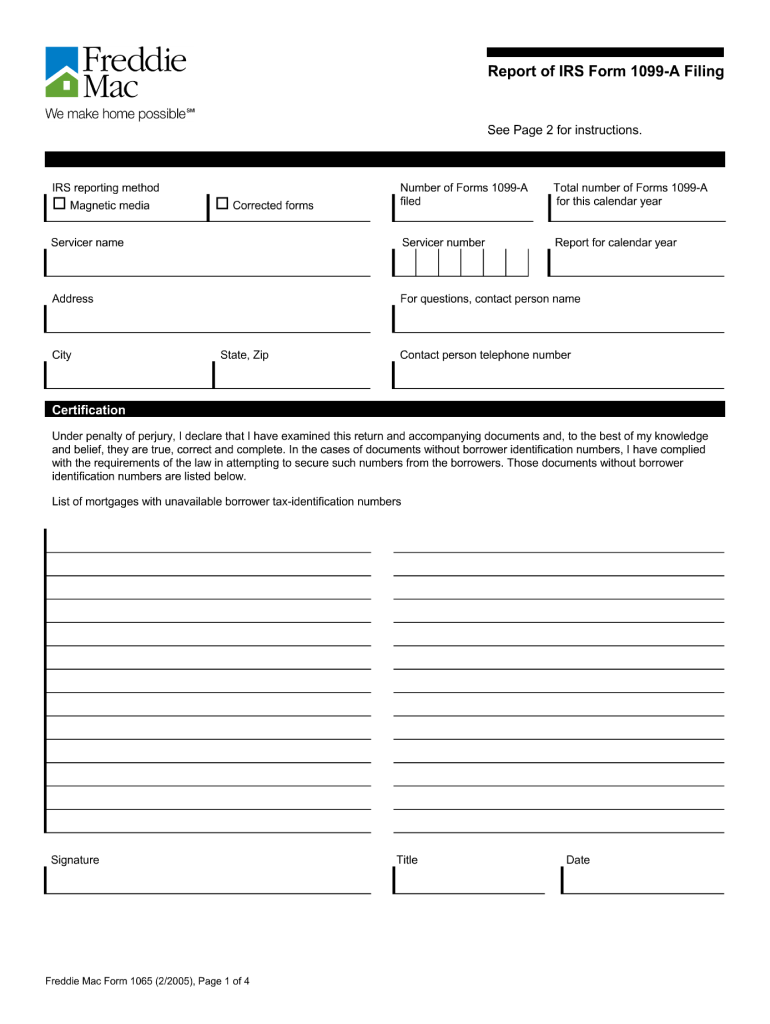

Mac 1065 Form

What is the Mac 1065

The Mac 1065 is a specific form utilized in the context of tax reporting for partnerships. This form is essential for partnership entities to report their income, deductions, gains, and losses to the Internal Revenue Service (IRS). It serves as a means for partnerships to disclose their financial activities for the tax year, ensuring compliance with federal tax regulations. The Mac 1065 is crucial for accurately reporting the partnership's financial information and distributing the relevant tax obligations among its partners.

How to use the Mac 1065

Using the Mac 1065 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, expense records, and any applicable deductions. Next, fill out the form with detailed information about the partnership's financial activities, ensuring that all figures are accurate and reflect the partnership's operations. Once completed, the form must be filed with the IRS, along with any required schedules that provide additional details about specific items reported on the Mac 1065.

Steps to complete the Mac 1065

Completing the Mac 1065 requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including income and expense reports.

- Fill out the basic information section, including the partnership name, address, and Employer Identification Number (EIN).

- Report income, deductions, and credits accurately in the designated sections.

- Complete any additional schedules, such as Schedule K-1, which details each partner's share of income and deductions.

- Review the entire form for accuracy and completeness.

- Submit the form to the IRS by the specified deadline.

Legal use of the Mac 1065

The legal use of the Mac 1065 is governed by IRS regulations, which require partnerships to file the form annually. It must be completed accurately to avoid penalties and ensure that all partners are correctly informed of their tax responsibilities. The form must be signed by a partner or an authorized representative of the partnership, affirming that the information provided is true and complete. Compliance with these legal requirements is essential for the validity of the form and the partnership's standing with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Mac 1065 are crucial for compliance. Generally, partnerships must file the form by March 15 of the year following the tax year being reported. If additional time is needed, partnerships can request a six-month extension, allowing them to file by September 15. It is important to be aware of these dates to avoid late filing penalties and ensure that all partners receive their Schedule K-1 in a timely manner.

Who Issues the Form

The Mac 1065 is issued by the Internal Revenue Service (IRS), which provides the necessary guidelines and instructions for its completion. The IRS updates the form periodically to reflect changes in tax law and reporting requirements. Partnerships must ensure they are using the most current version of the form to maintain compliance with federal regulations.

Quick guide on how to complete mac 1065

Effortlessly Prepare Mac 1065 on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Mac 1065 on any platform with the airSlate SignNow apps for Android or iOS and enhance your document-based workflows today.

The Easiest Way to Edit and Electronically Sign Mac 1065 Without Stress

- Locate Mac 1065 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight relevant sections of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mac 1065 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mac 1065

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the mac 1065 feature in airSlate SignNow?

The mac 1065 feature in airSlate SignNow allows users to efficiently manage and sign documents electronically. This feature integrates seamlessly with your macOS environment, ensuring a user-friendly experience. With mac 1065, you can streamline the signing process, making it faster and more efficient.

-

How much does airSlate SignNow cost with the mac 1065 solution?

AirSlate SignNow offers competitive pricing for its mac 1065 solution, making it a cost-effective option for businesses of all sizes. Pricing may vary based on the plan you choose, with options available for individual users and teams. Visit our pricing page for detailed information and choose the plan that best fits your needs.

-

Can I integrate mac 1065 with other software solutions?

Yes, the mac 1065 feature in airSlate SignNow supports integrations with a variety of software applications. This flexibility allows you to connect with popular platforms such as Google Drive, Salesforce, and more, enhancing your workflow. Streamlining document management across multiple tools has never been easier with mac 1065.

-

What are the benefits of using mac 1065 in my business?

Using mac 1065 in airSlate SignNow can signNowly enhance your business productivity. It offers a user-friendly interface, reduces paper waste, and speeds up the signing process. Additionally, it provides robust security features, ensuring that your documents are protected during electronic transactions.

-

Is airSlate SignNow compatible with macOS devices?

Absolutely! The mac 1065 feature in airSlate SignNow is specifically designed for optimal compatibility with macOS devices. This ensures that users experience smooth performance and functionality. Whether on a MacBook or iMac, you can efficiently manage your documents using mac 1065.

-

How does airSlate SignNow's mac 1065 enhance document security?

The mac 1065 feature in airSlate SignNow incorporates advanced security measures, including encryption and secure user authentication. This guarantees that your documents are protected from unauthorized access during the signing process. Trust the mac 1065 solution for your sensitive business documents.

-

Can I try mac 1065 before committing to a subscription?

Yes, airSlate SignNow offers a free trial for you to explore the mac 1065 feature before making a commitment. This allows you to understand its capabilities and determine how it can meet your document management needs. Sign up today to experience the benefits of mac 1065 firsthand.

Get more for Mac 1065

- Conventional financing addendum 312pdf form

- K1339 va financing addendum 5 15doc form

- Selling my home need virginia regional sales contract form

- Gcaar post settlement occupancy form

- Blank addendum 1 1010pdf form

- Condo certificate of resale from self managed association dc form

- Partner identification form and cost share worksheet www2 palomar

- Uniform real estate sales and purchase contract

Find out other Mac 1065

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors