Form 13

What is the Form 13

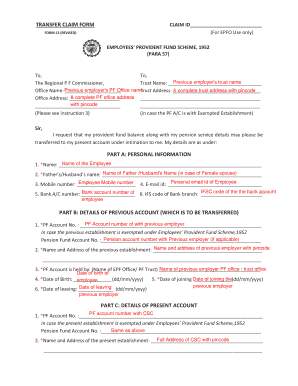

The Form 13 is a crucial document used primarily in the context of the Employees' Provident Fund Organisation (EPFO) in India. It serves as a request for the transfer of an employee’s provident fund balance from one account to another, typically when an employee changes jobs. This form enables seamless transitions and ensures that employees can maintain their retirement savings without unnecessary delays or complications.

How to use the Form 13

Using the Form 13 involves a straightforward process. First, the employee must fill out the required details, including personal information and the relevant EPF account numbers. After completing the form, it should be submitted to the respective EPFO office or through the online portal, if available. The form acts as a formal request to transfer the accumulated provident fund balance, which is essential for ensuring continued contributions to retirement savings.

Steps to complete the Form 13

Completing the Form 13 involves several key steps:

- Gather necessary information, including your EPF account details and personal identification.

- Fill out the form accurately, ensuring all fields are completed to avoid processing delays.

- Review the form for any errors or omissions.

- Submit the completed form to your previous employer or directly to the EPFO, depending on the process outlined by your organization.

Legal use of the Form 13

The legal use of the Form 13 is governed by the regulations set forth by the EPFO. It is essential that the form is filled out correctly and submitted in accordance with the guidelines to ensure that the transfer of funds is recognized legally. Proper documentation and adherence to the rules help safeguard the rights of employees regarding their provident fund savings.

Required Documents

To successfully complete and submit the Form 13, certain documents are typically required. These may include:

- A copy of the previous and current EPF account statements.

- Proof of identity, such as a government-issued ID.

- Any additional documentation requested by the EPFO or your employer.

Form Submission Methods

The Form 13 can be submitted through various methods, ensuring flexibility for employees. Common submission methods include:

- Online submission via the EPFO portal, which allows for quicker processing.

- In-person submission at the nearest EPFO office.

- Submission through the employer, who may facilitate the transfer process.

Examples of using the Form 13

Examples of using the Form 13 include scenarios where an employee has switched jobs and needs to transfer their provident fund balance from the previous employer to the new one. Another example is when an employee has multiple EPF accounts and wishes to consolidate them into a single account for better management of their retirement savings.

Quick guide on how to complete form 13

Accomplish Form 13 effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the resources necessary to formulate, modify, and eSign your files quickly and without interruptions. Manage Form 13 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign Form 13 with ease

- Obtain Form 13 and then click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize essential parts of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and then click the Done button to finalize your changes.

- Decide how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 13 and guarantee effective communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 13

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 13 and how does it work with airSlate SignNow?

Form 13 is a specific document utilized in various business scenarios. With airSlate SignNow, you can easily create, send, and eSign form 13, enabling you to manage your documents efficiently and securely. Our platform ensures that your form 13 is quickly processed, saving you time and effort.

-

What features does airSlate SignNow offer for managing form 13?

airSlate SignNow provides numerous features for managing form 13, such as customizable templates, real-time collaboration, and automated workflows. These tools help streamline the signing process, ensuring that you can efficiently manage form 13 without any hassle. Additionally, our intuitive interface makes it easy for users of all experience levels.

-

Are there any costs associated with using airSlate SignNow for form 13?

airSlate SignNow offers flexible pricing plans that cater to different business needs when using form 13. You can choose from various subscription options that allow you to scale with your requirements. Visiting our pricing page will help you find the most cost-effective option for utilizing form 13.

-

Can I integrate other tools with airSlate SignNow for form 13 processing?

Yes, airSlate SignNow supports integrations with a wide range of tools to enhance your form 13 processing. You can easily connect with CRM systems, cloud storage solutions, and other applications to streamline your workflow. This flexibility ensures that managing form 13 fits seamlessly into your existing processes.

-

What are the benefits of using airSlate SignNow for form 13?

Using airSlate SignNow for form 13 offers several benefits including improved efficiency, security, and convenience. You can quickly create, send, and eSign your documents, reducing turnaround times signNowly. Additionally, our robust security measures ensure that your sensitive data within form 13 remains protected.

-

How does airSlate SignNow ensure the security of form 13 documents?

airSlate SignNow prioritizes the security of your form 13 documents by utilizing advanced encryption and authentication protocols. Our platform complies with industry standards to safeguard your data from unauthorized access. You can confidently handle sensitive information with the assurance that your form 13 documents are secure.

-

Is it easy to eSign form 13 with airSlate SignNow?

Yes, eSigning form 13 with airSlate SignNow is incredibly user-friendly. Our platform allows you to add signatures, initials, and other required fields with just a few clicks. This simplicity ensures that your form 13 is signed quickly, allowing for faster processing and approval.

Get more for Form 13

- Fidelity w8ben form

- Voya select advantage ira a mutual fund custodial account form

- Diamond bank account update form

- Patient financial assistance application mc4244 15 uw health form

- New dealer information sheet dealership name arvest bank

- Mutual fund custodial account fund transfer and voya form

- Small purchase charge card program policy ampamp procedure virginia form

- Uh form 82 rev oct 2012docx

Find out other Form 13

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors