Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate

What is the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate

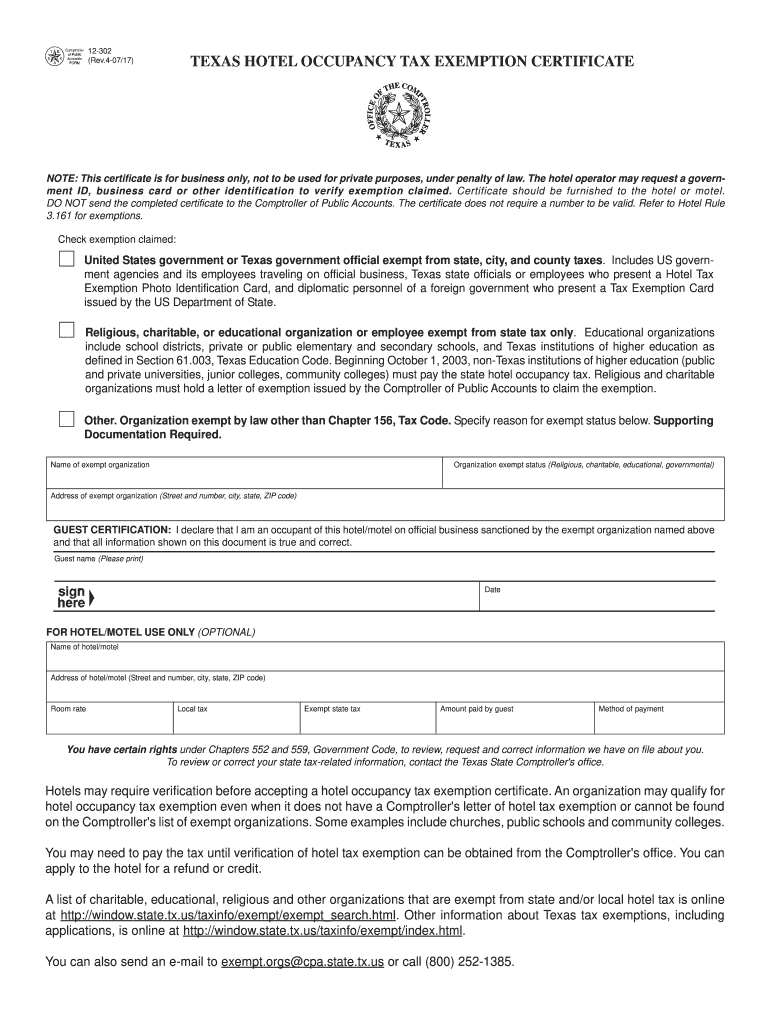

The Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate is a document used by individuals and organizations to claim exemption from hotel occupancy taxes in Texas. This form is essential for qualifying entities, such as government agencies, educational institutions, and certain nonprofit organizations, that are eligible for tax exemptions when staying at hotels or other lodging facilities. By completing this form, users can ensure they are not charged unnecessary taxes during their stay, thereby reducing overall travel costs.

How to use the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate

Using the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate involves several straightforward steps. First, ensure that you meet the eligibility criteria for tax exemption. Next, download the fillable form from an official source. Fill out the required fields, including your name, address, and the purpose of your stay. After completing the form, present it to the hotel at the time of check-in. This will allow the hotel to process your exemption correctly and ensure that you are not charged the occupancy tax.

Steps to complete the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate

Completing the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate requires attention to detail. Follow these steps for accurate completion:

- Download the form from a reliable source.

- Fill in your personal information, including your name and address.

- Indicate the type of exemption you are claiming by selecting the appropriate box.

- Provide information about the hotel, including its name and address.

- Sign and date the form to certify its accuracy.

Key elements of the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate

The Form 12 302 includes several key elements that are crucial for its validity. These elements include:

- Name of the Exempt Entity: Clearly state the name of the organization or individual claiming the exemption.

- Address: Provide the complete address of the exempt entity.

- Type of Exemption: Specify the reason for the exemption, such as government or educational purposes.

- Hotel Information: Include the name and address of the hotel where the stay will occur.

- Signature: The form must be signed by an authorized representative of the exempt entity.

Eligibility Criteria

To qualify for the exemption using the Form 12 302, certain eligibility criteria must be met. Generally, the following entities are eligible:

- Government agencies at the federal, state, or local level.

- Nonprofit organizations that have been granted tax-exempt status.

- Educational institutions recognized by the state.

It is essential to verify that your organization fits within these categories to successfully utilize the exemption certificate.

Legal use of the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate

The legal use of the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate is governed by Texas tax laws. The form must be completed accurately and presented at the time of check-in to ensure compliance with tax regulations. Failure to provide a valid exemption certificate may result in the hotel charging the occupancy tax, which cannot be refunded retroactively. Therefore, it is vital to understand the legal implications of using this form and to ensure that all information is truthful and complete.

Quick guide on how to complete form 12 302 fillable texas hotel occupancy tax exemption certificate

Complete Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, alter, and eSign your documents promptly without interruptions. Manage Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate with ease

- Obtain Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate and then click Get Form to begin.

- Employ the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 12 302 fillable texas hotel occupancy tax exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate?

The Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate is a document used by entities claiming exemption from hotel occupancy taxes in Texas. This form allows eligible organizations to avoid unnecessary tax expenses when staying at hotels for official purposes. By utilizing the Form 12 302, businesses can streamline their tax exemption claims efficiently.

-

How can I fill out the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate?

Filling out the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate is simple with airSlate SignNow. Users can easily enter necessary information into the fillable fields and digitally sign the document, ensuring a smooth submission process. Our platform provides step-by-step guidance to assist users in correctly completing the form.

-

Is there a cost associated with using the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate on airSlate SignNow?

airSlate SignNow offers a cost-effective solution for using the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate. Users can choose from various pricing plans that cater to different needs and budgets. We strive to provide an affordable option for businesses looking to manage their document workflows seamlessly.

-

What benefits does the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate provide?

The Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate provides signNow financial benefits by allowing qualified organizations to claim tax exemptions on hotel stays. Additionally, using this form through airSlate SignNow enhances efficiency, ensuring that businesses can focus on their core operations without the burden of unnecessary taxation.

-

Can the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate be integrated with other software?

Yes, the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate can be easily integrated with various software solutions through airSlate SignNow. This feature ensures seamless data transfer and streamlined processes, making it easier for users to manage their documentation alongside existing systems. Integration enhances overall productivity for businesses.

-

How does airSlate SignNow ensure the security of the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate?

airSlate SignNow prioritizes security, ensuring that the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate is protected throughout the signing process. We employ advanced encryption methods and comply with various security standards to safeguard sensitive information. Users can confidently store and share their documents, knowing their data is secure.

-

Is support available for users filling out the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate?

Absolutely! airSlate SignNow offers robust customer support for users filling out the Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate. Our team is available to assist with any questions or concerns, ensuring that users have the necessary resources to complete their forms effectively and efficiently.

Get more for Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate

Find out other Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement