Zs Qu1 Form

What is the Zs Qu1

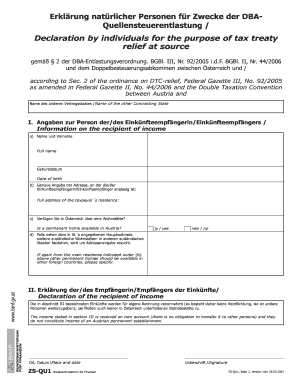

The Zs Qu1 is a specific form utilized in various administrative and legal contexts, primarily within the United States. This form serves to collect essential information required for compliance with regulatory standards. It is important for individuals and businesses to understand the purpose and requirements associated with the Zs Qu1 to ensure proper submission and adherence to legal obligations.

How to use the Zs Qu1

Using the Zs Qu1 involves several straightforward steps. First, ensure you have the correct version of the form, as outdated versions may not be accepted. Next, gather all necessary information and documentation required to complete the form accurately. Fill out the Zs Qu1 carefully, ensuring all fields are completed as required. Finally, review the form for any errors before submission to avoid delays or rejections.

Steps to complete the Zs Qu1

Completing the Zs Qu1 effectively requires attention to detail. Follow these steps:

- Obtain the latest version of the Zs Qu1 form from a reliable source.

- Read the instructions carefully to understand the information needed.

- Fill in your personal or business information as required.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form according to the specified submission methods.

Legal use of the Zs Qu1

The Zs Qu1 is legally binding when completed and submitted in accordance with applicable laws and regulations. To ensure its legal validity, it is crucial to adhere to the guidelines set forth by governing bodies. This includes using a recognized electronic signature solution that complies with legal standards, thus ensuring that the form is accepted by institutions and courts alike.

Key elements of the Zs Qu1

Several key elements define the Zs Qu1 and its functionality:

- Identification Information: Essential personal or business details must be accurately provided.

- Signature Requirements: Proper signatures must be included to validate the form.

- Submission Guidelines: Clear instructions on how and where to submit the form are crucial.

- Compliance Standards: The form must meet all relevant legal and regulatory standards.

Who Issues the Form

The Zs Qu1 is typically issued by specific governmental or regulatory agencies. These organizations are responsible for establishing the requirements and guidelines associated with the form. It is important for users to verify the issuing authority to ensure they are using the correct and most current version of the Zs Qu1.

Quick guide on how to complete zs qu1

Prepare Zs Qu1 effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It serves as a perfect environmentally friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle Zs Qu1 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Zs Qu1 without any hassle

- Obtain Zs Qu1 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Zs Qu1 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zs qu1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is zs qu1 and how does it relate to airSlate SignNow?

The term 'zs qu1' refers to a unique feature of airSlate SignNow that streamlines the document signing process. By utilizing zs qu1, businesses can effectively manage eSignatures and ensure compliance, all while enhancing their workflow efficiency.

-

How much does airSlate SignNow cost and what plans include zs qu1?

airSlate SignNow offers competitive pricing plans that include the zs qu1 feature. Customers can choose from various subscription options, with the standard plan providing a cost-effective solution for businesses looking to utilize eSigning capabilities.

-

What features are included with airSlate SignNow's zs qu1?

The zs qu1 feature in airSlate SignNow includes advanced eSignature tools, document templates, and collaboration capabilities. These tools help businesses increase productivity by enabling quick and secure document handling and signing.

-

How can zs qu1 benefit my business?

By using zs qu1 within airSlate SignNow, businesses can reduce the time spent on document management. This feature allows for faster turnaround times, improved organization, and an overall boost in operational efficiency.

-

Is zs qu1 easy to integrate with other tools and software?

Yes, zs qu1 is designed to seamlessly integrate with various third-party applications. This compatibility allows users to enhance their workflow by connecting airSlate SignNow with tools they already use.

-

What kind of security does airSlate SignNow offer with zs qu1?

airSlate SignNow prioritizes security with its zs qu1 feature by employing industry-standard encryption and authentication measures. This ensures that all eSigned documents are safe and compliant with legal regulations.

-

Who can benefit from using zs qu1 in airSlate SignNow?

Any business or individual that requires efficient document signing can benefit from zs qu1 in airSlate SignNow. It's particularly useful for teams collaborating remotely, ensuring everyone can sign documents promptly and securely.

Get more for Zs Qu1

Find out other Zs Qu1

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF