1120 W Instructions Form 2015

What is the 1120 W Instructions Form

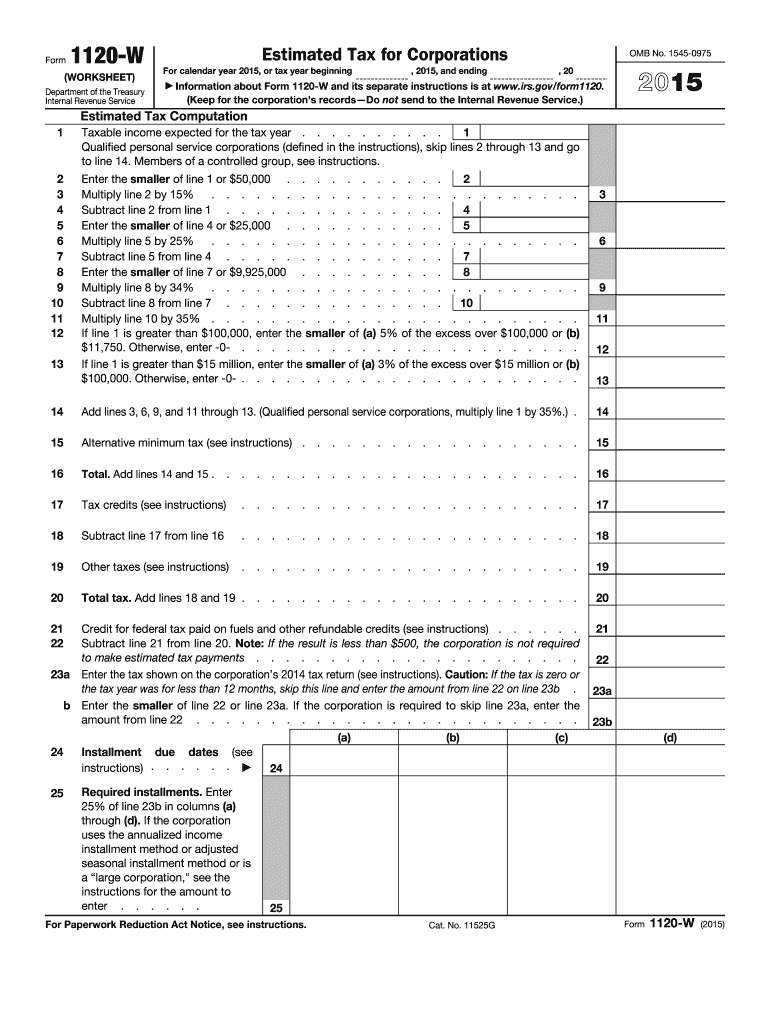

The 1120 W Instructions Form is a crucial document used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is specifically designed for corporations that are subject to income tax under the Internal Revenue Code. It provides detailed guidance on how to complete the associated tax return, ensuring compliance with IRS regulations. Understanding the purpose and requirements of the 1120 W Instructions Form is essential for accurate tax reporting and to avoid potential penalties.

Steps to complete the 1120 W Instructions Form

Completing the 1120 W Instructions Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and previous tax returns. Next, carefully follow the instructions provided on the form, filling in each section with the appropriate information. It is important to double-check calculations and ensure that all required signatures are included. Finally, review the completed form for any errors before submission to avoid delays or penalties.

How to obtain the 1120 W Instructions Form

The 1120 W Instructions Form can be obtained directly from the Internal Revenue Service (IRS) website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, many tax preparation software programs include the form, making it accessible for electronic completion. Ensure that you are using the most current version of the form to comply with the latest tax regulations.

Legal use of the 1120 W Instructions Form

The legal use of the 1120 W Instructions Form is governed by IRS regulations, which stipulate that corporations must file this form to report their income and calculate their tax liability. Proper completion and submission of the form are essential for maintaining compliance with federal tax laws. Failure to file or inaccuracies in reporting can result in penalties, interest on unpaid taxes, and potential legal issues. Therefore, understanding the legal implications of the form is vital for all corporations.

Filing Deadlines / Important Dates

Filing deadlines for the 1120 W Instructions Form are critical for compliance. Generally, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to be aware of any extensions that may apply and to file timely to avoid penalties. Keeping track of these important dates ensures that corporations remain in good standing with the IRS.

Form Submission Methods (Online / Mail / In-Person)

The 1120 W Instructions Form can be submitted in several ways, providing flexibility for corporations. The form can be filed electronically through authorized e-filing services, which is often the fastest method. Alternatively, corporations may choose to mail the completed form to the appropriate IRS address, ensuring that it is sent well before the filing deadline. In-person submissions are generally not available for this form, but consulting with a tax professional can provide additional guidance on the best submission method.

Quick guide on how to complete 1120 w instructions 2015 form

Effortlessly prepare 1120 W Instructions Form on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage 1120 W Instructions Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and sign 1120 W Instructions Form with minimal effort

- Locate 1120 W Instructions Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal significance as a conventional handwritten signature.

- Review all information carefully and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign 1120 W Instructions Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 w instructions 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 1120 w instructions 2015 form

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 1120 W Instructions Form and why is it important?

The 1120 W Instructions Form is a document provided by the IRS that outlines the steps for completing your corporate tax return. Understanding the 1120 W Instructions Form is crucial for businesses to ensure compliance and avoid any tax penalties.

-

How can airSlate SignNow help with the 1120 W Instructions Form?

airSlate SignNow simplifies the process of completing and signing the 1120 W Instructions Form. With its user-friendly interface, users can fill out, eSign, and send the form securely, streamlining your tax filing process.

-

Is there a cost associated with using airSlate SignNow for the 1120 W Instructions Form?

Yes, airSlate SignNow offers various pricing plans suitable for different business needs. Each plan provides access to essential features that facilitate the completion and management of the 1120 W Instructions Form efficiently.

-

What features are available in airSlate SignNow for the 1120 W Instructions Form?

airSlate SignNow includes a range of features such as template creation, secure storage, and customizable signing options, all designed to enhance your experience with the 1120 W Instructions Form. Users can also track the status of their documents, ensuring nothing is overlooked.

-

Can I integrate airSlate SignNow with other software to handle the 1120 W Instructions Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to connect your workflow and manage the 1120 W Instructions Form alongside other essential business tools. This enhances productivity and efficiency.

-

What benefits does airSlate SignNow provide for managing the 1120 W Instructions Form?

Using airSlate SignNow for the 1120 W Instructions Form comes with numerous benefits, including faster processing times, reduced paper use, and improved accuracy. This electronic solution helps businesses meet deadlines without the hassle of physical paperwork.

-

Do I need technical expertise to use airSlate SignNow for completing the 1120 W Instructions Form?

No technical expertise is needed! airSlate SignNow is designed for users of all skill levels. Its intuitive design ensures that you can quickly navigate through the steps of completing the 1120 W Instructions Form with ease.

Get more for 1120 W Instructions Form

- Warranty deed from two individuals to llc hawaii form

- Hawaii renunciation form

- Notice completion hawaii form

- Quitclaim deed by two individuals to corporation hawaii form

- Warranty deed from two individuals to corporation hawaii form

- Hawaii notice form

- Quitclaim deed from individual to corporation hawaii form

- Warranty deed from individual to corporation hawaii form

Find out other 1120 W Instructions Form

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed