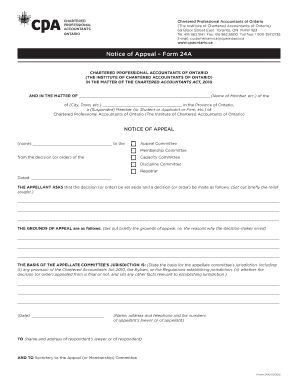

Form 24a

What is the Form 24a

The Form 24a is an essential document used in the context of appealing a notice related to tax assessments or decisions made by tax authorities. This form allows individuals or businesses to formally contest a decision they believe is incorrect. It is particularly relevant for those seeking to clarify or dispute the details of a notice they have received, ensuring that their concerns are officially recorded and addressed.

How to use the Form 24a

Using the Form 24a involves several key steps. First, ensure you have received a notice that you wish to appeal. Next, download the form from the appropriate tax authority's website or obtain a physical copy. Fill out the form with accurate information, including your personal details and specifics about the notice you are appealing. Once completed, submit the form according to the instructions provided, which may include mailing it to a designated address or submitting it electronically.

Steps to complete the Form 24a

Completing the Form 24a requires careful attention to detail. Follow these steps:

- Gather all relevant documentation related to the notice you are appealing.

- Provide your personal information, including name, address, and contact details.

- Clearly state the reason for your appeal, referencing the specific notice and any supporting evidence.

- Review the form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 24a

The Form 24a is legally recognized as a formal method of appealing tax-related notices. When properly filled out and submitted, it serves as a record of your intent to contest a decision made by tax authorities. It is important to comply with all legal requirements and deadlines associated with the appeal process to ensure that your submission is valid and considered by the relevant authorities.

Required Documents

When submitting the Form 24a, certain documents may be required to support your appeal. These can include:

- A copy of the notice you are appealing.

- Any relevant financial records or documentation that substantiate your claim.

- Previous correspondence with tax authorities regarding the notice.

Having these documents ready can strengthen your appeal and facilitate a smoother review process.

Form Submission Methods

The Form 24a can typically be submitted through various methods. Common options include:

- Online submission through the tax authority's official website.

- Mailing a physical copy of the form to the designated address.

- In-person delivery at local tax authority offices.

Choose the method that best suits your needs and ensures timely submission.

Quick guide on how to complete form 24a

Complete Form 24a effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents promptly without delays. Manage Form 24a on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 24a with ease

- Find Form 24a and click Get Form to initiate.

- Utilize the tools we offer to finalize your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 24a and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Canada notice in the context of document signing?

A Canada notice refers to a formal communication outlining crucial information or actions required under Canadian legislation. With airSlate SignNow, you can easily create, send, and manage Canada notices electronically, ensuring compliance and streamlined communication.

-

How does airSlate SignNow support the signing of Canada notices?

airSlate SignNow provides a user-friendly platform that allows users to eSign Canada notices securely. Our advanced features help you track document status, ensuring that all necessary signatures are obtained efficiently and in compliance with Canadian regulations.

-

What are the benefits of using airSlate SignNow for Canada notices?

Using airSlate SignNow for Canada notices offers several advantages, including increased efficiency, reduced paper usage, and enhanced security. This electronic solution ensures that you can send and sign important documents quickly while maintaining a clear record of all transactions.

-

Can airSlate SignNow integrate with other software for managing Canada notices?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your Canada notices alongside other business processes. This integration enhances productivity and ensures that all your documents are handled in one cohesive system.

-

How much does airSlate SignNow cost for handling Canada notices?

airSlate SignNow offers flexible pricing plans tailored to your needs, whether you're handling a few Canada notices or managing extensive documentation. Visit our pricing page to explore options that fit your budget while providing robust features for your document management.

-

Is airSlate SignNow compliant with Canadian regulations for Canada notices?

Absolutely! airSlate SignNow is designed to comply with Canadian eSignature laws, ensuring that your Canada notices are legally binding. Our platform meets all necessary security and compliance standards to protect your sensitive information.

-

Can I customize Canada notices using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your Canada notices according to your company's branding and requirements. This flexibility ensures that your documents reflect your professionalism and meet all specific needs of your business.

Get more for Form 24a

Find out other Form 24a

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy