Chase Bank W 9 Form

What is the Chase Bank W-9 Form

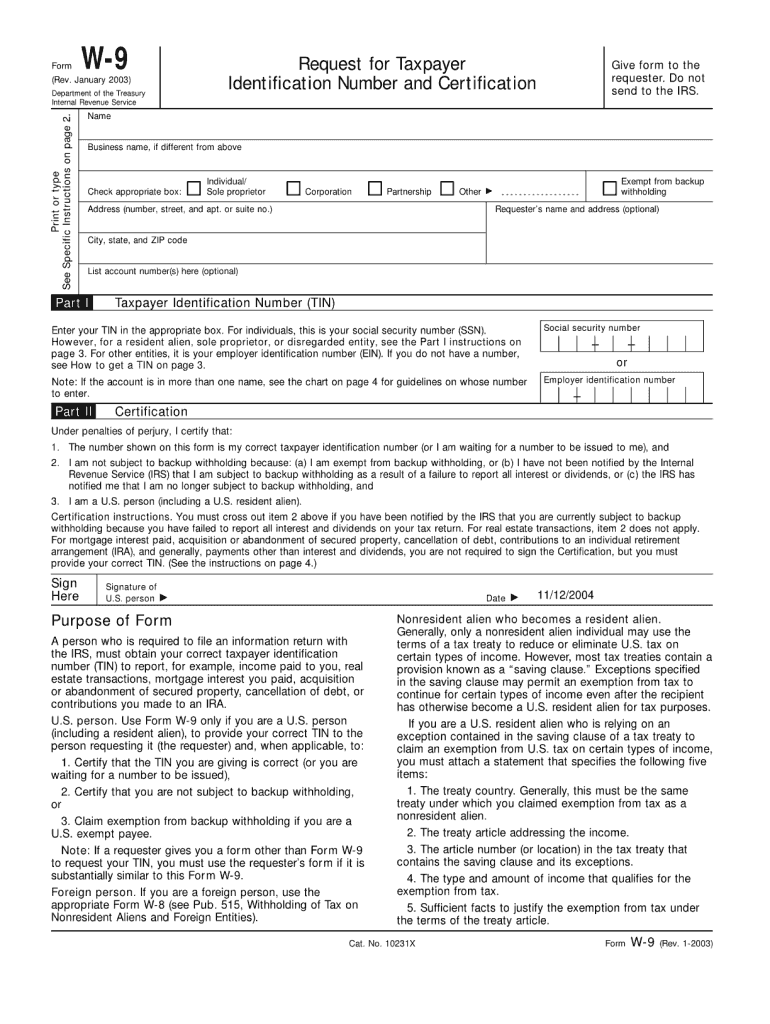

The Chase Bank W-9 form is a tax document used in the United States. It is primarily utilized by individuals and businesses to provide their taxpayer identification information to Chase Bank or other entities that require it for reporting purposes. This form is essential for ensuring compliance with IRS regulations, particularly for income reporting and tax withholding. By submitting the W-9, you certify that the information provided is accurate and that you are not subject to backup withholding.

Steps to Complete the Chase Bank W-9 Form

Completing the Chase Bank W-9 form involves several straightforward steps:

- Obtain the Form: You can download the W-9 form from the IRS website or request it directly from Chase Bank.

- Fill in Your Information: Provide your name, business name (if applicable), address, and taxpayer identification number (TIN), which can be your Social Security number or Employer Identification Number.

- Sign and Date: Ensure you sign and date the form to certify that the information is correct.

- Submit the Form: Send the completed form to the requesting party, such as Chase Bank, either electronically or via mail.

Legal Use of the Chase Bank W-9 Form

The Chase Bank W-9 form has legal significance as it serves to certify your taxpayer identification information. It is crucial for compliance with IRS regulations, particularly in situations where income is reported to the IRS. The form helps prevent backup withholding and ensures that the correct tax information is on file. Using the W-9 form appropriately can protect you from potential tax liabilities and penalties associated with incorrect reporting.

How to Obtain the Chase Bank W-9 Form

You can obtain the Chase Bank W-9 form through several methods:

- Download from the IRS Website: The W-9 form is available as a PDF on the IRS website, allowing you to print it directly.

- Request from Chase Bank: You can contact Chase Bank customer service or visit a local branch to request a physical copy of the form.

- Online Access: If you have an online account with Chase Bank, you may be able to access the form through their secure portal.

Examples of Using the Chase Bank W-9 Form

The Chase Bank W-9 form is commonly used in various scenarios, including:

- Freelancers and Contractors: Individuals who provide services to businesses may be asked to submit a W-9 to report income received.

- Banking Transactions: When opening a new account or applying for a loan, Chase Bank may request a W-9 to verify your taxpayer information.

- Investment Income: If you earn interest or dividends from Chase Bank accounts, a W-9 may be required for tax reporting purposes.

Form Submission Methods

The Chase Bank W-9 form can be submitted through various methods, depending on the preferences of the requesting party:

- Online Submission: Some entities may allow you to submit the W-9 electronically through secure portals.

- Mail: You can print the completed form and send it via postal mail to the requesting organization.

- In-Person: If required, you can deliver the form directly to a Chase Bank branch or the requesting entity.

Quick guide on how to complete chase bank w 9 form

Complete Chase Bank W 9 Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents quickly and without delays. Handle Chase Bank W 9 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Chase Bank W 9 Form with ease

- Obtain Chase Bank W 9 Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Decide how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and eSign Chase Bank W 9 Form and ensure outstanding communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chase bank w 9 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a chase w9 form?

The chase w9 form is a tax form used by businesses to collect necessary tax information from independent contractors and vendors. This form ensures that payees provide accurate details, allowing for proper tax reporting to the IRS. Completing the chase w9 form is essential for both businesses and contractors to avoid tax issues.

-

How can airSlate SignNow help me with the chase w9 form?

airSlate SignNow allows you to easily send, receive, and eSign the chase w9 form without hassle. Our platform provides a cost-effective solution that streamlines the document management process, ensuring you can focus on what matters most—your business. With intuitive features, you can quickly customize and share the chase w9 form with your contractors.

-

Is there a cost associated with using airSlate SignNow for the chase w9 form?

Yes, airSlate SignNow offers various pricing plans tailored to suit your business needs, including options for handling the chase w9 form. We believe in providing value, so you can choose a plan that fits your budget while accessing essential features for document management. Check our website for current pricing details.

-

Can I integrate airSlate SignNow with other tools for managing the chase w9 form?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications like Google Drive, Dropbox, and various CRMs, making it easy to manage the chase w9 form within your existing workflows. These integrations enhance productivity and ensure that your documents are always accessible wherever you work.

-

What features does airSlate SignNow offer for the chase w9 form?

Our platform offers several features for the chase w9 form, including custom templates, automated reminders, and real-time status tracking. These features reduce administrative burdens and enhance the efficiency of obtaining the information you need from contractors. Using airSlate SignNow simplifies the entire process of managing the chase w9 form.

-

How secure is airSlate SignNow when handling the chase w9 form?

Security is a top priority for airSlate SignNow. We use industry-standard encryption and compliance protocols to ensure your chase w9 form and other documents are safe from unauthorized access. Our commitment to security means you can confidently send and receive sensitive information through our platform.

-

Can I track the status of the chase w9 form once it’s sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of the chase w9 form once it has been sent. You will receive notifications when the form is viewed, signed, or completed, providing you with peace of mind and ensuring you can follow up as needed. This feature enhances communication and accountability.

Get more for Chase Bank W 9 Form

- Application form for extension of aruba travelguide

- Synthes small frag inventory 214192613 form

- The grand lodge of the state of israel of ancient and form

- Pre appointment information sheet

- Hog mileage program form

- Exigent circumstances for immediate action template form

- Repossession contract template 787755017 form

- Requirements contract template form

Find out other Chase Bank W 9 Form

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement