Form 2325

What is the Form 2325

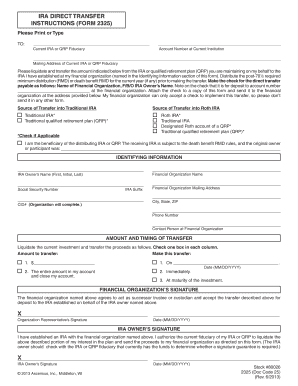

The Form 2325 is a specific document used primarily for tax purposes in the United States. It serves as a declaration or application that may be required by certain government agencies or organizations. Understanding its purpose is crucial for individuals and businesses alike, as it ensures compliance with federal and state regulations. The form typically includes various sections that require detailed information about the applicant, the nature of the request, and any relevant financial data.

How to use the Form 2325

Using the Form 2325 involves several steps to ensure that it is filled out accurately and submitted correctly. First, gather all necessary information and documents that support your application. This may include identification, financial records, and any previous correspondence related to the matter at hand. Next, carefully complete each section of the form, ensuring that all details are accurate and up to date. After filling out the form, review it for any errors before submission. Finally, follow the specific submission guidelines provided for the form, whether that be online, by mail, or in person.

Steps to complete the Form 2325

Completing the Form 2325 requires a methodical approach to ensure that all information is provided correctly. Here are the steps to follow:

- Step one: Read the instructions carefully to understand what information is required.

- Step two: Collect all necessary documentation that supports your application.

- Step three: Fill out the form, ensuring that all fields are completed accurately.

- Step four: Double-check the form for any mistakes or missing information.

- Step five: Submit the form according to the provided guidelines.

Legal use of the Form 2325

The legal use of the Form 2325 is governed by specific regulations and guidelines that ensure its validity. To be considered legally binding, the form must be completed in accordance with the laws applicable in your jurisdiction. This includes providing accurate information, obtaining necessary signatures, and adhering to deadlines. Additionally, using a reliable electronic signature platform can enhance the legal standing of the form, ensuring compliance with eSignature laws such as the ESIGN Act and UETA.

Key elements of the Form 2325

Understanding the key elements of the Form 2325 is essential for effective completion. The form typically includes:

- Applicant Information: Personal details such as name, address, and contact information.

- Purpose of the Form: A clear statement of what the form is intended for.

- Financial Information: Any relevant financial data that supports the application.

- Signature Section: A designated area for the applicant's signature, which may require witnessing.

Form Submission Methods

Submitting the Form 2325 can be done through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online Submission: Many agencies allow forms to be submitted electronically, which can expedite processing times.

- Mail: Physical submission via postal service is often an option, but it may take longer for processing.

- In-Person Submission: Some forms may need to be submitted directly to a designated office, allowing for immediate confirmation of receipt.

Quick guide on how to complete form 2325

Complete Form 2325 effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Form 2325 on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

The easiest way to modify and electronically sign Form 2325 without hassle

- Find Form 2325 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to deliver your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 2325 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2325

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2325 and how does it work with airSlate SignNow?

Form 2325 is a specific document that can be easily eSigned using airSlate SignNow. Our platform allows users to upload, customize, and send form 2325 directly for signatures, simplifying the signing process signNowly.

-

What are the pricing options for using airSlate SignNow with form 2325?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan based on the volume of documents processed, including those that involve form 2325, ensuring you only pay for what you need.

-

Are there any special features for managing form 2325 with airSlate SignNow?

Yes, airSlate SignNow provides several features specifically designed for managing form 2325. Users can create templates, set reminders for signers, and track the status of their documents, making the process efficient and organized.

-

What are the benefits of using airSlate SignNow for form 2325?

Using airSlate SignNow for form 2325 offers numerous benefits such as enhanced security, compliance with legal standards, and increased productivity. Our solution streamlines the signing process, allowing users to focus on their core business activities.

-

Can I integrate airSlate SignNow with other applications for handling form 2325?

Absolutely! airSlate SignNow seamlessly integrates with several popular applications, enhancing your workflow for managing form 2325. You can connect platforms like CRM systems and cloud storage services to streamline document handling.

-

How secure is the process of signing form 2325 with airSlate SignNow?

The security of signing form 2325 with airSlate SignNow is a top priority for us. Our platform employs industry-standard security measures, including encryption and multi-factor authentication, ensuring that your documents and data are safe.

-

Is there customer support available for issues related to form 2325?

Yes, airSlate SignNow offers robust customer support to assist users with any issues regarding form 2325. Our dedicated team is available via chat, email, or phone to ensure that you have the assistance you need.

Get more for Form 2325

Find out other Form 2325

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form