Changes to the Net Operating Loss Carryover and Loosening 2021

What is the Changes To The Net Operating Loss Carryover And Loosening

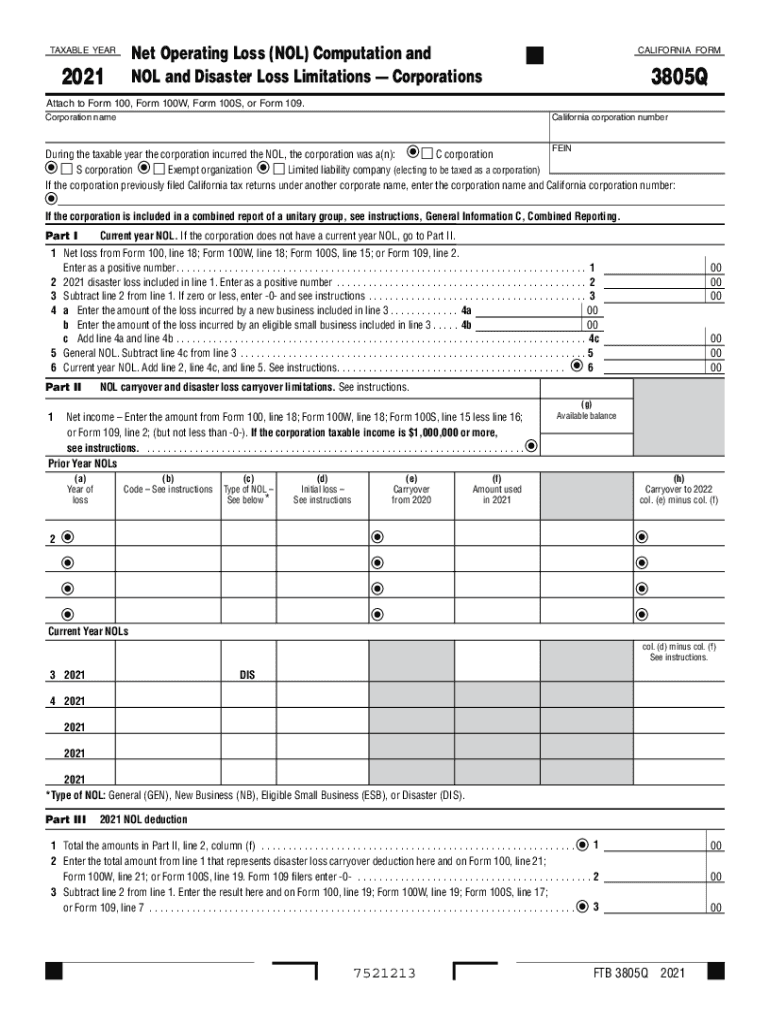

The Changes To The Net Operating Loss Carryover And Loosening refers to modifications in tax regulations that affect how businesses can utilize net operating losses (NOLs) to offset taxable income. These changes allow businesses to carry forward losses from previous years to reduce their tax liability in future years. Understanding these changes is crucial for businesses seeking to optimize their tax strategies and ensure compliance with IRS guidelines.

How to use the Changes To The Net Operating Loss Carryover And Loosening

To effectively use the Changes To The Net Operating Loss Carryover And Loosening, businesses should first determine their eligible losses from prior tax years. Once identified, these losses can be applied against taxable income in subsequent years, following the updated regulations. It is essential to maintain accurate records and documentation of all losses and carryovers to ensure proper reporting and compliance during tax filing.

Steps to complete the Changes To The Net Operating Loss Carryover And Loosening

Completing the Changes To The Net Operating Loss Carryover And Loosening involves several key steps:

- Identify the net operating losses from previous years.

- Review the current tax regulations to understand the carryover rules.

- Calculate the amount of NOL to carry forward to the current tax year.

- Complete the necessary tax forms, ensuring accurate reporting of the carryover.

- Submit the completed forms to the IRS by the designated filing deadline.

Legal use of the Changes To The Net Operating Loss Carryover And Loosening

The legal use of the Changes To The Net Operating Loss Carryover And Loosening is governed by IRS regulations. Businesses must adhere to the guidelines set forth by the IRS to ensure that their NOL carryovers are valid. This includes maintaining proper documentation and ensuring that losses are applied in accordance with the law. Non-compliance can lead to penalties and disallowed deductions, so understanding the legal framework is essential.

IRS Guidelines

The IRS provides specific guidelines regarding the Changes To The Net Operating Loss Carryover And Loosening. These guidelines outline how businesses can report NOLs, the time frames for carryovers, and any limitations that may apply. It is important for businesses to consult these guidelines to ensure they are following the correct procedures and maximizing their tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for the Changes To The Net Operating Loss Carryover And Loosening are critical for compliance. Businesses must be aware of the tax year deadlines for submitting their NOL carryover claims. Typically, these dates align with the standard tax filing deadlines, but it is advisable to check for any specific changes or extensions that may apply. Timely filing is essential to avoid penalties and ensure that losses are properly accounted for.

Eligibility Criteria

Eligibility for the Changes To The Net Operating Loss Carryover And Loosening depends on several factors, including the type of business entity and the nature of the losses incurred. Generally, businesses that experience a net operating loss in a given tax year may qualify to carry those losses forward. It is important for businesses to assess their specific circumstances and consult with a tax professional to determine their eligibility.

Quick guide on how to complete changes to the net operating loss carryover and loosening

Effortlessly Complete Changes To The Net Operating Loss Carryover And Loosening on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent green alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Changes To The Net Operating Loss Carryover And Loosening on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Changes To The Net Operating Loss Carryover And Loosening with Ease

- Find Changes To The Net Operating Loss Carryover And Loosening and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Changes To The Net Operating Loss Carryover And Loosening to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct changes to the net operating loss carryover and loosening

Create this form in 5 minutes!

People also ask

-

What are the Changes To The Net Operating Loss Carryover And Loosening?

The Changes To The Net Operating Loss Carryover And Loosening refer to the recent adjustments in tax regulations affecting how businesses can utilize net operating losses. These changes can signNowly impact tax planning strategies and the overall financial health of a business. It's essential to consult with a tax professional to understand how these adjustments might affect your specific situation.

-

How can airSlate SignNow help with documentation related to Changes To The Net Operating Loss Carryover And Loosening?

airSlate SignNow offers a streamlined approach to managing documentation for the Changes To The Net Operating Loss Carryover And Loosening. Our platform allows users to securely send and eSign important tax-related documents with ease. This efficiency can save time and minimize errors during potentially complex tax filing processes.

-

What pricing plans are available for airSlate SignNow in light of Changes To The Net Operating Loss Carryover And Loosening?

airSlate SignNow offers various pricing plans to accommodate different business needs, especially for those navigating the Changes To The Net Operating Loss Carryover And Loosening. Our plans are designed to be cost-effective, ensuring that you can access critical document management features without breaking the bank. Check our pricing page for detailed options tailored to your requirements.

-

Are there any specific features in airSlate SignNow that address Changes To The Net Operating Loss Carryover And Loosening?

Yes, airSlate SignNow includes features that can help users manage the documentation related to the Changes To The Net Operating Loss Carryover And Loosening effectively. Features such as customizable templates, real-time collaboration, and document tracking ensure that you have the right tools to handle your financial documents efficiently.

-

Can I integrate airSlate SignNow with other tools to manage Changes To The Net Operating Loss Carryover And Loosening?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications to help manage the Changes To The Net Operating Loss Carryover And Loosening. This connectivity allows businesses to enhance their workflows by linking document management with accounting and tax software, providing a holistic approach to financial management.

-

What benefits does airSlate SignNow offer for managing tax documents related to Changes To The Net Operating Loss Carryover And Loosening?

One of the key benefits of using airSlate SignNow for managing tax documents related to the Changes To The Net Operating Loss Carryover And Loosening is its ease of use. The platform allows for quick document creation, secure sharing, and eSigning, making the process hassle-free. This can lead to reduced turnaround times and improved accuracy in tax filing.

-

How secure is airSlate SignNow for handling sensitive information regarding Changes To The Net Operating Loss Carryover And Loosening?

Security is a top priority for airSlate SignNow, especially when handling sensitive information about the Changes To The Net Operating Loss Carryover And Loosening. Our platform employs advanced encryption protocols and secure storage solutions to protect your data. You can trust that your documents are safeguarded throughout the entire signing and sharing process.

Get more for Changes To The Net Operating Loss Carryover And Loosening

- Warranty deed from two individuals to llc oklahoma form

- Warranty deed from individual to two individuals oklahoma form

- Ok deed 497322874 form

- Warranty deed from husband and wife two individuals to husband and wife two individuals oklahoma form

- Oklahoma special warranty deed form

- Grant deed individual to trust oklahoma form

- Ok company form

- Special warranty mineral deed from a trust two trustees to an individual oklahoma form

Find out other Changes To The Net Operating Loss Carryover And Loosening

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement