iowa Employee Withholding Form 2019 accurately, employees should have the following documents on hand:

- A valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- Information regarding filing status and allowances, which may include previous tax returns or W-2 forms.

- Any additional documents that may affect withholding preferences, such as divorce decrees or child support agreements.

Quick guide on how to complete ps form 4 445720534

Effortlessly Prepare Ps Form 4 on Any Device

Digital document management has gained traction among firms and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, letting you obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Ps Form 4 on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric task today.

How to Alter and eSign Ps Form 4 with Ease

- Find Ps Form 4 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and eSign Ps Form 4 to ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ps form 4 445720534

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa employee withholding form 2019?

The Iowa employee withholding form 2019 is a tax form that employees in Iowa must complete to determine the amount of state income tax withheld from their paychecks. It helps ensure compliance with Iowa's tax laws and enables accurate withholding based on individual tax situations.

-

How can I access the Iowa employee withholding form 2019?

You can easily access the Iowa employee withholding form 2019 through the Iowa Department of Revenue website or use airSlate SignNow's platform to download, fill out, and eSign the form efficiently. Our solution simplifies document handling, making it easier for you to complete tax forms.

-

What features does airSlate SignNow offer for managing the Iowa employee withholding form 2019?

airSlate SignNow provides features such as document templates, seamless eSignature options, and storage for the Iowa employee withholding form 2019. These features enhance efficiency and allow users to manage their tax documents with ease and security.

-

Is there a cost associated with using airSlate SignNow for the Iowa employee withholding form 2019?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, starting with a free trial. This allows you to explore our services for handling the Iowa employee withholding form 2019 before committing to a subscription.

-

Can I integrate airSlate SignNow with other software for processing the Iowa employee withholding form 2019?

Yes, airSlate SignNow can be integrated with numerous software applications, including accounting and payroll systems. This integration allows for a streamlined workflow when processing the Iowa employee withholding form 2019 alongside other important business documents.

-

What are the benefits of using airSlate SignNow for the Iowa employee withholding form 2019?

Using airSlate SignNow for the Iowa employee withholding form 2019 provides numerous benefits, including reduced paperwork, faster document turnaround times, and enhanced security. Our platform allows for quick eSigning, which means you can manage tax forms without the hassle of physical paperwork.

-

How secure is airSlate SignNow for handling the Iowa employee withholding form 2019?

airSlate SignNow prioritizes the security of your documents, including the Iowa employee withholding form 2019, using industry-standard encryption and compliance measures. Your sensitive information is protected at every step of the document signing and management process.

Get more for Ps Form 4

- Special minimum wage license wisconsin fillable form

- Licensing checklist wisconsin department of children and dcf wisconsin form

- Long form affidavit florida electronic

- Ahca background screening application for exemption 2013 form

- Dbpr hr 7007 form

- Florida tax application editable 2011 form

- Statement of facts general state of texas coun form

- Form mo 60 application for extension of time to file

Find out other Ps Form 4

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors