Mortgage Assumption Agreement Form

What is the Mortgage Assumption Agreement Form

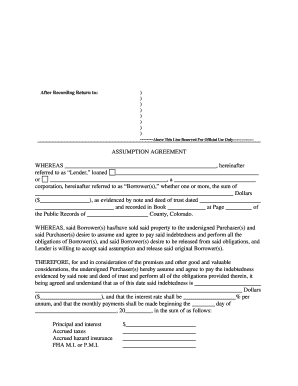

The mortgage assumption agreement form is a legal document that allows a buyer to take over the seller's existing mortgage. This process is often referred to as a loan assumption. The buyer assumes responsibility for the mortgage payments and the terms of the loan, which can be beneficial if the original loan has a lower interest rate than current market rates. This agreement typically outlines the rights and obligations of both parties, ensuring that the lender is aware of the change in responsibility.

How to use the Mortgage Assumption Agreement Form

Using the mortgage assumption agreement form involves several key steps. First, both the buyer and seller must agree on the terms of the assumption. Next, they complete the form, providing necessary information such as the property details, loan amount, and the parties involved. Once filled out, the form must be signed by both parties and submitted to the lender for approval. It is essential to ensure that all information is accurate and complete to avoid delays in the approval process.

Steps to complete the Mortgage Assumption Agreement Form

Completing the mortgage assumption agreement form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the original mortgage documents, property details, and personal identification.

- Fill out the form with accurate information about the buyer, seller, and the mortgage.

- Review the completed form for any errors or omissions.

- Both parties should sign the form to validate the agreement.

- Submit the signed form to the lender for approval.

Key elements of the Mortgage Assumption Agreement Form

The mortgage assumption agreement form includes several critical elements that must be addressed. These elements typically consist of:

- The names and addresses of the buyer and seller.

- The details of the existing mortgage, including the loan balance and interest rate.

- A description of the property being assumed.

- Terms and conditions of the assumption, including payment obligations.

- Signatures of both parties and the date of signing.

Legal use of the Mortgage Assumption Agreement Form

The legal use of the mortgage assumption agreement form is governed by state and federal laws. It is essential that the form complies with all applicable regulations to ensure its enforceability. The agreement must be clear and unambiguous, outlining the responsibilities of both parties. Additionally, the lender must approve the assumption for it to be legally binding. Understanding the legal implications of this form can help both buyers and sellers navigate the process more effectively.

State-specific rules for the Mortgage Assumption Agreement Form

Each state in the U.S. may have specific rules and regulations regarding mortgage assumptions. It is important to be aware of these variations, as they can affect the validity of the mortgage assumption agreement form. Some states may require additional disclosures or have different processes for obtaining lender approval. Consulting with a real estate attorney or a knowledgeable professional can help ensure compliance with state-specific requirements.

Quick guide on how to complete mortgage assumption agreement form

Prepare Mortgage Assumption Agreement Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Mortgage Assumption Agreement Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign Mortgage Assumption Agreement Form with ease

- Obtain Mortgage Assumption Agreement Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Mortgage Assumption Agreement Form and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage assumption agreement form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage assumption agreement PDF?

A mortgage assumption agreement PDF is a legal document that allows a buyer to take over the mortgage obligations of the current owner. This agreement outlines the terms under which the buyer assumes the existing mortgage, relieving the seller of their mortgage responsibilities. It's crucial for both parties to understand the implications of this document before proceeding.

-

How can I create a mortgage assumption agreement PDF using airSlate SignNow?

You can easily create a mortgage assumption agreement PDF with airSlate SignNow by using our intuitive document editor. Start with a template or upload your own document, customize it to fit your needs, and then send it for eSignature. The process is straightforward, making it quick to generate legally binding agreements.

-

Is there a cost associated with using airSlate SignNow for a mortgage assumption agreement PDF?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features for creating and managing documents like the mortgage assumption agreement PDF. Check our pricing page for detailed information on the options available.

-

What are the benefits of using airSlate SignNow for a mortgage assumption agreement PDF?

Using airSlate SignNow for a mortgage assumption agreement PDF streamlines the signing process while ensuring compliance with legal standards. You'll benefit from faster turnaround times, reduced paperwork, and a secure platform for storing your documents. This efficiency is crucial for both personal and business transactions.

-

Can I use airSlate SignNow to share my mortgage assumption agreement PDF with multiple parties?

Absolutely! airSlate SignNow allows you to share your mortgage assumption agreement PDF with multiple parties seamlessly. You can customize the signing order and ensure that all required parties sign the document. This feature simplifies collaboration and keeps everyone in the loop.

-

What integrations does airSlate SignNow offer for managing mortgage assumption agreement PDFs?

airSlate SignNow integrates with various tools and platforms to enhance your document management experience. Whether you use CRM systems, cloud storage, or other business applications, you can connect them with our service. This ensures that your mortgage assumption agreement PDF fits smoothly into your workflow.

-

Is the mortgage assumption agreement PDF legally binding?

Yes, a properly executed mortgage assumption agreement PDF through airSlate SignNow is legally binding. By using our secure eSignature feature, you ensure compliance with electronic signature laws. Always consult with a legal professional to verify that the document meets specific requirements for your situation.

Get more for Mortgage Assumption Agreement Form

- Pdf transcript request form st thomas aquinas college

- Dept id state form

- Speech language pathology observation hours verification form bw

- V1 standard verification worksheet triton form

- Application for admission at the university of north florida form

- Marymount transcript request form

- Calworks program supply request form rio hondo college riohondo

- Scholarship tennessee promise form

Find out other Mortgage Assumption Agreement Form

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple