Form 1041 N Rev January Fill in Capable U S Income Tax Return for Electing Alaska Native Settlement Trusts 2005

What is the Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts

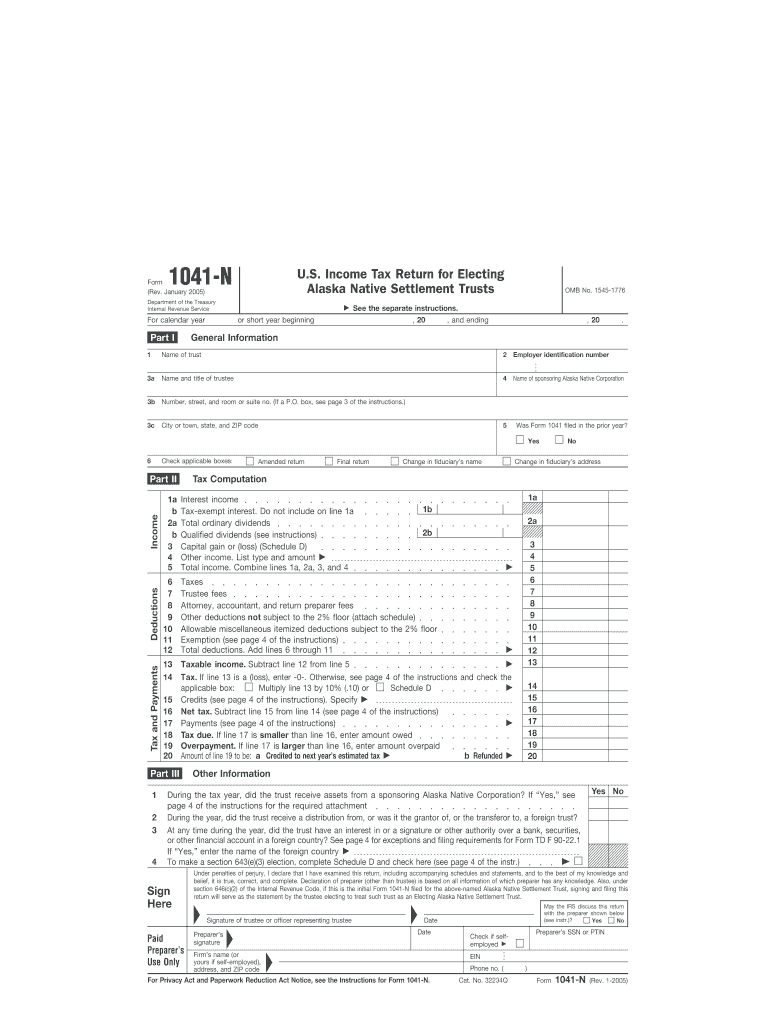

The Form 1041 N Rev January is a specialized U.S. income tax return designed for electing Alaska Native Settlement Trusts (ANSTs). This form allows these trusts to report their income, deductions, and tax liabilities to the Internal Revenue Service (IRS). ANSTs are unique entities established to manage and distribute funds for the benefit of Alaska Native shareholders, and this form ensures compliance with federal tax regulations. By utilizing this form, trustees can accurately reflect the financial activities of the trust while benefiting from specific tax provisions applicable to Alaska Native settlements.

Steps to Complete the Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts

Completing the Form 1041 N Rev January involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and prior tax returns. Next, accurately fill in the identifying information for the trust, including its name, address, and Employer Identification Number (EIN). Then, report all sources of income, such as dividends, interest, and capital gains, in the appropriate sections of the form.

After reporting income, deduct allowable expenses related to the trust's operations. Ensure that all calculations are precise and that you maintain supporting documentation for each entry. Once completed, review the form thoroughly for any errors or omissions before signing and dating it. Finally, submit the form to the IRS by the designated deadline to avoid penalties.

Legal Use of the Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts

The legal use of the Form 1041 N Rev January is vital for ensuring that electing Alaska Native Settlement Trusts comply with federal tax laws. This form serves as an official record of the trust's income and expenditures, which is essential for tax reporting purposes. It is important to note that failure to file this form accurately and on time can lead to penalties and interest charges imposed by the IRS.

Additionally, the form must be completed in accordance with IRS guidelines, which outline the specific requirements for ANSTs. This includes adhering to the rules regarding distributions to beneficiaries and maintaining proper documentation to support the trust's financial activities. By using the form correctly, trustees can protect the trust's tax-exempt status and ensure the proper management of funds for the benefit of Alaska Native shareholders.

IRS Guidelines for the Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts

The IRS provides specific guidelines for completing the Form 1041 N Rev January, which are crucial for trustees to follow. These guidelines include instructions on how to report income, deductions, and distributions accurately. The IRS also outlines the eligibility criteria for trusts to elect this status, ensuring that only qualifying entities can utilize the form.

Trustees should familiarize themselves with the IRS's requirements for maintaining records and documentation, as these are essential for substantiating the information reported on the form. Additionally, the IRS emphasizes the importance of timely filing to avoid penalties. Understanding these guidelines helps ensure compliance and facilitates the smooth operation of the trust.

How to Obtain the Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts

The Form 1041 N Rev January can be obtained directly from the IRS website or through authorized tax preparation services. It is available as a fillable PDF, making it convenient for trustees to complete the form electronically. Additionally, printed copies can be requested from the IRS if preferred.

When obtaining the form, it is essential to ensure that you are using the most current version to comply with any updates or changes in tax law. Regularly checking the IRS website for updates can help trustees stay informed about any modifications that may affect their filing requirements.

Filing Deadlines for the Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts

Filing deadlines for the Form 1041 N Rev January are crucial for compliance. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year basis, this means the deadline is April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day.

It is important for trustees to mark these deadlines on their calendars to ensure timely submission. Failure to file by the deadline can result in penalties, so being aware of these dates is essential for maintaining compliance with IRS regulations.

Quick guide on how to complete form 1041 n rev january 2005 fill in capable us income tax return for electing alaska native settlement trusts

Complete Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts effortlessly on any device

Managing documents online has become increasingly common among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts without hassle

- Locate Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal weight as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks on any device of your choice. Edit and electronically sign Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 n rev january 2005 fill in capable us income tax return for electing alaska native settlement trusts

Create this form in 5 minutes!

How to create an eSignature for the form 1041 n rev january 2005 fill in capable us income tax return for electing alaska native settlement trusts

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts is a tax document used by qualifying Alaska Native Settlement Trusts to report income, deductions, and credits. This specific form is designed to ensure compliance with regulations while maximizing tax benefits for trust recipients. Understanding this form is crucial for proper tax reporting.

-

How can airSlate SignNow help with Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts?

airSlate SignNow simplifies the process of filling out and eSigning the Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts. Our platform provides customizable templates and an intuitive interface that ensures accurate completion and submission. This makes tax filing more efficient and less daunting for trust administrators.

-

Is airSlate SignNow affordable for filing Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to various business needs, making it accessible for those filing Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts. Our subscription options provide great value while allowing users to manage their documents and signatures efficiently. This ensures you can focus more on your tax responsibilities without financial strain.

-

What features does airSlate SignNow offer for handling tax documents like Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts?

airSlate SignNow includes essential features such as document templates, electronic signatures, and real-time tracking for your Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts. These tools streamline the document management process, making it simple to get required signatures and ensure timely submissions. Users can also securely store and share documents within our platform.

-

Can I integrate airSlate SignNow with other applications for tax filing?

Absolutely! airSlate SignNow supports integrations with various applications commonly used for tax filing and accounting that can assist with Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts. This seamless integration helps you centralize tasks, synchronize data, and enhance productivity. Streamlining your processes has never been easier.

-

Is it easy to collaborate with team members using airSlate SignNow for tax documents?

Yes, collaboration is a strong feature of airSlate SignNow when managing tax documents such as Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts. Users can invite team members to review and eSign documents, facilitating efficient communication and workflow. This makes it convenient for teams to collaborate on tax-related tasks.

-

What security measures does airSlate SignNow implement for tax-related documents?

Safety is a priority at airSlate SignNow, especially for sensitive tax documents like Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts. We incorporate top-notch security protocols, including data encryption and secure servers, to protect your information. You can confidently manage your tax documents, knowing that your data is secure.

Get more for Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts

- Notice of mechanics and materialmans lien and demand for payment hawaii form

- Quitclaim deed by two individuals to husband and wife hawaii form

- Warranty deed from two individuals to husband and wife hawaii form

- Transfer on death deed hawaii form

- Enhanced life estate or lady bird warranty deed from two individuals or husband and wife to an individual hawaii form

- Quitclaim deed from an individual to a three individuals hawaii form

- Hawaii renunciation and disclaimer of joint tenant or tenancy interest hawaii form

- Quitclaim deed by two individuals to llc hawaii form

Find out other Form 1041 N Rev January Fill In Capable U S Income Tax Return For Electing Alaska Native Settlement Trusts

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template