Business Reporting Personal Property East Baton Rouge Parish 2022-2026

What is the Business Reporting Personal Property in East Baton Rouge Parish

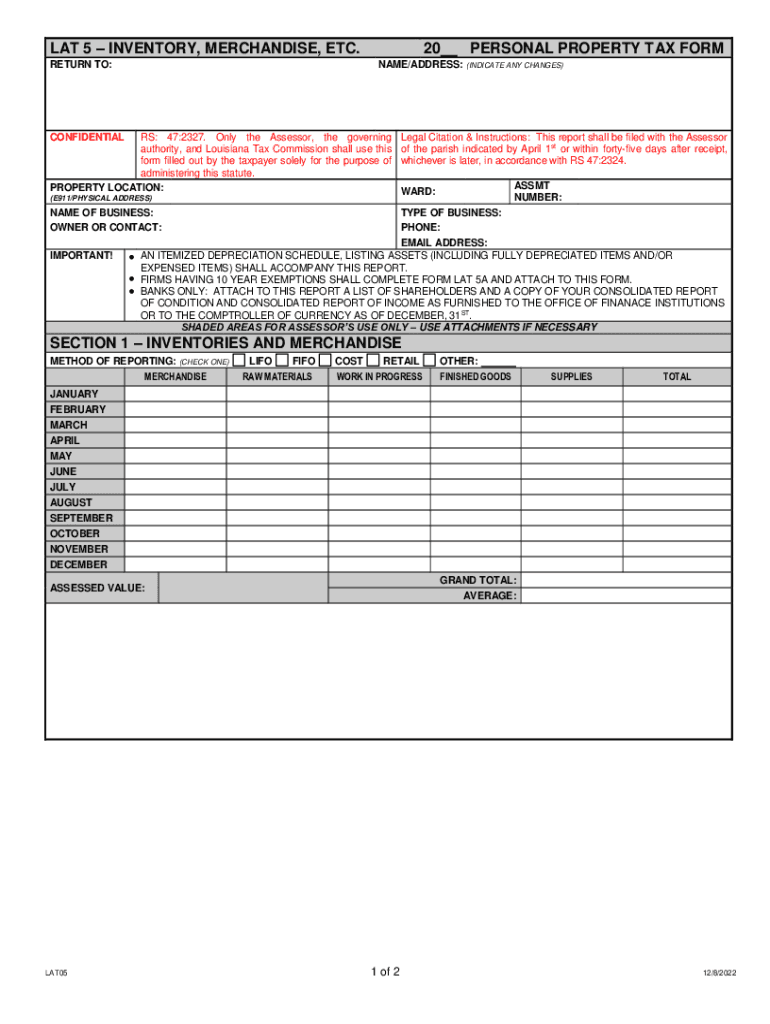

The Business Reporting Personal Property in East Baton Rouge Parish refers to the documentation required for local businesses to report their personal property for tax purposes. This form is essential for ensuring compliance with local tax regulations and helps the parish assess the value of personal property owned by businesses. Accurate reporting allows the local government to allocate resources effectively and maintain public services.

Steps to complete the Business Reporting Personal Property in East Baton Rouge Parish

Completing the Business Reporting Personal Property involves several key steps:

- Gather necessary documents, including previous tax returns, purchase receipts, and inventory lists.

- Fill out the form accurately, ensuring all personal property is listed, including equipment, furniture, and other assets.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the Business Reporting Personal Property in East Baton Rouge Parish

The legal use of the Business Reporting Personal Property form is governed by state and local tax laws. Businesses must adhere to these regulations to avoid penalties. The form serves as a declaration of assets, and failure to report accurately can result in fines or additional tax liabilities. Compliance ensures that businesses contribute their fair share to local services and infrastructure.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of filing deadlines associated with the Business Reporting Personal Property. Typically, the deadline for submission is April fifteenth of each year. Missing this deadline may result in penalties or interest charges. Keeping track of important dates helps businesses maintain compliance and avoid unnecessary fees.

Required Documents

When completing the Business Reporting Personal Property, several documents are necessary to ensure accurate reporting:

- Previous year’s tax return for reference.

- Purchase receipts for all personal property.

- Inventory lists detailing all assets owned by the business.

- Any additional documentation that supports the value of personal property.

Penalties for Non-Compliance

Failure to comply with the requirements of the Business Reporting Personal Property can lead to significant penalties. Businesses may face fines, interest on unpaid taxes, or even legal action. Understanding these consequences emphasizes the importance of timely and accurate reporting to avoid complications that could affect business operations.

Quick guide on how to complete business reporting personal property east baton rouge parish

Prepare Business Reporting Personal Property East Baton Rouge Parish effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and electronically sign your documents quickly and without hurdles. Handle Business Reporting Personal Property East Baton Rouge Parish on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to amend and electronically sign Business Reporting Personal Property East Baton Rouge Parish without hassle

- Obtain Business Reporting Personal Property East Baton Rouge Parish and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searching, or mistakes requiring new printed copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Modify and electronically sign Business Reporting Personal Property East Baton Rouge Parish and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business reporting personal property east baton rouge parish

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it function as a lat form?

airSlate SignNow is a powerful electronic signature solution that serves as an excellent lat form for businesses to manage document workflows. It allows users to easily send, sign, and store documents securely. The intuitive interface ensures that anyone can use the lat form effectively without extensive training.

-

What are the pricing options for using the airSlate SignNow lat form?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. The options range from a basic package for individual users to comprehensive plans for teams that include enhanced features. Understanding your needs will help you choose the most suitable lat form pricing option.

-

What key features does the airSlate SignNow lat form provide?

The airSlate SignNow lat form includes features such as document templates, customizable workflows, and real-time tracking. These tools help streamline the signing process and improve productivity. Additionally, users can access advanced security measures to protect their documents.

-

How can the airSlate SignNow lat form benefit my business?

Utilizing the airSlate SignNow lat form can signNowly enhance your business's efficiency by reducing turnaround times for document signing. It eliminates the need for printing, scanning, and mailing, ultimately saving costs and resources. This ease of use promotes a more organized approach to document management.

-

Can airSlate SignNow integrate with other applications?

Yes, the airSlate SignNow lat form seamlessly integrates with various business applications to enhance your workflow. Popular integrations include CRM systems, cloud storage solutions, and collaboration tools. This compatibility ensures that you can synchronize your document management with existing processes.

-

Is the airSlate SignNow lat form secure for sensitive documents?

Absolutely, the airSlate SignNow lat form prioritizes security and employs advanced encryption to protect your sensitive documents. Features like two-factor authentication and audit trails add additional layers of security. This commitment to safeguarding your data is paramount for businesses handling confidential information.

-

What types of documents can I manage using the airSlate SignNow lat form?

With the airSlate SignNow lat form, you can manage a variety of document types, including contracts, agreements, and forms. The platform is versatile enough to cater to different sectors, making it suitable for legal, healthcare, and financial documents. This broad capability ensures that all your document signing needs are met.

Get more for Business Reporting Personal Property East Baton Rouge Parish

- Ok lien 497322839 form

- Quitclaim deed by two individuals to husband and wife oklahoma form

- Warranty deed from two individuals to husband and wife oklahoma form

- Quitclaim deed from a llc to two individuals oklahoma form

- Oklahoma intestate form

- Quitclaim deed from husband wife and two individuals to husband and wife two individuals oklahoma form

- Warranty deed grantee form

- Oklahoma quitclaim deed 497322846 form

Find out other Business Reporting Personal Property East Baton Rouge Parish

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation