Ashland Ky Net Profit License Fee Return Form

What is the Ashland Ky Net Profit License Fee Return

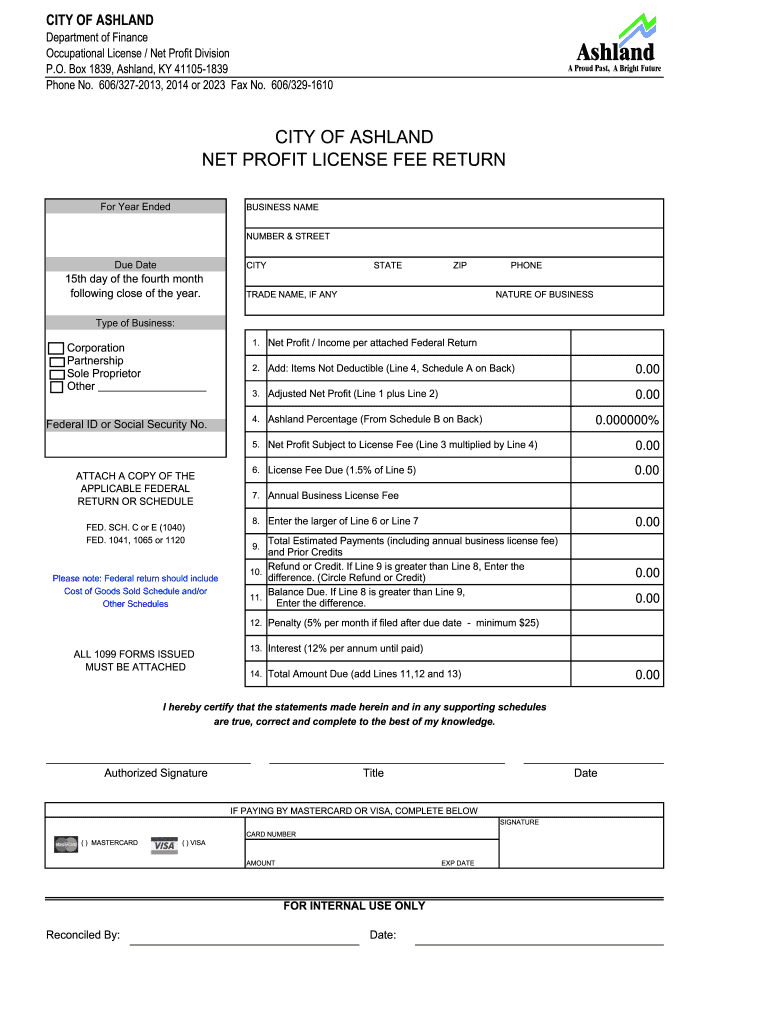

The Ashland Ky Net Profit License Fee Return is a tax document that businesses operating in the city of Ashland, Kentucky, must file to report their net profits. This return is essential for determining the amount of license fee owed to the city based on the business's earnings. The fee is calculated as a percentage of the net profit, and the return must accurately reflect the financial performance of the business during the reporting period. Understanding this form is crucial for compliance with local tax regulations and for maintaining good standing with the city.

Steps to Complete the Ashland Ky Net Profit License Fee Return

Completing the Ashland Ky Net Profit License Fee Return involves several key steps:

- Gather Financial Records: Collect all financial statements, including income statements and balance sheets, to ensure accurate reporting.

- Calculate Net Profit: Determine the net profit by subtracting total expenses from total revenue.

- Fill Out the Form: Input the calculated net profit into the appropriate sections of the return form.

- Review for Accuracy: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the Form: File the completed return by the specified deadline, either online or by mail.

Legal Use of the Ashland Ky Net Profit License Fee Return

The legal use of the Ashland Ky Net Profit License Fee Return is governed by local tax laws and regulations. Businesses must ensure that the return is filed accurately and on time to comply with the city's requirements. Failure to do so may result in penalties, including fines or additional fees. It is important for business owners to familiarize themselves with the legal implications of filing this return and to maintain proper records to support their claims.

Required Documents for the Ashland Ky Net Profit License Fee Return

To complete the Ashland Ky Net Profit License Fee Return, businesses typically need the following documents:

- Income statements showing total revenue and expenses

- Balance sheets detailing assets and liabilities

- Previous year's tax returns for reference

- Any additional documentation that supports deductions or credits claimed

Form Submission Methods

The Ashland Ky Net Profit License Fee Return can be submitted through multiple methods to accommodate different preferences:

- Online Submission: Many businesses opt to file electronically for convenience and faster processing.

- Mail: The completed form can be printed and mailed to the designated city office.

- In-Person: Businesses may also choose to submit the form in person at the local tax office.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the Ashland Ky Net Profit License Fee Return can result in various penalties. These may include:

- Monetary fines based on the amount of unpaid fees

- Interest charges on late payments

- Potential legal action for persistent non-compliance

Quick guide on how to complete city of ashland net profit license fee return kentucky occupational

Handle Ashland Ky Net Profit License Fee Return from anywhere, at any time

Your daily business operations may require additional focus when managing state-specific business documents. Reclaim your work hours and lower the expenses associated with paper-based processes using airSlate SignNow. airSlate SignNow provides you with a variety of pre-formatted business documents, including Ashland Ky Net Profit License Fee Return, which you can utilize and share with your associates. Effortlessly manage your Ashland Ky Net Profit License Fee Return with powerful editing and electronic signature tools, and send it directly to your recipients.

How to acquire Ashland Ky Net Profit License Fee Return in a few simple steps:

- Choose a form pertinent to your state.

- Click Learn More to view the document and ensure its accuracy.

- Click Get Form to start working on it.

- Ashland Ky Net Profit License Fee Return will automatically appear in the editor. No further actions are required.

- Utilize airSlate SignNow’s advanced editing features to complete or adjust the form.

- Locate the Sign tool to create your signature and electronically sign your document.

- When finished, click Done, save changes, and access your document.

- Send the form via email or SMS, or use a link-to-fill option with your partners or allow them to download the document.

airSlate SignNow signNowly saves time in handling Ashland Ky Net Profit License Fee Return and allows you to find essential documents all in one place. A comprehensive collection of forms is organized and designed to address vital business tasks necessary for your operations. The advanced editing interface reduces the likelihood of errors, enabling you to easily correct mistakes and review your documents on any device prior to dispatching them. Start your free trial today to discover all the advantages of airSlate SignNow for your everyday business processes.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of ashland net profit license fee return kentucky occupational

How to create an electronic signature for your City Of Ashland Net Profit License Fee Return Kentucky Occupational online

How to generate an eSignature for the City Of Ashland Net Profit License Fee Return Kentucky Occupational in Google Chrome

How to generate an eSignature for putting it on the City Of Ashland Net Profit License Fee Return Kentucky Occupational in Gmail

How to generate an eSignature for the City Of Ashland Net Profit License Fee Return Kentucky Occupational from your smartphone

How to generate an eSignature for the City Of Ashland Net Profit License Fee Return Kentucky Occupational on iOS

How to create an eSignature for the City Of Ashland Net Profit License Fee Return Kentucky Occupational on Android devices

People also ask

-

What is the net profit return for businesses in Pineville, KY?

The net profit return in Pineville, KY, can vary signNowly based on the industry and operational efficiency. By using services like airSlate SignNow, businesses can streamline their document handling processes, potentially boosting their net profit return in Pineville, KY.

-

How can airSlate SignNow help improve my business's net profit return in Pineville, KY?

airSlate SignNow offers an easy-to-use platform that can signNowly reduce administrative time and costs. By automating document signing and management, your business can increase productivity and ultimately enhance your net profit return in Pineville, KY.

-

What pricing options are available for using airSlate SignNow in Pineville, KY?

airSlate SignNow provides flexible pricing plans tailored to suit various business sizes and needs. Investing in airSlate SignNow can provide a higher net profit return in Pineville, KY, by minimizing costs associated with traditional document handling methods.

-

What features does airSlate SignNow offer to enhance profitability in Pineville, KY?

Key features of airSlate SignNow include eSigning, document templates, and integration with various business systems. These functionalities can help increase efficiency and support a higher net profit return in Pineville, KY.

-

Are there any integrations with other software available for airSlate SignNow in Pineville, KY?

Yes, airSlate SignNow integrates seamlessly with popular platforms such as Google Drive, Salesforce, and Microsoft Office. This capability can enhance your workflow and contribute to a improved net profit return in Pineville, KY.

-

How does using airSlate SignNow impact customer satisfaction in Pineville, KY?

By implementing airSlate SignNow, businesses can deliver a smoother signing experience, leading to happier customers. Higher customer satisfaction can translate into better retention rates and positively affect your net profit return in Pineville, KY.

-

Can small businesses in Pineville, KY benefit from airSlate SignNow?

Absolutely! Small businesses in Pineville, KY can leverage airSlate SignNow to digitize their document workflows without incurring high costs. This efficiency can enhance their operational success and increase net profit return in Pineville, KY.

Get more for Ashland Ky Net Profit License Fee Return

- Wwwmassgov16dor 2017 corp addl form loaform loa loan out affidavitallocation revenue mass

- Dr 18n application for amusement machine certificate n 0116 tc 0322 form

- Income tax withholding formsnebraska department of revenue

- Wwwmassgov15dor 2018 corp addl form tsamassachusetts department of revenue form tsa film credit

- Instructions for preparing form f 1065 r 0119 florida

- Nebraska resale or exempt sale certificate form 13

- Solid waste and surcharge return form

- Nebraska resale or exempt sale certificate form for sales tax exemption 13

Find out other Ashland Ky Net Profit License Fee Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors