St 1 Form

What is the St 1 Form

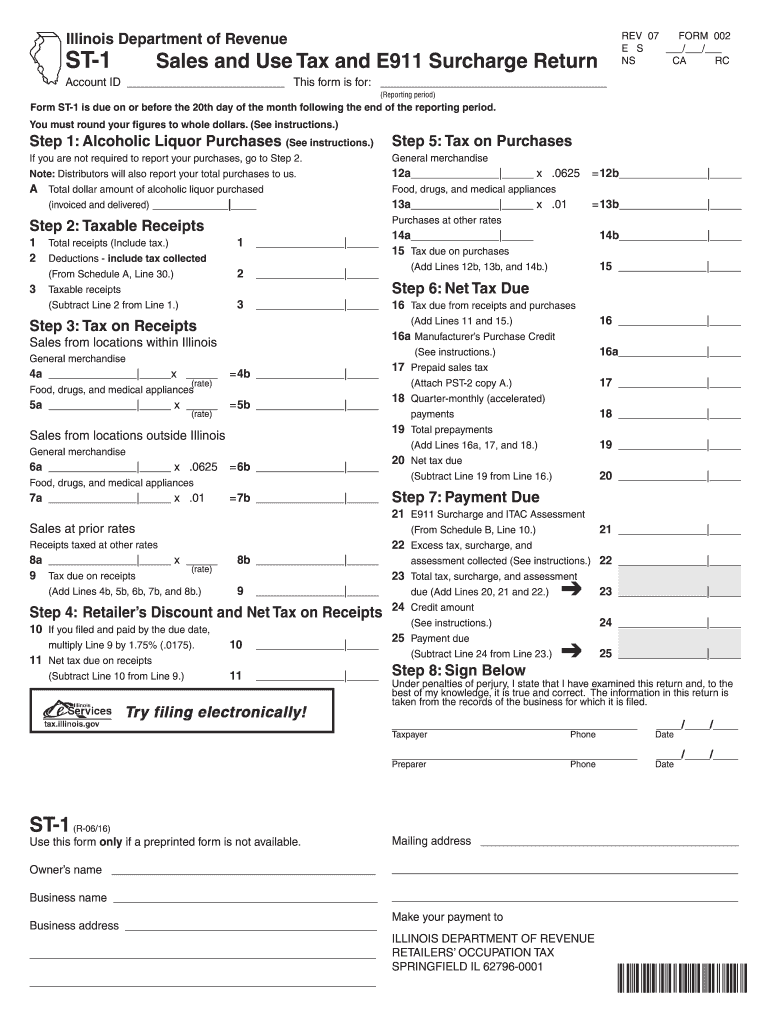

The St 1 form is a crucial document used in Illinois for sales tax exemption purposes. It allows qualifying entities to purchase goods and services without paying sales tax. This form is primarily utilized by organizations that meet specific criteria, such as non-profit organizations, government bodies, and certain educational institutions. Understanding the purpose and function of the St 1 form is essential for businesses and organizations looking to manage their tax obligations effectively.

How to use the St 1 Form

To use the St 1 form, eligible entities must complete it accurately and present it to sellers at the time of purchase. The form requires detailed information about the purchaser, including the name, address, and type of organization. It is important to ensure that the form is filled out completely to avoid any issues during transactions. Sellers should retain a copy of the completed form for their records, as it serves as proof of the tax-exempt status of the purchaser.

Steps to complete the St 1 Form

Completing the St 1 form involves several straightforward steps:

- Gather necessary information about the organization, including its legal name and address.

- Indicate the type of organization on the form, such as a non-profit or governmental entity.

- Provide a description of the items being purchased and ensure they qualify for tax exemption.

- Sign and date the form to certify its accuracy.

Once completed, the form should be presented to the seller at the point of sale.

Legal use of the St 1 Form

The St 1 form is legally binding when used correctly. It must be filled out in accordance with Illinois state regulations to ensure that purchases are exempt from sales tax. Misuse of the form, such as providing false information or using it for ineligible purchases, can result in penalties. It is essential for users to understand the legal implications of the St 1 form to maintain compliance with tax laws.

Filing Deadlines / Important Dates

While the St 1 form itself does not have specific filing deadlines, it is important for users to be aware of the timing of their purchases. Organizations should ensure that the form is completed and presented at the time of the transaction to avoid any sales tax charges. Additionally, users should stay informed about any changes to Illinois tax laws that may affect their eligibility for sales tax exemption.

Form Submission Methods (Online / Mail / In-Person)

The St 1 form is typically presented in person at the time of purchase, but it can also be submitted via mail if necessary. Organizations may choose to keep copies of the form for their records, ensuring that they have documentation of their tax-exempt status. It is important to check with individual sellers regarding their preferred submission methods for the St 1 form.

Who Issues the Form

The St 1 form is issued by the Illinois Department of Revenue. This department oversees the administration of sales tax laws in the state and provides the necessary documentation for tax-exempt purchases. Organizations seeking to use the St 1 form should ensure they are familiar with the guidelines set forth by the Illinois Department of Revenue to ensure compliance.

Quick guide on how to complete illinois sales tax st 1 form

Complete St 1 Form effortlessly on any device

The management of online documents has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the features required to create, alter, and electronically sign your documents promptly without interruptions. Manage St 1 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure now.

The simplest way to alter and electronically sign St 1 Form without any hassle

- Find St 1 Form and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign St 1 Form to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out the 1080 form when filing taxes?

There is no such form in US taxation. Thus you can not fill it out. If you mean a 1098 T you still do not. The University issues it to you. Please read the answers to the last 4 questions you posted about form 1080. IT DOES NOT EXIST.

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the illinois sales tax st 1 form

How to make an eSignature for the Illinois Sales Tax St 1 Form in the online mode

How to generate an eSignature for the Illinois Sales Tax St 1 Form in Google Chrome

How to make an eSignature for putting it on the Illinois Sales Tax St 1 Form in Gmail

How to make an eSignature for the Illinois Sales Tax St 1 Form straight from your mobile device

How to create an eSignature for the Illinois Sales Tax St 1 Form on iOS devices

How to generate an electronic signature for the Illinois Sales Tax St 1 Form on Android

People also ask

-

What is an ST 1 form and how is it used?

The ST 1 form is a vital document used for sales tax exemption in various states. airSlate SignNow allows businesses to easily create, send, and eSign ST 1 forms, streamlining the process for both organizations and their clients.

-

How can airSlate SignNow help with the ST 1 form?

With airSlate SignNow, you can effortlessly manage the ST 1 form by using our intuitive interface to fill out, send, and eSign documents. Our platform ensures that your forms are legally binding and securely stored, providing peace of mind.

-

What are the pricing options for using the ST 1 form with airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for teams that frequently need to handle ST 1 forms. You can choose from monthly or annual billing for cost-effective solutions tailored to your requirements.

-

Are there any features specific to managing the ST 1 form?

Yes, airSlate SignNow includes features specifically beneficial for managing the ST 1 form. These features include customizable templates, the ability to add multiple signers, real-time tracking, and automated reminders to ensure timely completion.

-

Can airSlate SignNow integrate with other software while using the ST 1 form?

Absolutely! airSlate SignNow offers a variety of integrations with popular business applications, enabling seamless management of the ST 1 form alongside your other tools. This connectivity simplifies workflows and enhances productivity across your organization.

-

What are the benefits of using airSlate SignNow for the ST 1 form?

Using airSlate SignNow for the ST 1 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for rapid turnaround on important documents, aiding in timely compliance and streamlined processes.

-

Is it easy to get started with the ST 1 form on airSlate SignNow?

Yes, getting started with the ST 1 form on airSlate SignNow is quick and easy. Simply create an account, choose a template for your ST 1 form, and you can start sending and eSigning immediately, all without any prior technical knowledge.

Get more for St 1 Form

- Business reporting personal property east baton rouge parish form

- Audit questionnaire form 00 750 audit questionnaire

- Form e 536r fillable schedule of county sales and use taxes for claims

- About form 3911 taxpayer statement regarding refund

- Changes to the net operating loss carryover and loosening form

- Fillable online instructions for form ftb 3582 fax email

- 2021 schedule d 1 sales of business property 2021 schedule d 1 sales of business property form

- Veterans pension rate tableeffective 12119 pension form

Find out other St 1 Form

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF