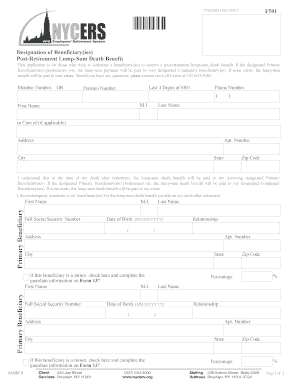

Nycers Post Retirement Death Benefit Form

What is the Nycers Post Retirement Death Benefit

The Nycers Post Retirement Death Benefit is a financial provision designed to support the beneficiaries of retired members of the New York City Employees' Retirement System (NYCERS). This benefit is typically provided as a lump sum payment to eligible beneficiaries upon the death of a retired member. The amount of the death benefit can vary based on several factors, including the member's years of service and the specific retirement plan they participated in. Understanding the details of this benefit is crucial for both retirees and their beneficiaries to ensure proper financial planning.

How to obtain the Nycers Post Retirement Death Benefit

To obtain the Nycers Post Retirement Death Benefit, beneficiaries must follow a specific process. First, they need to complete the required Nycers death benefit claim form, which is often referred to as the F501 form. This form requires detailed information about the deceased member, including their retirement details and the relationship of the claimant to the deceased. Once the form is completed, it should be submitted to NYCERS along with any supporting documents, such as a death certificate. It is essential to ensure that all information is accurate and complete to avoid delays in processing the claim.

Steps to complete the Nycers Post Retirement Death Benefit

Completing the Nycers Post Retirement Death Benefit form involves several important steps:

- Gather necessary documents, including the deceased member's retirement information and a certified copy of the death certificate.

- Obtain the Nycers death benefit claim form (F501) from the NYCERS website or office.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with supporting documents to NYCERS via mail or in person.

Key elements of the Nycers Post Retirement Death Benefit

Several key elements define the Nycers Post Retirement Death Benefit. These include:

- Eligibility: The benefit is available to the designated beneficiaries of retired NYCERS members.

- Benefit Amount: The amount of the death benefit is determined by the member's retirement plan and service history.

- Claim Process: Beneficiaries must complete the F501 form to initiate the claim.

- Payment Method: The benefit is typically disbursed as a lump sum payment to the beneficiaries.

Required Documents

When applying for the Nycers Post Retirement Death Benefit, certain documents are required to support the claim. These typically include:

- A certified copy of the deceased member's death certificate.

- The completed Nycers death benefit claim form (F501).

- Any additional documentation that verifies the relationship between the claimant and the deceased, such as marriage certificates or birth certificates.

Form Submission Methods

Beneficiaries can submit the Nycers death benefit claim form through various methods. The most common submission methods include:

- By Mail: Completed forms can be mailed to the NYCERS office.

- In-Person: Beneficiaries may also choose to submit the form in person at a NYCERS office for immediate processing.

Quick guide on how to complete nycers post retirement death benefit

Prepare Nycers Post Retirement Death Benefit seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Nycers Post Retirement Death Benefit on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Nycers Post Retirement Death Benefit effortlessly

- Locate Nycers Post Retirement Death Benefit and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review the details carefully and click the Done button to save your amendments.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Nycers Post Retirement Death Benefit and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nycers post retirement death benefit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nycers death benefit amount that eligible recipients can expect?

The nycers death benefit amount varies based on several factors including the member's service time and salary. Generally, eligible beneficiaries typically receive a flat benefit plus additional amounts based on the member's final earnings. It's important to check the specific details on the NYCRS website or consult with an agency representative for exact figures.

-

How can I apply for the nycers death benefit amount?

To apply for the nycers death benefit amount, beneficiaries must complete the appropriate application form available from the NYC Employees’ Retirement System. Additionally, presenting the necessary documentation, such as the member's death certificate and proof of relationship, is essential in the process. For assistance, signNowing out to a retirement services officer can provide guidance.

-

Are there any charges associated with accessing information about the nycers death benefit amount?

There are no charges for beneficiaries when accessing information regarding the nycers death benefit amount. The NYC retirement system aims to provide transparent and accessible information to those who may be eligible. Any inquiries can be directed to their support services for comprehensive assistance.

-

What factors influence the nycers death benefit amount I might receive?

The nycers death benefit amount is influenced by factors such as the length of service, the position of the member, and their final salary before retirement. Additionally, if the member was a Tier 1 or Tier 2 employee, the benefit calculation could differ signNowly from Tiers 3 and above. Each case is unique, so reviewing individual circumstances with NYCRS is advisable.

-

Can I still receive the nycers death benefit amount if the member was not retired?

Yes, beneficiaries may still be eligible to receive the nycers death benefit amount even if the member was not yet retired. However, criteria must be met regarding the member's service within the NYC retirement system. It's crucial to consult the guidelines set by the NYCRS to determine eligibility.

-

What documentation is required to claim the nycers death benefit amount?

To claim the nycers death benefit amount, beneficiaries will need to provide several documents including a death certificate, proof of identity, and evidence of their relationship to the deceased. Additionally, other documents relating to the member's service may be required depending on specific cases. Gathering all necessary papers beforehand can expedite the claim process.

-

How long does it take to process the nycers death benefit amount?

Typically, processing the nycers death benefit amount can take several weeks, depending on the complexity of the case and the completeness of submitted documentation. The NYCRS aims to process applications as efficiently as possible, but responding promptly to any requests for additional information will help speed up the process. Beneficiaries are encouraged to stay in touch for updates on their applications.

Get more for Nycers Post Retirement Death Benefit

Find out other Nycers Post Retirement Death Benefit

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter