Kyc Form 2014-2026

What is the KYC Form

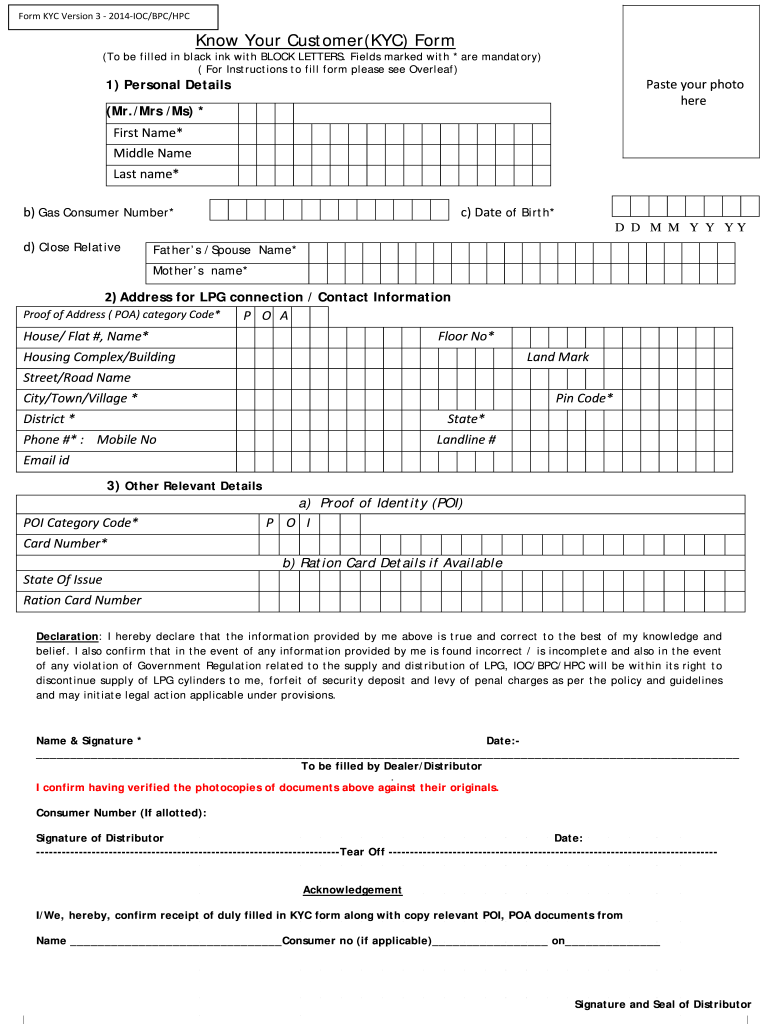

The KYC form, or Know Your Customer form, is a crucial document used by financial institutions and businesses to verify the identity of their clients. This process is essential for preventing fraud, money laundering, and other illegal activities. The form typically requires personal information such as name, address, date of birth, and identification details. By completing the KYC form, customers help organizations comply with regulatory requirements and maintain the integrity of the financial system.

How to Obtain the KYC Form

Obtaining the KYC form is a straightforward process. Most financial institutions provide the form on their official websites, allowing customers to download it easily. Alternatively, customers can request a physical copy from their local branch. It is essential to ensure that the form is the most current version, as regulations may change, necessitating updates to the form. Always verify that you are using the correct version for your specific needs.

Steps to Complete the KYC Form

Completing the KYC form involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary personal details, including identification documents, proof of address, and any other information specified by the institution.

- Fill Out the Form: Carefully enter your information in the KYC form. Ensure that all fields are completed accurately to avoid delays in processing.

- Review for Accuracy: Double-check the information provided to ensure there are no errors or omissions.

- Submit the Form: Follow the submission guidelines provided by the institution, whether online, by mail, or in person.

Legal Use of the KYC Form

The KYC form serves a legal purpose in the financial sector. By collecting and verifying customer information, institutions comply with regulations set forth by government agencies. This process helps protect against financial crimes and ensures that businesses operate within the law. It is vital for customers to understand that providing accurate information is not only a legal requirement but also a safeguard for their financial security.

Required Documents

When filling out the KYC form, specific documents are typically required to verify identity and address. Commonly required documents include:

- Government-issued ID: Such as a driver's license, passport, or state ID.

- Proof of Address: Utility bills, bank statements, or lease agreements that display your name and address.

- Social Security Number: This may be required for tax identification purposes.

Form Submission Methods

Submitting the KYC form can be done through various methods, depending on the institution's requirements:

- Online Submission: Many institutions allow customers to upload their completed forms and documents directly through their secure online portals.

- Mail: Customers may choose to send the completed form and required documents via postal service to the designated address provided by the institution.

- In-Person: Visiting a local branch to submit the form directly to a representative is another option for those who prefer face-to-face interactions.

Quick guide on how to complete form kyc version know your customer kyc form

A concise manual on how to assemble your Kyc Form

Locating the suitable template can turn into a difficulty when you are tasked with providing formal international documents. Even if you possess the necessary form, it might be cumbersome to promptly fill it out according to all the specifications if you utilize paper versions as opposed to managing everything digitally. airSlate SignNow is the web-based eSignature platform that aids you in overcoming all of these hurdles. It allows you to select your Kyc Form and swiftly complete and sign it on-site without needing to reprint documents in case of any errors.

Here are the tasks you need to accomplish to assemble your Kyc Form using airSlate SignNow:

- Click the Get Form button to upload your document to our editor instantly.

- Begin with the first vacant space, enter your information, and proceed with the Next feature.

- Complete the empty fields using the Cross and Check options from the toolbar above.

- Choose the Highlight or Line features to mark the most important information.

- Click on Image and upload one if your Kyc Form necessitates it.

- Utilize the right-side panel to add more fields for you or others to complete if needed.

- Review your inputs and confirm the document by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude editing the document by clicking the Done button and selecting your file-sharing preferences.

Once your Kyc Form is assembled, you can share it exactly how you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely save all your finalized documents in your account, categorized in folders according to your liking. Don’t spend time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

How can I fill out a KYC form online for SBI?

Fill out ? If you want to update your kyc, you can just write up a formal letter with your cif/ac details and attach photo copies of the proofs, self attested by you and send them by post to your home branch or you can do it yourself, if you have online banking facility.

-

How is KYC completed?

KYC can be done online or offline.In case of offline, this is how you do.There are two ways to do Offline verification:Offline Aadhar XMLQR code.Generation of the XML file for Offline Verification:a. Visit www.uidai.gov.inb. Click on Aadhar Services tab and select Aadhar Paperless local e-KYC.c. A new page will open where you will have to enter your 12 digit Aadhar number and an OTP will be sent to your registered mobile number.d. In the redirected page mention your Name, address as it is mentioned in your Aadhar Card.e. Your name and address will appear on the shareable document. Enter ‘Share Code’ as per the instruction of the website. Enter the Security code and submit. On your successful submission, an XML file will be downloaded on your PCVerification using the QR code:a. Download the QR reader application.b. Click on ‘Scan from the QR reader’ in UIDAI website.c. Scan the QR code given in your Aadhar card, your demographic details and photo will be displayed and verified.You can do e-KYC at your place by aadhaar OTP based authentication, where you will have to give your 12 digit aadhaar number and an OTP will be sent to your registered number. After you enter your OTP your verification process is complete.Follow this link below to know various KYC methodshttps://bit.ly/2EiYi7S

-

What are the benefits of upgrading Paytm and filling out the KYC form?

You can open savings account in Paytm Payment Bank by upgrading it and submitting KYC documents. Read more about Paytm Payment Bank and its features.

-

How do I fill up a DHL India KYC form for an international shipping?

Whatever you do don’t import using Fefedex. They first of all change your invoice. Make your individual product to Company import.Your individual KYC will not work there and they will blame you on this. Finally you will end up loosing your product as well as shipping charges. You cannot signNow the insensitive Senior Management and Customer care’s idiotic reply will make you annoyed. Believe me, I am a victim of this Fefedex. I know what they can do.Some complaints against then are as follows:fedex courier ComplaintsFedEx Customer CareComplaint against FEDEX for not delivering the courier which is with them from 26/04/13Top 1,967 Complaints and Reviews about FedExTop 1,967 Complaints and Reviews about FedExAWB No: 573818785207. Still no delivery

-

Banking: How does a bank's KYC (know your customer) process really work?

Know Your Customer (KYC), as the name implies, Banks are required by Regulators to know whom they are dealing with.For a natural person, they need to know:Identity: everything that is listed on the identification document, such as full name, date and place of birth, nationality, residential address, etc. In many countries the Banks also need to know whether you are a "US Person" because of the FATCA requirements.Political Status: whether the client or his/her relative is holding on to any prominent political appointment.Criminal/Terrorism/Sanctions link: whether the client is linked to any financial crime, terrorism or sanctions.Source of fund: the source of fund has to be legal, of course.Expected volume of transaction: if there is an exceptionally large amount of money involved in the transaction, the Bank need to ensure that the source of fund is legal.For an entity, they need to know:Beneficial Owner: who is ultimately in control of this entity. Identification documents required.Representative: who is operating this entity on behalf of the Owner. Identification documents required.Political Status: Is the entity a State-Owned Enterprise (SOE).Criminal/Terrorism/Sanctions link.Source of fund.Expected volume of transaction.We have covered the requirements, now let us look at the process:Client on-boarding: The Bank establishes a relationship with the Client and collect all the identification or business registration documents.Screening: The Client will be checked against a database for name matches with politicians, criminals, terrorists and other sanctioned persons/entities. If there is no matches, good, they can carry on with their business relationships. If there are matches, the Compliance Officers will beginning their painful process of verifying whether the matches are real matches or false matches. If it is a false match, good, if not they will need to decide what to do with the Client now that there is a match with the database. If the Client is a criminal or terrorist linked, they probably need to freeze the account and submit a report to the authorities. Another form of screening is to monitor the transactions and spot any unusual transactions. If the transaction is out of the norm, the Bank need to verify that nothing fishy is going on.Repeat screening. The screening process will repeat periodically as the Client status and the database may change over time.Conclusion:The whole KYC process is not difficult to understand and can be summarized in to 1-2-3. But the execution of the process can be tedious and a lot of paperwork is involved.

-

How is know your customer (KYC) done?

KYC is performed digitally now a days, with revolutions in the tech world. There are many softwares present in the market that help you verify the identity of the users. One of the best is Shufti Pro (Quick & Secure Digital Verification in Real Time - Shufti Pro). It helps perform quick and accurate real-time digital identity verification services.All the user has to do is show their face to the camera, followed by their ID documents (ID card, passport, driver’s license, credit/debit card, etc.), and their identity will be verified (or not). Customer on-boarding time reduces by 90% due to the e-KYC services provided by Shufti Pro.It is easy to integrate, and use. To know more about how e-KYC works in Shufti Pro, click here.If you have a website or a smart phone application, you can implement Shufti Pro which offers a REST API. So once its integrated, you can easily transfer your real-time video stream to Shufti Pro and it returns you with the verification results using the same API.(Disclaimer: I'm an employee at Shufti Pro and hence, closely familiar with its workings. I highly recommend the app, not because of my affiliation with it, but because of its accuracy, efficiency and prowess.)

Create this form in 5 minutes!

How to create an eSignature for the form kyc version know your customer kyc form

How to make an electronic signature for the Form Kyc Version Know Your Customer Kyc Form in the online mode

How to create an eSignature for your Form Kyc Version Know Your Customer Kyc Form in Google Chrome

How to create an eSignature for signing the Form Kyc Version Know Your Customer Kyc Form in Gmail

How to make an eSignature for the Form Kyc Version Know Your Customer Kyc Form from your smartphone

How to generate an eSignature for the Form Kyc Version Know Your Customer Kyc Form on iOS

How to create an eSignature for the Form Kyc Version Know Your Customer Kyc Form on Android

People also ask

-

What is a Kyc Form and why is it important?

A Kyc Form, or Know Your Customer Form, is a crucial document used by businesses to verify the identity of their clients. This form helps organizations meet compliance requirements and mitigate risks associated with fraud. By utilizing a Kyc Form, businesses can ensure they are engaging with legitimate customers, enhancing security and trust.

-

How does airSlate SignNow facilitate the Kyc Form process?

airSlate SignNow streamlines the Kyc Form process by allowing users to create, send, and eSign documents securely. With our platform, you can draft customized Kyc Forms, ensuring that all necessary information is collected efficiently. Our easy-to-use interface simplifies the process, making it accessible for both businesses and their clients.

-

Is there a cost associated with using airSlate SignNow for Kyc Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for handling Kyc Forms. Our cost-effective solution ensures that you get the best value for your investment, allowing you to manage Kyc Forms without breaking the bank. Check our pricing page for more details on available plans.

-

Can I integrate airSlate SignNow with other applications for Kyc Forms?

Absolutely! airSlate SignNow provides seamless integrations with numerous applications, allowing you to enhance your Kyc Form management. Whether you need to connect with CRM systems, document storage, or other business tools, our platform supports integrations that streamline your workflow.

-

What features does airSlate SignNow offer for managing Kyc Forms?

airSlate SignNow includes a variety of features for managing Kyc Forms, such as customizable templates, secure eSigning, and real-time tracking. These features ensure that you can efficiently handle Kyc Form submissions while maintaining compliance with industry standards. Our platform's user-friendly design makes it easy to navigate and manage all your documents.

-

How secure is my data when using the Kyc Form feature in airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our Kyc Form feature, your data is protected by industry-leading encryption and compliance measures. We ensure that all sensitive information collected through Kyc Forms is securely stored and transmitted, giving you peace of mind.

-

What support options are available for users of Kyc Forms on airSlate SignNow?

airSlate SignNow offers comprehensive support options for users managing Kyc Forms. Our dedicated customer service team is available to assist you with any questions or concerns, ensuring you can effectively utilize our platform. Additionally, we provide a range of online resources, including tutorials and FAQs, to help you get the most out of your Kyc Form experience.

Get more for Kyc Form

- Mohawk college residence cancellation withdrawal request form

- Room change request form name student id building room phone all the following steps must be done to complete the move 1

- Financial petition yorku form

- Vgh ultrasound requisition form

- Immunization information form vancouver coastal health childhood immunization history

- Application for a permit to construct or demolish form

- City of brampton fillable form certificate of insurance

- Form 24a

Find out other Kyc Form

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement